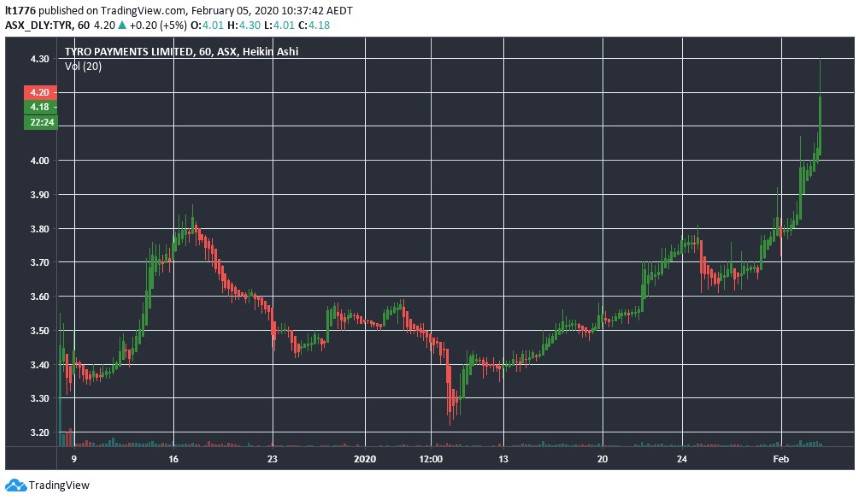

At time of writing, the share price of Tyro Payments Ltd [ASX:TYR] is up 5.5%, trading at $4.22.

The Tyro share price is on a strong run at the moment and up more than 50% from its original IPO price of $2.75.

Source: Tradingview.com

Reports emerged in the AFR today that the RBA is looking at a regulatory change that could strip the Big Four banks of more than a half billion in revenue. The Tyro share price likely got a boost from the news as they have pre-empted the move.

Tyro share price up further on news it is has already adapted to potential RBA change

The Tyro share price got a boost when trading opened today and it got a mention in the AFR article released this morning.

RBA head of payments policy Tony Richards was quoted as saying:

‘What is it about this market that banks have the opportunity to send payments through whichever rails are cheapest – Eftpos in most cases – but are not choosing to do it? Banks could be doing least-cost routing in the background for their merchant customers … It would be simple for them to go to all smaller merchants and tell them they offer the ability to send payments on their behalf through cheaper rails. But no major bank is doing that – none of them are actively going to their smaller customers saying, ‘Here is an opportunity to reduce your payments costs.‘

So it comes down to the Big Four banks’ relationship with merchants — and Tyro made changes to its policy back in 2018 that have benefitted merchants.

Tyro CEO Robbie Cooke said:

‘For us, it made sense – we are about our merchants achieving the most economical transaction cost, so implementing LCR [least-cost routing] is true to what we stand for as a business.’

So it appears yet again, the Big Four are on the back foot as a smaller more nibble opponent moves in on their business.

With the exception of Commonwealth Bank of Australia [ASX:CBA], all of the Big Four banks’ share prices have taken a hit over the last three months, something we identified early.

But what are the prospects for the Tyro share price moving forward?

I suspect after a steep rise and some media hype, a retracement could be on the cards.

This is a fancy way for saying a pullback before a continuing share price rise.

I’ve previously identified that the way forward for Tyro could be its ability to morph from a payment services company into a fintech.

That is, can it continue to grow its loan originations?

So if you are a Big Four investor who is looking to jump ship, we have a handy free fintech report which identifies three stocks that could benefit from the demise of the Big Four banks.

It is also worth wrapping your head around why their dividends are under threat here.

Finally, if you want get our insights direct to you inbox every morning, take out a free Money Morning subscription.

You won’t regret it — you’ll get stories on big trends in the financial services/fintech sector, as well as any other sector that presents an investment opportunity. Stuff you won’t get from mainstream outlets.

Regards,

Lachlann Tierney,

For Money Morning

Comments