In today’s Money Morning…beaten-down travel businesses have a lot of short interest…automotive companies for flight from the city…one left-field small-cap to watch as people go nomadic…and more…

It’s not quite like the ‘Hertz Rally’.

But there are a group of beaten-down ASX shares poised to benefit from a Victorian economy recovery.

For context, in June the share price of Hertz Global Holdings Inc [NYSE:HTZ] soared more than 900% on speculation of a buyout for the bankrupt car loan company.

As Reuters notes, Hertz wasn’t alone:

‘Hertz, which had roughly $18.8 billion in debt at the end of March, is one of the largest companies so far to be undone by the coronavirus pandemic, which has crushed the travel industry.

‘Hertz is not the only U.S. company in bankruptcy whose shares have soared in recent days. J. C. Penney Company Inc, Chesapeake Energy Corp and Whiting Petroleum Corp have also seen similar rallies.’

Irrational markets, speculative frenzy — the familiar derision came out of the woodwork.

Now, I’m not saying you should try and punt on bankrupt Victorian companies.

Quite the opposite actually.

What I am saying though, is that after a long shift to growth in the market, there could be some ‘value gems’ out there that were under-appreciated for a long time.

Companies with strong balance sheets and the ability to ramp up sales as things get back to normal.

Anyway, here are profiles of a few companies that could benefit from a recovery.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Beaten-down travel businesses have a lot of short interest

The three companies that first come to mind are Qantas Airways Ltd [ASX:QAN], Webjet Ltd [ASX:WEB], and Flight Centre Travel Group Ltd [ASX:FLT].

Business as normal is still a long way off as reflected in the comparison of their charts for the past year:

|

|

| Source: Tradingview.com |

You can see Qantas (teal line) outperforming Webjet (red line) and Flight Centre (blue line).

All of these companies went for capital raisings to shore up their balance sheets.

At some point, people will take to the sky again.

But you may need to be extraordinarily patient.

It’s worth noting that over 14% of Webjet shares on issue are short positions, and more than 7% of Flight Centre shares on issue are short as well.

Automotive companies for flight from the city

Melbourne’s ‘ring of steel’ is still in place, but what about when people can finally escape to the more beautiful parts of regional Victoria?

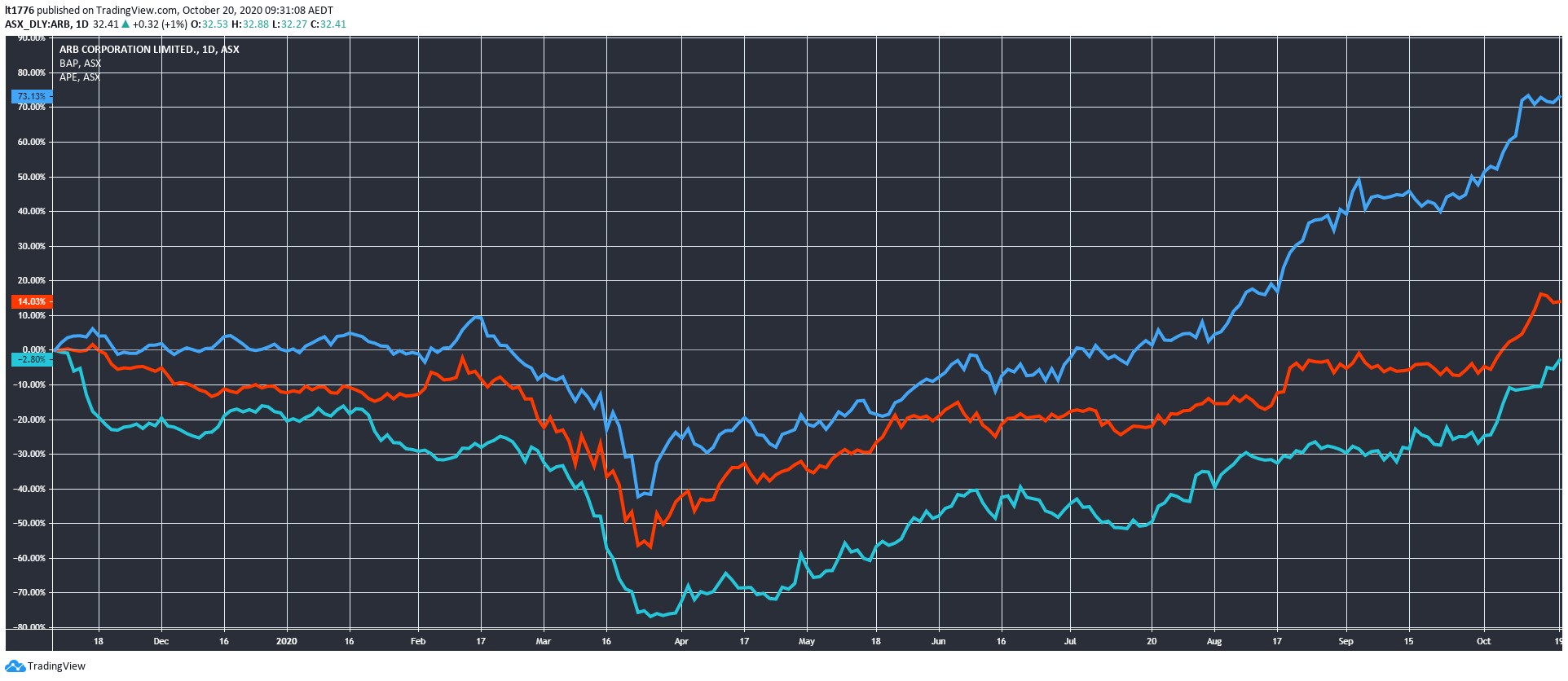

To a degree, I think the market may’ve already latched onto this one, as you can see in the charts for Bapcor Ltd [ASX:BAP], Eagers Automotive Ltd [ASX:APE], and ARB Corporation Ltd [ASX:ARB]:

|

|

| Source: Tradingview.com |

As you can see, ARB (blue line) is doing better than BAP (red line) and APE (teal line).

They are all pushing up past where they were in February after strong September results.

These companies might fall into the ‘already bolted’ category, but don’t be surprised to see them continue the run if they can replicate recent results.

A bit of further research on this sector may reap rewards.

One left-field small-cap to watch as people go nomadic

People are going nomadic, particularly in the US.

As per the RV Industry Association’s June report:

‘RV wholesale shipments tracked by the RV Industry Association posted their best month in 2020 and the highest monthly total since October 2018 as deliveries to retailers reached 40,462 units in June, a 10.8% rise over the June 2019 total of 36,525 units.’

And it’s not just ‘grey nomads’ anymore either.

As per CNBC:

‘Dealers and RV manufacturers, such as Thor Industries, Winnebago and Forest River, have reported spikes in demand during the spring and summer of 2020, and industry analysts say several good months could be ahead.

‘A lot of these buyers are first-timers and many are purchasing lower-cost units, which are often favored by younger consumers.

‘“All dealers are reporting a high mix of first-time buyers as evident by lack of trade-in units,” said Wells Fargo analyst Tim Conder in a July 15 note. “Dealers are saying as high as 80% of customers are first-time buyers … vs. the typical 25% mix. The pandemic is driving the purchase decision for new-entrants.’

Something similar could be on the cards in Australia.

Once Victoria’s barriers between regional areas and the city are lifted — people could flood into the countryside.

And what’s the big problem in remote areas?

Being able to stay in touch with people.

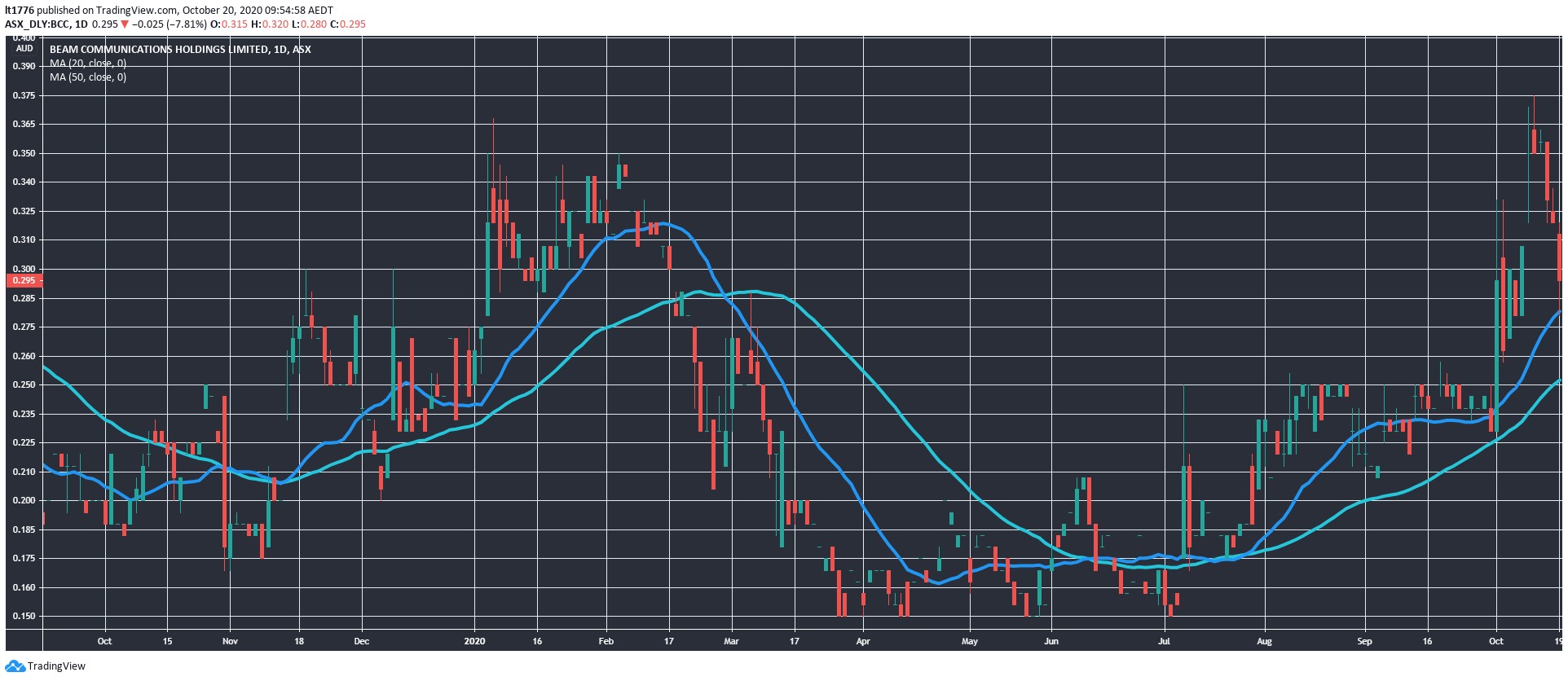

As such, Beam Communications Holdings Ltd [ASX:BCC] with their range of communications products geared for far off places might benefit.

The BCC share price went on a mini-run recently and is retracing a bit now following a capital raise:

|

|

| Source: Tradingview.com |

This is just one idea.

The point is though, a deep think about the trends and remote effects generated from a Victorian recovery could be a valuable exercise as an investor.

Happy hunting.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments