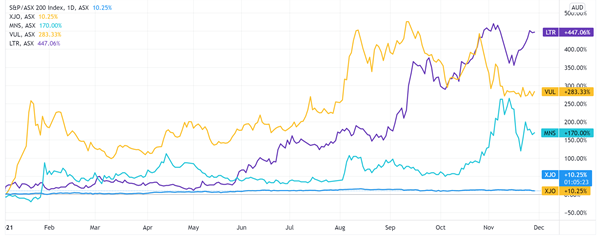

We examine Monday’s updates from Vulcan Energy Resources Ltd [ASX:VUL], Magnis Energy Technologies Ltd [ASX:MNS], and Liontown Resources Ltd [ASX:LTR].

Magnis retains lawyers to assess options regarding ‘defamatory articles’

Magnis released a curt update this morning in response to an overnight article from the Australian.

The article, titled ‘Magnis hooked up with alleged on-the-run drug boss’, claims that MNS engaged alleged drug-smuggling kingpin Hakan Arif to act as its agent in Turkey.

The Australian used former senior employees as its sources, including ex-Macquarie executive Warwick Smith.

Smith told the newspaper he left MNS’s board ‘partly due to concerns that Magnis was involved with Arif.’

In a strongly worded reply, Magnis said that ‘each of the assertions in the article and the headline is false.’

‘Magnis has retained Queen’s Counsel and senior lawyers to represent it in proceedings arising from the assertions and imputations in this article and from recent defamatory articles including from the same author and newspaper and will bring proceedings against any republication of these false assertions.

‘Magnis has never had any engagement with Mr Arif and has never made any payment to him.’

MNS shares were up 2% in afternoon trade.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Vulcan signs lithium supply agreement with Stellantis

Vulcan, whose stock is down nearly 30% over the last month following the publication of a critical report from short-seller J Capital, today announced the signing of another supply agreement.

VUL and NYSE-listed Stellantis signed a binding lithium hydroxide offtake agreement.

Under the agreement, Vulcan will supply a minimum of 81,000 tonnes and a maximum of 99,000 tonnes of battery-grade lithium hydroxide over an initial five-year term.

The deal will commence in 2026, provided VUL successfully starts commercial operation and possesses full product qualification.

Today’s news comes after Vulcan signed a binding lithium hydroxide offtake agreement with Renault earlier this month.

As we covered then, the final agreement with Renault settled on VUL supplying less lithium than previously considered by the two parties back in August.

VUL shares were up 3.3% in afternoon trade.

Liontown’s bulk program yields ‘premium’ lithium samples

Liontown today disclosed to the market sample testwork results collected from its Kathleen Valley lithium project.

LTR said the bulk concentrate collected ‘successfully produced premium 6% lithium and tantalum concentrate samples.’

Liontown will use the sample concentrate produced to support its current offtake negotiations and its planned downstream prefeasibility study.

LTR shares were largely flat in afternoon trade.

ASX lithium stocks: further info

Now, if you want extra information on evaluating and comparing lithium miners, I suggest reading our lithium guide released last month.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here