We examine the latest quarterly results from Syrah Resources Ltd [ASX:SYR] and Lake Resources NL [ASX:LKE].

LKE and SYR shares are in focus today as the two lithium stocks released their December quarter results.

Below, we delve into the highlights.

Lithium: 2021’s big story, but what about 2022?

As we covered at the start of the year, lithium was a big story in 2021.

Eight of the top 10 best performing stocks of 2021 on the All Ords were lithium stocks.

And Lake Resources made some of the largest gains, rising over 1,200% last year.

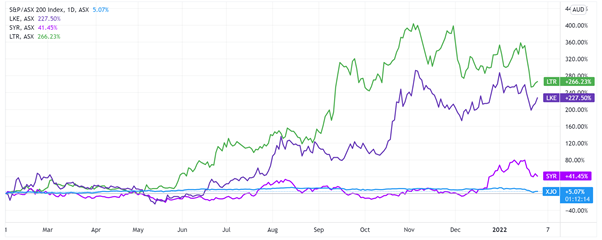

But the momentum enjoyed by lithium stocks in 2021 is wavering in the new year.

As you can see below, SYR and LKE stocks dipped in January.

So far this month, LKE shares are down 10% and SYR shares are down 9%.

So what did the two lithium stocks report in their respective December quarterlies?

And can the latest results reignite momentum in these stocks?

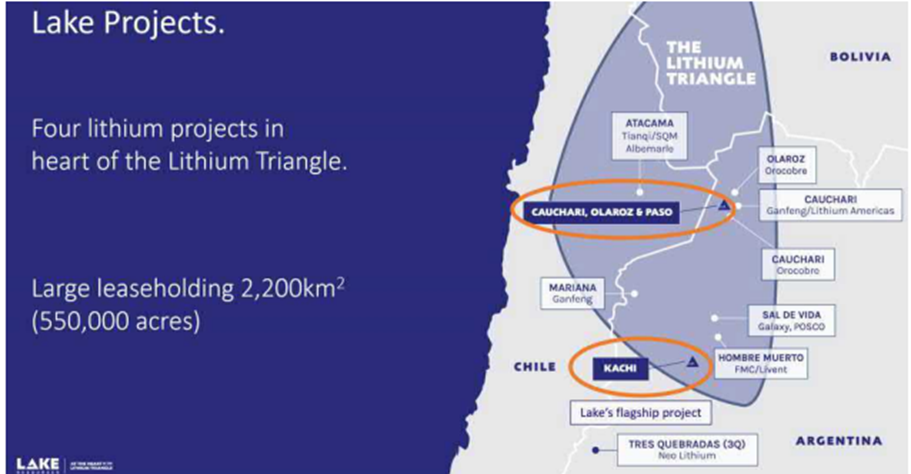

Lake Resources expands production base case

During the December quarter, LKE revealed that the definitive feasibility study production base case rose to 50,000 tonnes per annum of lithium carbonate equivalent (LCE) for its Kachi Lithium Project in Argentina.

Despite the upped production base case, Lake Resources is yet to finalise long-term financing for its project.

The lithium stock did state that about 70% of the required financing is ‘indicatively available’.

‘Long duration, low-cost project debt finance for Kachi is indicatively available from UK Export Credit Agency UKEF and Canada’s EDC to support approximately 70% of the total finance required for Kachi’s expanded production, subject to standard project finance term.’

LKE reported net cash outflows from operating activities of $1.8 million in the December quarter.

Its coffers were bolstered by the proceeds from exercising options, which brought in $29.4 million for the quarter.

Lake Resources now has $71.3 million in cash and cash equivalents.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Syrah Resources flags continued supply chain issues

Syrah, the operator of the Balama Graphite Operation in Mozambique and a downstream active anode materials facility in the US, revealed it is still dealing with supply chain woes.

SYR revealed that its December quarterly production was constrained by ‘container shipping market disruption.’

Syrah expects ‘material’ improvements in the upcoming quarter.

‘Additional breakbulk shipment option expected to materially improve production and sales from the March 2022 quarter.’

SYR received US$10.1 million from customers in the December quarter. But it wasn’t enough to offset operating expenses.

Syrah ended the quarter with net cash outflows from operating activities of US$12.8 million.

The graphite producer ended up spending US$17.9 million on production costs alone.

The big reason is that at its current production run rate, Syrah’s revenue cannot cover its costs.

SYR reported Balama C1 cash costs (FOB Nacala) of US$1,159 per tonne for the quarter.

But its guidance for Balama C1 cash costs (FOB Nacala) is US$430–470 per tonne at a 15kt per month production rate.

In the December quarter in total, SYR produced only 13kt of natural graphite.

Year-to-date (12 months), Syrah has spent US$46.3 million on production costs, against customer receipts of US$25.4 million.

Somewhat worryingly, at the end of the quarter, Syrah only had about four quarters of funding available at its current cash burn levels.

A capital raise may soon be in the offing, I suspect…a capital raise or a new debt facility.

Now, if you want extra information on evaluating and comparing lithium miners, I suggest reading our comprehensive lithium guide.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector and individual lithium stocks.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here