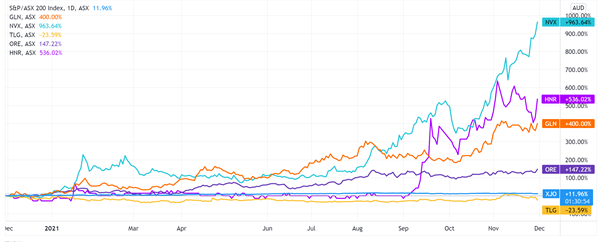

We examine Tuesday’s updates from lithium stocks GLN, NVX, TLG, and HNR.

Hannans soars 20% on battery recycling news

Junior lithium explorer Hannans Ltd [ASX:HNR], entered a binding agreement to recycle lithium batteries in the Nordics today.

Hannans converted a conditional memorandum of understanding to a binding agreement to recover ‘high purity scrap and end-of-life lithium batteries’’ in Norway, Sweden, Denmark, and Finland.

HNR pointed to the high EV penetration and four planned Giga factories in the region.

The lithium small-cap further said:

‘The volume of scrap and end-of-life lithium batteries available for recycling in the Nordics will underpin a vibrant lithium battery recycling sector into the future.’

One of the requisites for the deal to go through is the completion of a $5 million capital raising by Hannans before 31 December 2021.

HNR shares were up 20% in late afternoon trade.

Galan shares up on ‘excellent’ PEA results

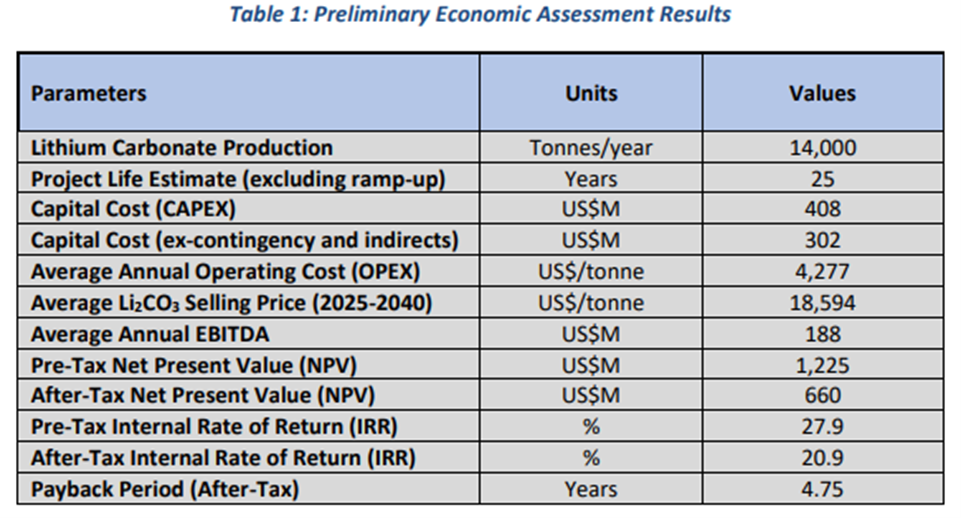

Today Galan Lithium Ltd [ASX:GLN] released results from a preliminary economic assessment for its wholly-owned Candelas Project in Argentina.

The PEA suggested GLN’s Candelas could produce 14,000 tonnes per annum of battery-grade lithium carbonate.

The project’s unleveraged pre-tax net present value came to US$1.225 billion at an 8% discount rate, with an internal rate of return of 27.9%.

The post-tax IRR came in at 20.9%.

Candelas was estimated to have a 4.75-year payback period on a life estimate of 25 years.

GLN said it now has two projects with preliminary economic assessments, bringing its long-term production potential to 34,000 LCE.

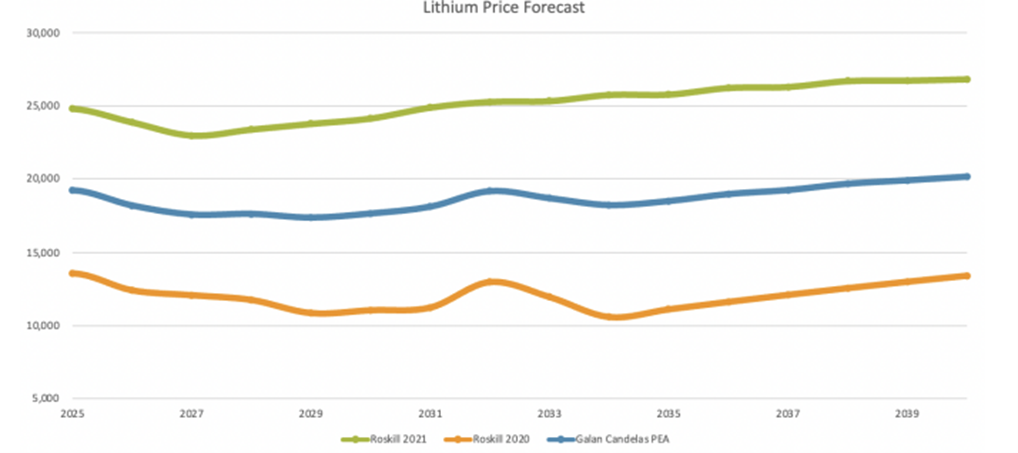

Galan used an average LCE selling price (for the years 2025–40) of US$18,594 a tonne on average operating costs of US$4,277 a tonne.

That means Galan’s project is expected to bring in an average annual EBITDA of US$188 million.

Talga shares tank on Tripartite LOI update

Talga Group Ltd [ASX:TLG] provided a very brief update today that sent its share price 15% lower in afternoon trade.

The battery anode and graphene company relayed that the non-binding letter of intent executed with investment firm Mitsui has lapsed.

As TLG reported:

‘Following advanced and productive discussions towards Vittangi project level funding, the parties at this stage were not able to complete a satisfactory transaction and the formal LOI has now lapsed. Mitsui and Talga continue to advance their project development discussions under the separate and existing Memorandum of Understanding.’

Talga said it’s pursuing existing and new financing opportunities despite the deal with Mitsui falling through.

It will be interesting to see what impact this has — if any — on how the market treats non-binding agreements lithium stocks strike with would-be financiers, manufacturers, or automakers.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Novonix share price continues climb

Novonix Ltd [ASX:NVX] shares were up 8% in afternoon trade as the high-flying lithium battery stock released its AGM presentation.

NVX shares are trading at all-time highs today, with the stock edging towards $12.

Novonix now has a market capitalisation over $5.7 billion, having gained 985% in the last 12 months alone.

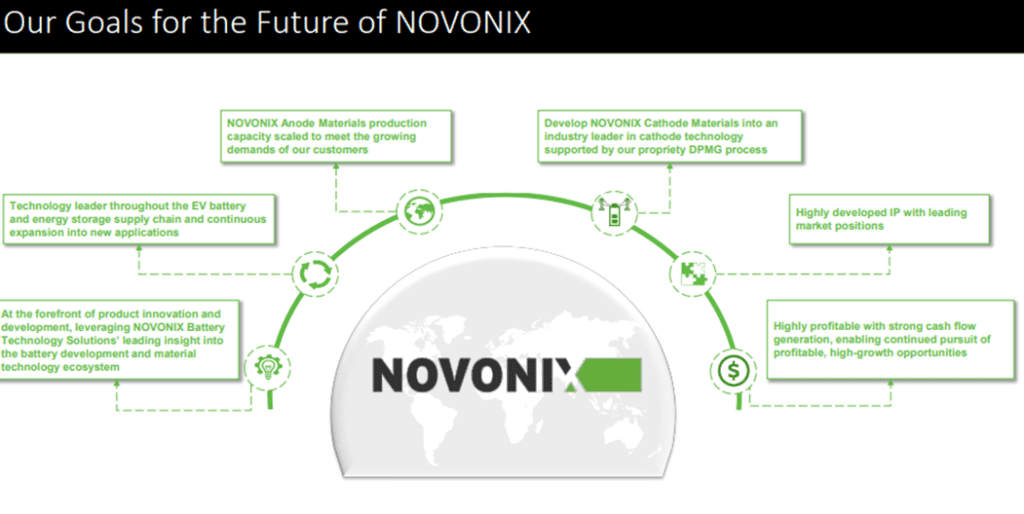

At its most recent AGM, Novonix reiterated its positive outlook on the global lithium battery industry, telling shareholders it’s aiming to become a tech leader in the EV battery supply chain.

There was also further information regarding NVX’s potential listing on the NASDAQ. As Novonix Chairman Tony Bellas explained:

‘Also at the corporate level, the Company submitted a draft registration statement to the U.S. Securities and Exchange Commission in connection with a potential listing on NASDAQ. That process is still in train.

‘The complexion of the company is changing with its focus as a North American-based battery materials and battery technology company. Our operations are now almost entirely in North America, our senior executives are all based in North America, our largest shareholder is now an iconic US-headquartered company — a household brand name founded in Texas in 1927. We also have a significantly broader US shareholder base as a consequence of our OTC markets listing and this will be augmented soon by a potential listing on NASDAQ.’

ASX lithium stocks — further resources

If you want extra information on evaluating and comparing lithium miners, I suggest reading our recent lithium guide.

It’s thorough and takes you through vital factors to consider when considering the lithium sector.

And if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here