From Afterpay Ltd [ASX:APT] to Vulcan Energy Resources Ltd [ASX:VUL], BNPL and lithium stocks are under heavy selling pressure today as markets worry about Omicron and inflation.

ASX BNPL stocks tumble on red day

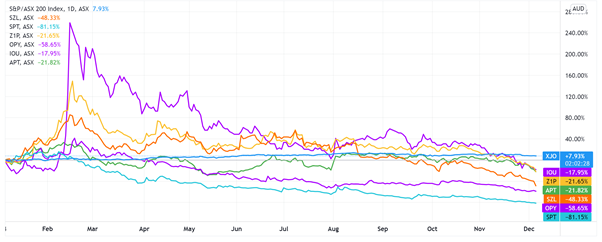

As we covered last week, this year has not been kind to BNPL stocks.

Investors poured into the sector a few years ago — aiming to emulate the gains early Afterpay backers made by tipping money into APT’s rivals.

But the whole sector underwent a harsh rerating this year. All ASX BNPL stocks are underperforming the market, even Afterpay.

Today, the sell-off intensified:

Zip Co Ltd [ASX:Z1P] is down 9.6% in afternoon trade.

Sezzle Inc [ASX:SZL] is down a substantial 15%.

Splitit Payments Ltd [ASX:SPT] is down 4%, reaching its 52-week low and edging towards an all-time low.

Openpay Group Ltd [ASX:OPY] is down 5%.

And Afterpay is down 5%, trading below $100, at $93.

Shares in Square (recently renamed Block), the US fintech giant set to acquire APT, fell 20% in a month as the sell-off hits others major bourses.

The sell-off raises uncomfortable questions for BNPL stocks.

Since most are yet to turn a profit, these stocks rely on equity and debt to fund their growth and receivables.

With share prices plummeting — in many cases to 52-week lows — tapping the market for needed funds becomes harder.

And debt financing may get harder still when interest rates rise. Margins — already thin — could shrink as financing costs lift.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

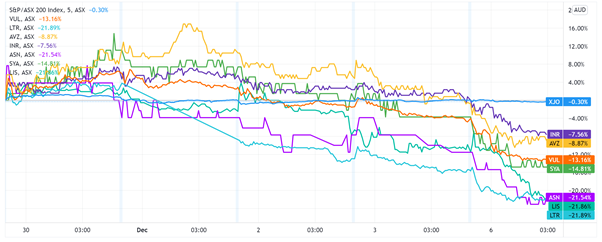

ASX lithium stocks plummet

It was a sea of red for lithium stocks this afternoon.

After a sustained run over the last few years that saw the likes of Lake Resources NL [ASX:LKE] rise nearly 1,000% in the last 12 months, the hot lithium sector looks to have overheated.

Consider the following afternoon trade numbers:

Vulcan is down 10%.

AVZ Minerals Ltd [ASX:AVZ] is down 9%.

Liontown Resources Ltd [ASX:LTR] is down 7%.

Ioneer Ltd [ASX:INR] is down 7%.

Sayona Mining Ltd [ASX:SYA] is down 14%.

And Anson Resources Ltd [ASX:ASN] is down 13%.

Will the lithium sector switch attention to established producers?

Even established producers like diversified miner Mineral Resources Ltd [ASX:MIN] didn’t escape scrutiny.

MIN shares were down 2% in afternoon trade.

But it is the established players like MIN and Orocobre Ltd [ASX:ORE] that could get more attention from investors than their junior counterparts.

Many of the hot lithium stocks that have gone on runs this year are still in the exploration or development stage.

Production is years away.

Vulcan, for instance, expects to produce lithium at its Upper Rhine Valley project in 2026.

Which means that most of the ASX-listed lithium stocks aren’t making any money and require huge upfront funding to cover exploration and development costs.

But securing funding may get harder in 2022 and beyond with interest rates rising.

If financing costs rise, this will impact project economics…and long-term valuations.

The market is jittery. And some investors are exiting their positions in growth stocks more susceptible to souring mood…and expectations of rising rates.

The Federal Reserve already warned it may well taper its economic support sooner than planned.

So what’s needed in these times is sound risk management practices.

For more information, I suggest checking out the report on a unique technical analysis strategy used by our resident guru Murray Dawes.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here