In today’s Money Morning…Jules Verne and the push to hydrogen…the ‘ASX-listed hydrogen stock index’…so what do you choose as a forward-thinking investor?…and more…

I sat down for a chat with Adam Bacon of Ebony Energy — which was recently acquired by Hexagon Energy Materials Ltd [ASX:HXG] — to talk about all things hydrogen. If you are into disruptive energy technology it’s a must listen. You can catch the full recording right here in our latest episode of The Money Morning Podcast.

Follow The Money Morning Podcast on Spotify here and on Apple Podcasts here.

Today’s article is all about ASX-listed hydrogen stocks and the potential for a global hydrogen market.

You may’ve heard about Twiggy Forrest’s big moves in the space. In his Boyer Lecture he concluded by saying: ‘I choose hydrogen. What do you choose?’

In the same lecture he argued that the ‘green hydrogen’ market could exceed US$12 trillion in revenues by 2050.

Larger than any industry in the world.

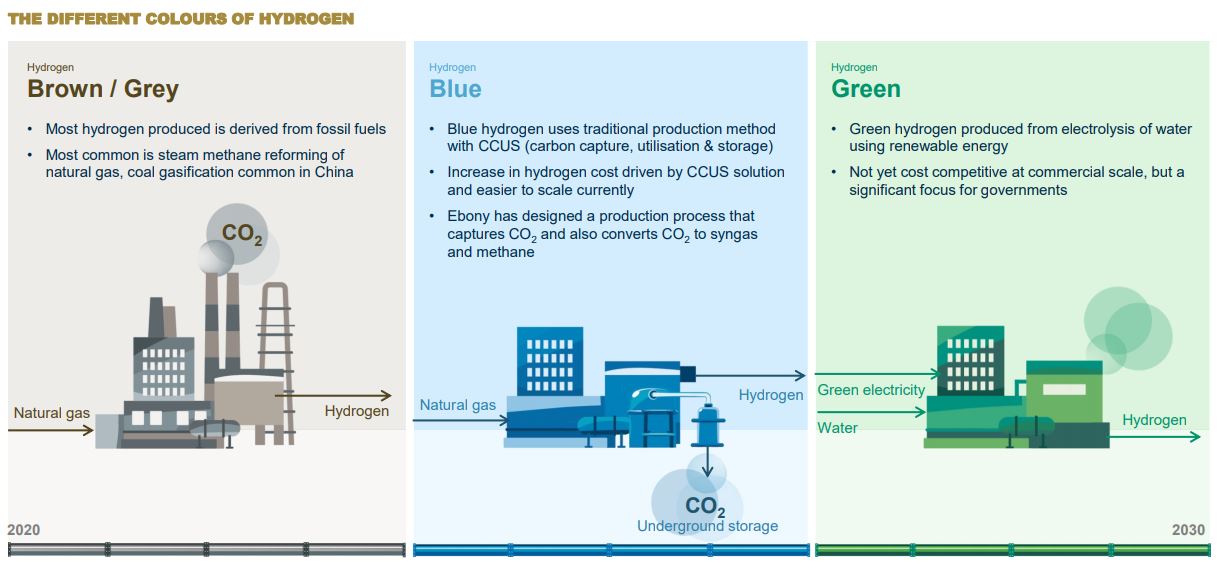

There’s brown/grey hydrogen, blue hydrogen, and the near mythical ‘green’ hydrogen.

You can see a breakdown of the various types of hydrogen below:

|

|

| Source: Hexagon Energy Materials Ltd |

I learned all about the distinction between the various types of hydrogen in my conversation with Adam Bacon, so definitely check that out.

Three Ways to Invest in the Renewable Energy Boom

But for now, Twiggy, meet Jules Verne.

Jules Verne and the push to hydrogen

It’s 1874 and Jules Verne writes in The Mysterious Island:

‘”It is to be hoped so,” answered Spilett, “for without coal there would be no machinery, and without machinery there would be no railways, no steamers, no manufactories, nothing of that which is indispensable to modern civilization!”

‘“But what will they find?” asked Pencroft. “Can you guess, captain?”

‘“Nearly, my friend.”

‘“And what will they burn instead of coal?”

‘“Water,” replied Harding.

‘“Water!” cried Pencroft, “water as fuel for steamers and engines! Water to heat water!”

‘“Yes, but water decomposed into its primitive elements...”

‘Water will be the coal of the future.’

It was pure fantasy at the time. But Verne was talking about green hydrogen which comes from electrolysis.

Fast-forward 150 years later and it’s becoming reality.

Part of it comes down to what governments are committing to.

For example, Japan is betting big on hydrogen, along with Saudi Arabia and Australia.

As per coverage in Bloomberg, Saudi Arabia is planning for the following:

‘The world’s biggest crude exporter doesn’t want to cede the burgeoning hydrogen business to China, Europe or Australia and lose a potentially massive source of income. So it’s building a $5 billion plant powered entirely by sun and wind that will be among the world’s biggest green hydrogen makers when it opens in the planned megacity of Neom in 2025.’

In my interview with Adam Bacon, he noted that countries in the Middle East like Saudi Arabia are uniquely positioned to dominate the hydrogen market.

That’s because until green hydrogen is perfected, the world will need depleted fossil fuel projects for the process — particularly for carbon sequestration.

But at the same time, that doesn’t mean Australia can’t thrive.

Think of it like this, just because the Middle East has a lot of oil doesn’t mean Woodside Petroleum Ltd [ASX:WPL] is a pointless business.

It all has to do with access to markets and supply chains.

Another one of the key takeaways from my chat with Adam, was that blue hydrogen enters the frame as a bridge to the much desired green hydrogen future.

And it’s all about economics — forget ideology.

You can want something to happen, but to make it happen, the product needs to sit at the right point on the cost curve.

Which is why I want to show you the following chart.

The ‘ASX-listed hydrogen stock index’

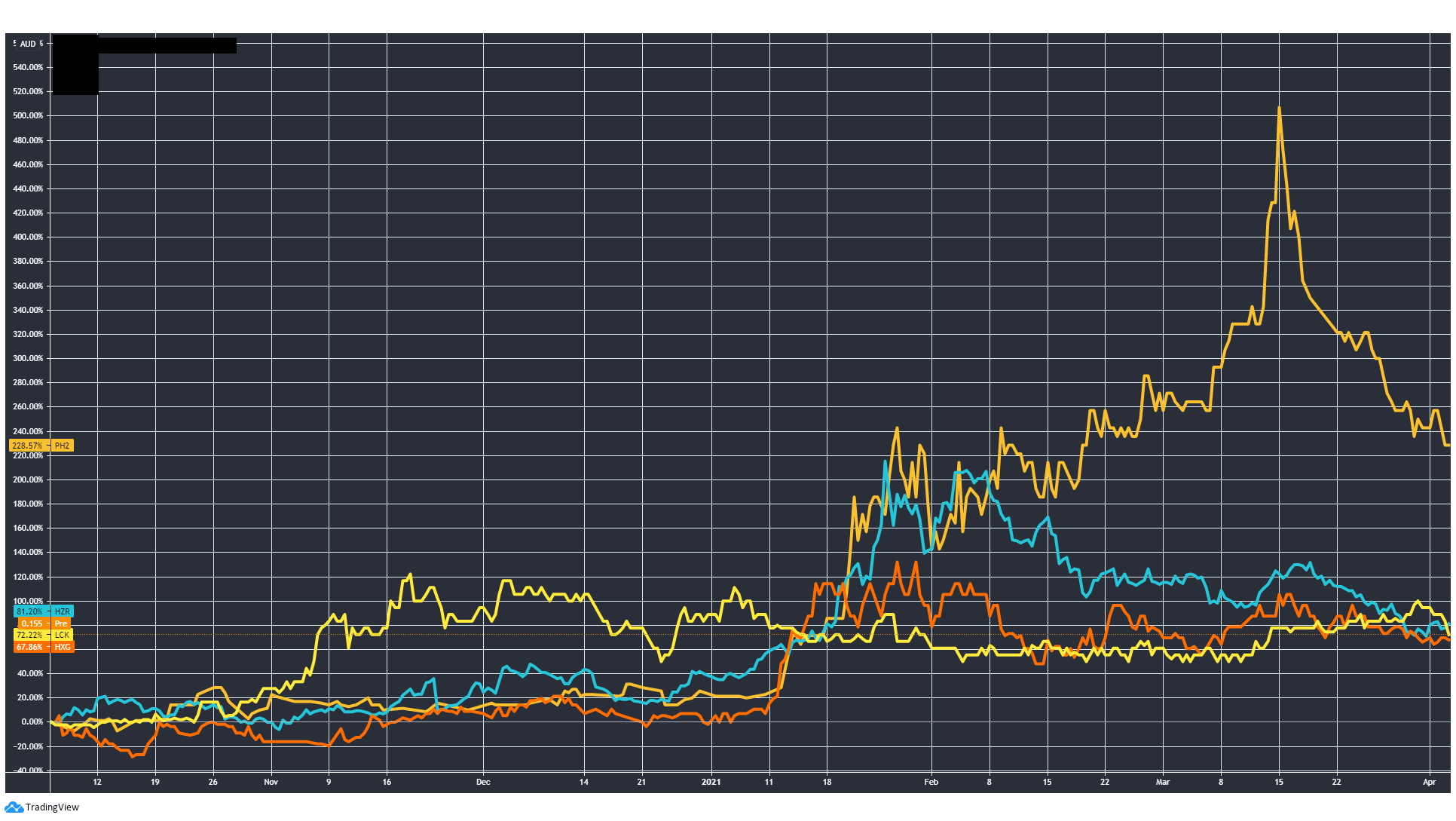

You can see how a selection of four ASX-listed hydrogen stocks performed over a six-month window:

|

|

| Source: Tradingview.com |

I’ve redacted the names of the stocks out of deference to current subscribers of Exponential Stock Investor.

We did a hydrogen themed monthly recommendation two months ago, with some early success.

With a bit of digging, I’m sure you can figure out the names though.

But as you can see on the chart, January/February is when things really started to take off.

Bear in mind that these are all small-cap companies at the moment.

Highly speculative and risky to be sure, but at the same time these could be future giants in an Asia/Pacific hydrogen market.

So what do you choose as a forward-thinking investor?

Twiggy chose hydrogen — will you choose hydrogen too?

Regards,

|

Lachlann Tierney,

For Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Comments