In today’s Money Morning…election sends this ETC and LIC higher…watch these ASX-listed cannabis companies go…it’s happy days now though…and more…

Editor’s note: In today’s video I look at what happened to the primary cannabis ETF post-US election and a few interesting charts worth paying attention to if you are interested in ASX-listed pot stocks. Please click the thumbnail below to view.

The simple answer is, yes they are.

The charts tell us this much.

Back in 2018 the hype was immense, and many novice investors piled into companies that had no revenue, no products, and no clear plan for commercialisation.

Cue the disappointment as the regulatory landscape in Australia didn’t change.

There were some obvious flaws in the business models — the primary flaw being the tyranny of distance.

It goes like this…

Wait, so you’re telling me you are going to make a product in a tightly-regulated market (Australia) to ship to a much larger market (US/Canada) to compete with established companies who don’t have to jump through as many hoops?

Where’s the margin on that?

It just didn’t add up.

Now though, things are changing.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

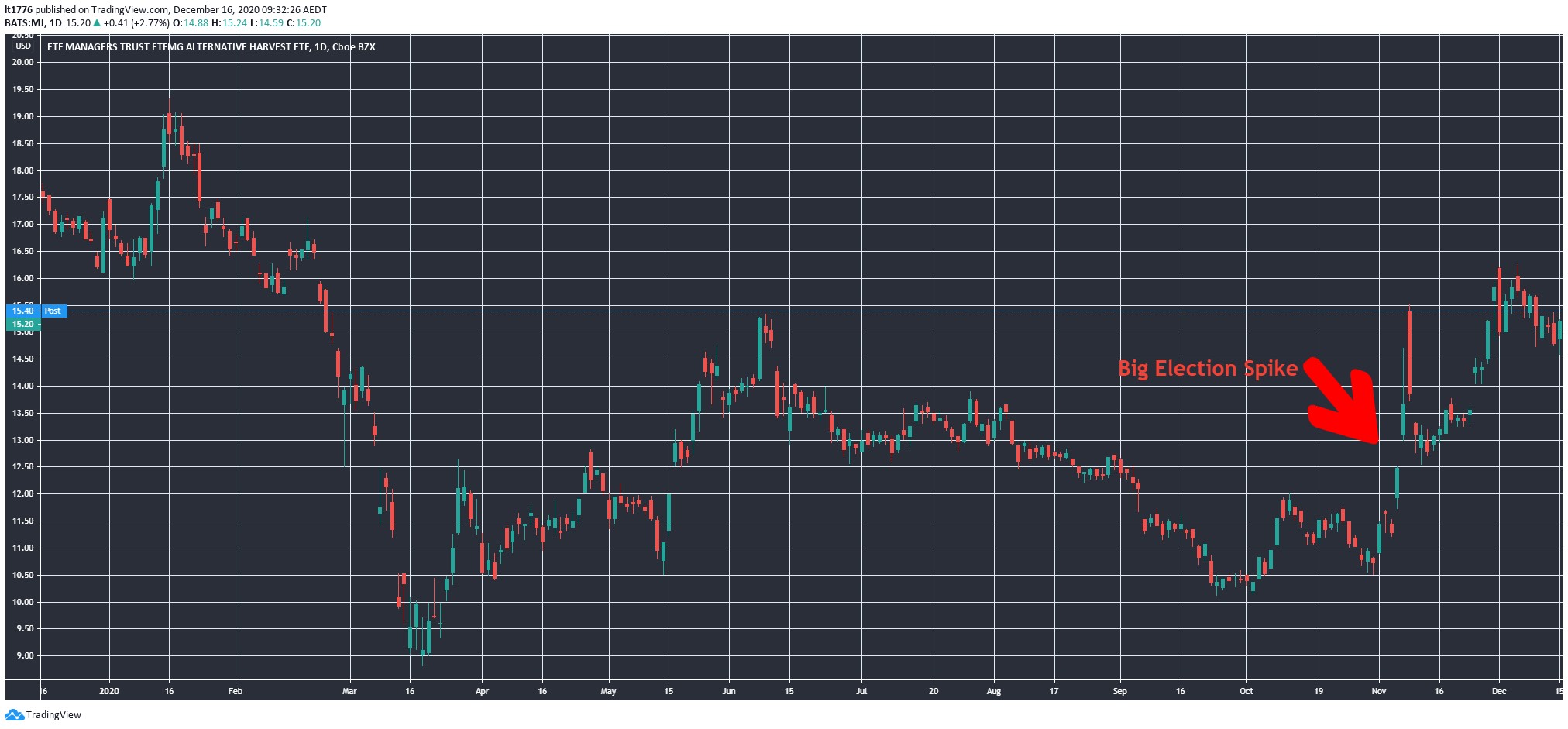

Election sends this ETF and LIC higher

Biden won the election, promising further easing of regulations, and the main cannabis ETF — ETFMG Alternative Harvest ETF [MJ] — started to move:

|

|

| Source: Tradingview.com |

At the same time ASX-listed cannabis LIC — MMJ Group Holdings Ltd [ASX:MMJ] — moved as well.

Now, MMJ holds a number of stakes in North American companies across the value chain and uses Alternative Harvest as its benchmark.

Their recent market commentary is well worth paying attention to as well (emphasis added):

‘Good news came in the form of voters in individual states choosing cannabis legalization via ballot proposition measures including New Jersey, Arizona, South Dakota, Montana and Mississippi. Oregon even chose the dramatic step of voting to have all recreational drugs be decriminalized. These additional US states represent several billion dollars in potential tax revenue that can be collected by state governments in these COVID-hit hard times. These five states alone could add $2.5bln a year in annual top line sales for the industry…

‘After many years of explosive stock price growth, 2020 was a major wakeup call for the entire cannabis industry. The rubber met the road for companies in terms of delivering on actual revenue and EBITDA as opposed to providing hopeful projections for the future. The entire sector was re-rated much lower. However, as we’ve been saying for quite some time, 2020 could be a bottoming year for cannabis stocks with the US elections providing the next catalyst for an upward move. This time, however, the stocks are moving up from a much lower base and are trading at multiples that make more sense given the market size of existing and newly opening medical and recreational markets. If rational investor behaviour holds and the valuation silliness of earlier years doesn’t come back, we could be in line for a much more sustained and steadier longer-term growth picture.’

The potential bottoming for 2020, and 2021 shaping as a boom year for ASX-listed cannabis companies was something we highlighted last month.

And it’s a phenomenon that’s playing out for a number of companies as I write.

Watch these ASX-listed cannabis companies go

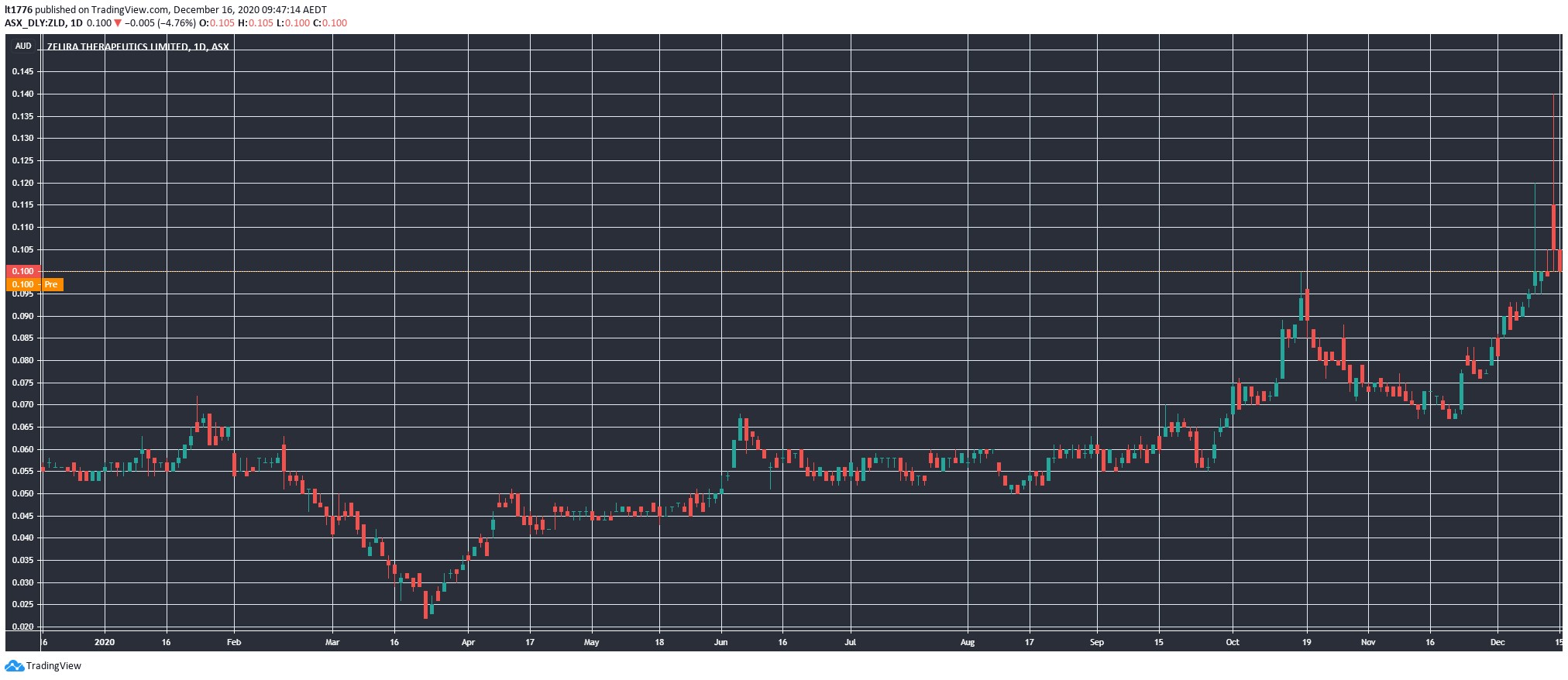

First up is Zelira Therapeutics Ltd [ASX:ZLD], formerly known as Zelda — yes the Nintendo game character.

This company is specifically focused on the pharmaceutical and clinical trial side of things and its share price has been in a steady uptrend since March:

|

|

| Source: Tradingview.com |

You can see a big spike at the end there on a further expansion into the lucrative US market.

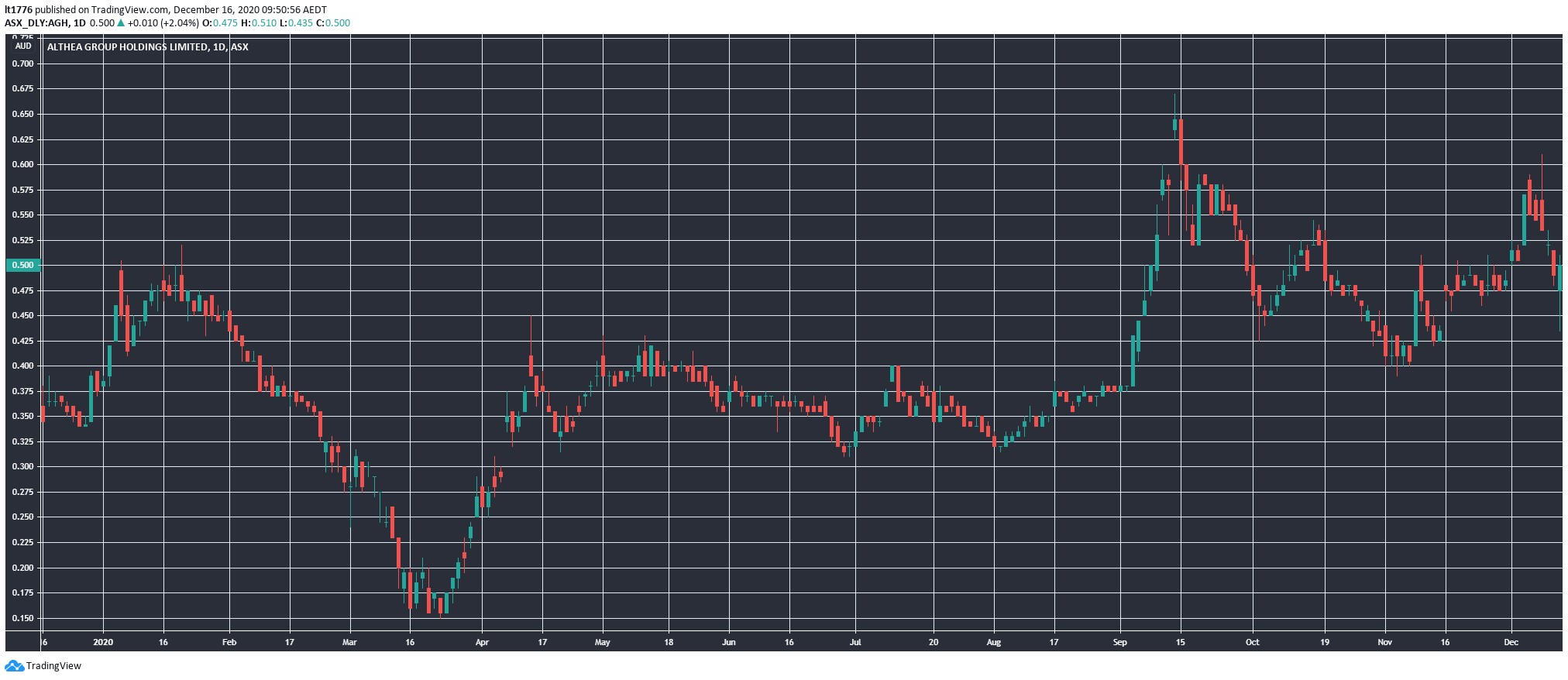

The next chart worth paying attention to is Althea Group Holdings Ltd [ASX:AGH]:

|

|

| Source: Tradingview.com |

Althea is very much focused on the small but growing Australian market.

They also have products in the UK and are moving into Germany.

Should the regulatory picture change in Australia, their dominant position here could give it an edge over other companies.

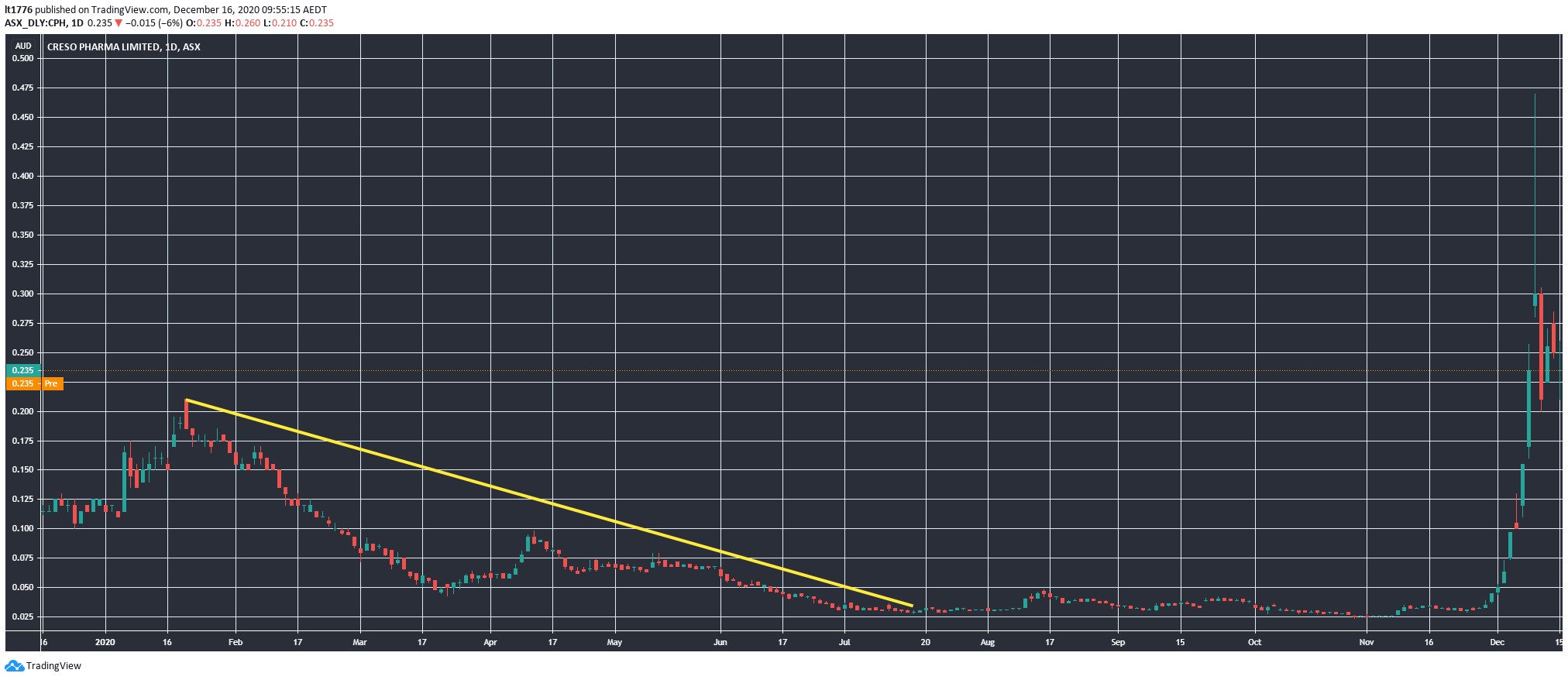

Finally, here is the wildest chart of them all, Creso Pharma Ltd [ASX:CPH]:

|

|

| Source: Tradingview.com |

A long-term downtrend, then months of sideways trading at very low levels.

Then a monumental spike that took it from around 2.5 cents to over 45 cents in a matter of days.

It’s old news in ASX forums these days, but it just goes to show you what can happen if the right factors come together for a small-cap.

Over the past two years I’ve followed CPH closely, and they faced a number of hurdles.

At one stage, they even looked like they were on the brink.

It’s happy days now though.

Here’s the key takeaway point from all of this too…

It’s not just about wantonly moving from hype sector to hype sector with small-caps.

The trick is to beat the hype to the punch.

It’s about identifying the beneficiaries of key trends, drilling down on the best positioned companies, and then sticking to your convictions.

Do this, and you put yourself in a much better position as an investor.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.