The ASX 200 has taken a severe battering over the last five weeks, down over 30% at the close of the market yesterday.

Since late February 2020 the COVID-19 virus has gripped the globe and in doing so has dumped global markets to recession levels. With some companies announcing major layoffs and others shocked into trading halts. You can see the steep drop in the chart below:

Source: Optuma

What were the best- and worst-performing sectors?

Taking into account the market overall had pushed down over the last five weeks, energy has been the hardest hit sector over this time declining over 53% (first chart), with Consumer staples showing more resistance to the pandemic with a fall of over 12% (second chart).

Source: Optuma

Source: Optuma

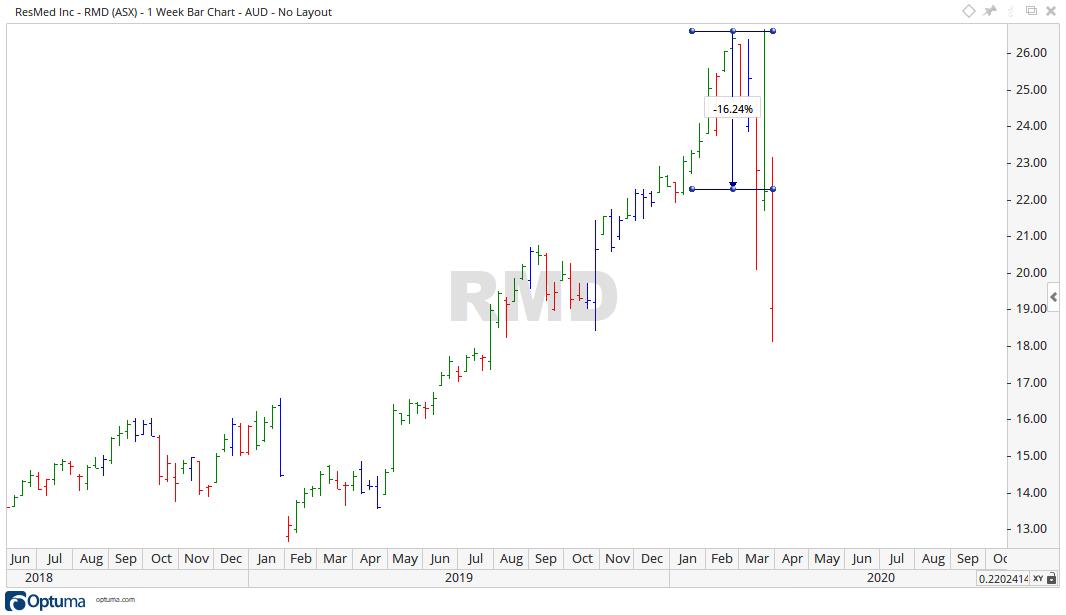

Looking across the market, some of the best performers were Northern Star Resources Ltd [ASX:NST] (first chart) and ResMed [ASX:RMD] (second chart) being down 11.65% and 16.24%, respectively, at the time of writing.

Source: Optuma

Source: Optuma

The market also saw some stocks take a hammering, with Credit Corp Group Ltd [ASX:CCP] down 73.89%, Corporate Travel Management Ltd [ASX:CTD] down 66.38%, and Flight Centre Travel Group Ltd [ASX:FLT] put into a trading halt!

Managing director Graham Turner noted:

‘We are dealing with unprecedented restrictions and extraordinary circumstances that are having a significant impact on our customers, people, suppliers and all other stakeholders.’

Mr Turner also said:

‘People are effectively unable to travel in the near-term, either domestically or internationally, and some are unable to be repatriated to their home countries, which is affecting thousands of people and is a problem that we’re working to help solve. Signalling troubling times in the Australian market.’

What’s next for the ASX 200?

It’s safe to say the market and country are now in recession territory as was expected by the IMF globally. Today the market rose 1.77% after being up yesterday as well, with the announcement overnight of a $2 trillion US stimulus package in response to the COVID-19 pandemic. This may be seen by some as a sign of confidence coming back into the market.

With the virus still accelerating globally with more deaths and cases daily, it could be too early to say the market is looking positive.

Regards,

Carl Wittkopp,

For Money Morning

PS: In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.

Comments