ASX announcements are numerous and daily. Let’s catch up on three ASX announcements you may have missed.

PointsBet announces acquisition

PointsBet Holdings Ltd [ASX:PBH] shares are trading 13% higher this week.

This is partly due to Tuesday’s acquisition announcement.

PointsBet’s wholly-owned Irish subsidiary — Lockspell — entered a binding share purchase agreement with Banach Technology.

PointsBet will acquire Banach for US$43 million on a cash and debt-free basis.

55% of the price will be paid in cash and the rest in scrip — 1,752,875 PointsBet shares calculated using the 20-day VWAP immediately prior to the share purchase agreement.

Banach provides proprietary risk management platforms and trading models supporting pre-game and in-play betting products for the four major American sports as well as international football (soccer).

Banach founders helped establish the Quants department at Paddy Power, now known as Flutter Entertainment.

According to PointsBet, the acquisition will ‘position PoinstBet as a leader of in-play sports wagering in the United States, just as in-play wagering is expected to grow exponentially.’

If you are excited by all things tech and algorithms and proprietary machine learning programs, then I think you may also enjoy reading our free report on new small-cap fintech stocks.

The report will go through three innovative Aussie fintech stocks with exciting growth potential. Check it out if you’re interested.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

CBA BNPL announcement targets Afterpay’s market dominance

Commonwealth Bank of Australia [ASX:CBA] released a media update announcing its own buy now, play later (BNPL) offering.

CommBank’s BNPL will only be available to ‘eligible customers’ following internal and external credit assessments.

This didn’t seem to deter Afterpay Ltd [ASX:APT] investors, with APT shares closing 1.2% up on Wednesday.

Two things really stood out to me from CBA’s media update.

One, CommBank’s BNPL offering will be available everywhere the bank’s cards are currently accepted.

Instead of signing up or marketing to merchants, CommBank leveraged its existing base to instantly provide CommBank users access to anywhere where CommBank cards are accepted.

This would be a vast number given its status as one of the biggest Australian banks.

Two, businesses will pay no additional fees with CommBank BNPL above the standard merchant services fees they already accrue.

This is significant since the crowded BNPL space will likely start competing on cost to lure merchants to adopt theirs and not their competitors’ platform.

This move by CommBank may make it a no-brainer for merchants (unless the standard merchant services fees are equal to or higher than what BNPL charges merchants).

A couple of quick thoughts I had.

Users who are not with Commonwealth Bank are unlikely to deal with the hassle of switching to CommBank all for the sake of accessing its BNPL offering, especially if they already have other BNPL apps installed.

So its customer base is capped in a way that Afterpay’s isn’t.

But what happens when the other banks follow and offer their own BNPL offerings?

You could imagine product names like WestpacIT, ANZap, NABpay.

What would happen to the likes of Afterpay and Zip Co Ltd [ASX:Z1P] then?

Final thought: How will CommBank BNPL impact CBA’s existing partnership with privately-owned BNPL behemoth Klarna?

Food for thought.

Lake Resources refreshes project valuation

In other news, Lake Resources NL [ASX:LKE] share price is up 12% over the last week.

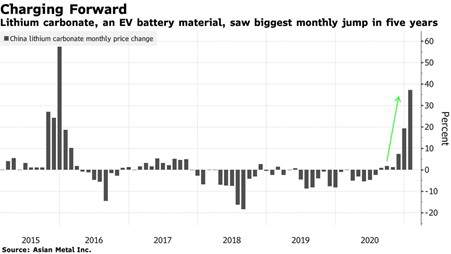

On Wednesday, the clean lithium developer notified the market that it has refreshed its ‘flagship’ Kachi Lithium Brine Project Pre-Feasibility Study (PFS) based on revised lithium price estimates.

According to the company, the revised lithium price estimate means the project value NPV8 (net present value using a discount rate of 8%) is now US$1.6 billion.

This is an increase of about 110% from NPV8 of US$748 million.

The Lake Resources estimate relied on a lithium price forecast of US$15,500 per tonne for high-purity battery-grade lithium carbonate and held all other parameters constant.

LSE shares closed 1.4% up on Wednesday.

How little the stock moved may signal that LKE investors have already priced in the potential of the project.

The price of lithium is up over the last few weeks too, so the market may have treated LSE’s update as information already largely anticipated in the LKE current share price.

Source: Bloomberg

Source: Bloomberg

The rising lithium price and the potential boom in electric vehicles and clean energy corresponded with share price jumps for lithium stocks.

As we’ve covered here in Money Morning, stocks like Vulcan Energy Resources Ltd [ASX:VUL], Lithium Australia NL [ASX:LIT] and EcoGraf Ltd [ASX:EGR] are up over the past year as investors seek exposure to sustainable energy markets.

Now if you want to read more information on lithium stocks, then you can read this free report here. It delves further into the lithium sector and also reveals three stocks that you could benefit on the back of renewed demand for lithium in 2021.

Regards,

Lachlann Tierney

For Money Morning

Comments