We review this week’s ASX news, from MNS and CPH getting caught up in ASIC probes to CBA shares tanking on their latest quarterly.

Let’s start with the small-caps sector…and the Australian Securities and Investments Commission (ASIC).

Magnis chair Frank Poullas investigated by ASIC

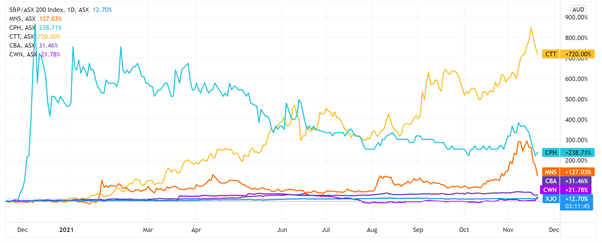

Magnis Energy Technologies Ltd [ASX:MNS] share price is down 35% since The Australian reported on Wednesday that Magnis chair Frank Poullas is under investigation by ASIC.

The Australian cited sources close to the watchdog suggesting ASIC has not ruled out expanding the investigation to encompass Magnis itself.

Further details are scant at the moment as ASIC did not offer more detail when queried by The Australian.

Magnis did release a short response to the market late on Wednesday.

The next-gen battery maker said the reporting contained ‘a number of unsubstantiated statements.’

MNS further stated that the company itself is not under investigation by ASIC.

Magnis did not comment on the situation surrounding its chair, Frank Poullas.

MNS shares were down 15% on Friday afternoon trade.

Creso management caught up in AFP raids

The Magnis chairman wasn’t the only executive caught up in intrigue.

Pot stock darling Creso Pharma Ltd [ASX:CPH] saw its shares plummet after the Australian Federal Police raided the offices of a Sydney brokerage tied to CPH’s co-founder and non-executive chair, Adam Blumenthal.

Mr Blumenthal serves as an executive chair at EverBlu Capital.

On Tuesday, the AFP raided EverBlu’s Sydney CBD offices as part of ASIC’s investigation ‘into the ramping of a cannabis stock,’ reported The Australian.

EverBlu is known across Sydney’s corporate community as a broker for small-cap stocks.

Apart from the connection through Mr Blumenthal, EverBlu also worked with the pot stock on several capital raisings.

Regarding Mr Bluementhal’s involvement with EverBlu, Creso had this to say (emphasis added):

‘The Company is aware of two articles published by the Australian Financial Review today, which reported that the Australian Federal Police were executing a search warrant at the Sydney offices of Everblu Capital, of which Creso Pharma Limited’s Chairman, Adam Blumenthal, is a director.

‘The Company is yet to be able to independently verify the nature of the enquiry or determine whether the matter relates to Creso Pharma Limited.

‘The Company confirms, however, that it has not been served with any notices from any regulatory body in connection with the matter. As a result, the Company does not consider there to be any basis for it to make public announcement in relation to this matter. Otherwise, the Company is not aware of any other explanation for the recent trading in its securities.’

CPH shares are down 40% year-to-date.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Cettire customers rise 220%

Cettire Ltd [ASX:CTT] on Thursday released its latest trading numbers for the four months to 31 October.

The luxury items online retailer has been on a tear after publicly listing on the ASX last December, with CTT shares rising over 700% since then.

Growth in key metrics in this week’s trading update indicates why some investors are buying in to this growth stock’s story.

Here are the highlights:

- Gross revenue up 184% to $78.9 million

- Sales revenue up 172% to $57.8 million

- Unique website visits up 231% to 10.4 million

- Active customers up 220% to 158,260

The difference between gross revenue and sales revenue is the amount deducted for allowances and returns from customers.

Allowances and returns ate up more share of gross revenue than in the previous corresponding period.

Sales revenue as a percentage of gross revenue fell from 77% to 73%.

Cettire’s conversation rate dipped 7% in the current period, down from 1.11% to 1.03%.

The CTT share is down 12% since the trading update.

Blackstone offers $12.50 per share to acquire Crown

Ever tried. Ever failed. No matter. Try again. Fail again. Fail better.

Global investment fund Blackstone Inc [NYSE:BX] is living out its version of Beckett’s inspirational mantra.

Having previously offered to acquire Crown Resorts Ltd [ASX:CWN] for $11.85 a share and $12.35 a share, Blackstone nursed Crown’s rejections and today returned with a higher offer.

Only this time, Blackstone hopes its attempt will not be a better failure but a sound success.

Crown was quick to note the offer is unsolicited and non-binding. To boot, Blackstone’s offer price will be reduced by the value of any dividends declared or paid by CWN.

Blackstone’s upped offer is quite the development, if you consider that only last month the Victorian Royal Commission into Crown’s Melbourne licence concluded:

‘The Royal Commission finds Crown is unsuitable to hold a casino licence on the basis that it has engaged in conduct that is “illegal, dishonest, unethical and exploitative.” The Royal Commission notes that the scale of the wrongdoing is so widespread and egregious that “[n]o other finding was open”.’

Blackstone’s revised offer may have something to do with Crown’s seemingly too-big-to-fail status.

Despite finding CWN was unsuitable to hold a casino licence, the Royal Commission nonetheless concluded that the ‘immediate cancellation of the licence is not in the interests of the Victorian community.’

The Royal Commission found it was still a better outcome overall to have Crown retain its licence, even though Crown engaged in ‘illegal, dishonest, unethical, and exploitative’ conduct.

In Blackstone’s mind, then, maybe that’s a strategic moat worth paying a few extra cents a share for.

CWN share were up 15% in Friday afternoon trade.

CBA shares fall as margins shrink

It’s not often you see Commonwealth Bank of Australia [ASX:CBA] trade like a small-cap.

But after Australia’s largest public company released its September quarter on Wednesday, its share price tumbled in a manner not befitting a blue chip.

Since the update, CBA shares are down almost 10%, taking the CBA stock from $107 a share to the current $97.5.

In 1Q22, CBA posted cash NPAT of $2.2 billion, up 20% on 1Q21.

But other figures weren’t so great.

Cash NPAT was actually 9% lower than CBA’s 2H21 quarter average.

CommBank also saw a 1% decline in operating income, even despite shaving expenses by 1%.

But it was the bank’s margins that set the cats among the pigeons.

CBA reported that its net interest margin was ‘considerably lower in the quarter.’

CommBank attributed the slide to multiple factors:

‘Drivers of the decline were consistent with those indicated at the Group’s FY21 results in August, including higher liquid asset balances (contributing ~3.5% of the Average Interest Earning Assets (AIEA) growth but with minimal impact to NII), home loan price competition and switching to lower margin fixed rate loans, as well as the continued impact of a low interest rate environment.’

JPMorgan analysts said CBA’s September quarter update was ‘much weaker’ than expected:

‘We see likely material downgrades to pre-provision profit forecasts, reflecting heightened margin pressures, lower non-interest income, and higher cost growth.’

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here