The Anson Resources Ltd’s [ASX:ASN] share price is up after announcing exploration at Yellow Cat has confirmed high grades of uranium and vanadium.

Anson reported high-grade assay values of up to 87,600ppm uranium (10.33% U3O8) and 143,500ppm vanadium (25.61% V2O5).

This news was positive enough for ASN shares to spike.

ASN shares are currently up 5.6%.

ASN shares have outperformed ASX 200 the last 12 months, gaining almost 370%.

Yellow Cat assays confirms high-grade uranium and vanadium

Today Anson announced the completion of the second stage of its uranium and vanadium exploration program at its 100% owned Yellow Cat Project in Utah.

Anson said the exploration yielded ‘exceptional high-grade’ assays with values of up to 87,600ppm uranium (10.33% U3O8) and 143,500ppm vanadium (25.61% V2O5).

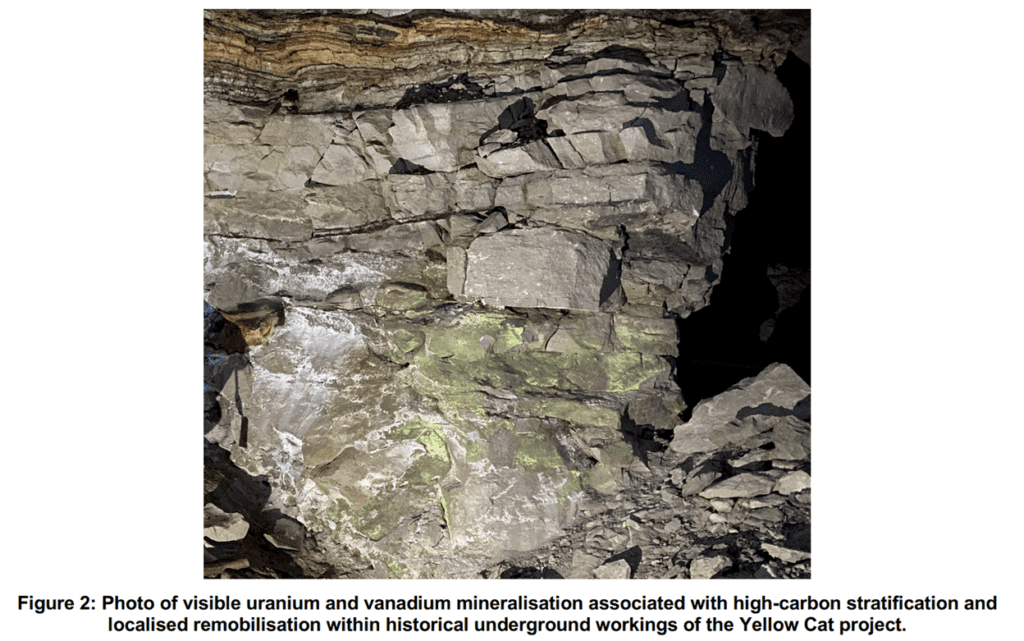

ASN also noted that multiple occurrences of visible mineralisation were observed on the faces of the historic underground workings within the project area.

Later, Anson took a third party on board to complete a survey of mineralised outcrops, accessible historical open pit, underground mine workings, and remnant ore pads.

The company notes that during the work, hundreds of historical drill holes across the project area were identified, many of which were well labelled and matched coordinates on maps in Anson’s possession.

The surface outcrops and ore pad grab samples were submitted to the laboratory.

Anson believes that the Yellow Cat Project in Utah has the potential to supply high-grade uranium ore to help fill existing local mill processing capacity.

Furthermore, it plans to use all the available data to refine the knowledge of local mineralisation, while guiding refinement of drill targets for the planned drilling campaign.

The planned drilling is expected to involve shallow drill holes at depths between 20–40 meters. This will require a small rig resulting in minimal disturbance.

Anson’s Executive Chairman and CEO, Bruce Richardson, commented:

‘These high-grade assay results and a data base that provides a detailed understanding of the geological setting, provides further opportunity to increase the project exploration target.”

‘The Company is continuing to develop the Yellow Cat project through the next stage of its exploration program with the aim of increasing shareholder value.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

What’s next for ASN?

Anson’s Yellow Cat project is located within the Colorado Plateau physiographic region, an area that has seen significant new interest from ASX-listed exploration and development companies.

So Anson seems to be sitting on coveted land.

Today’s announcement also comes at a time when uranium prices are rising.

The Wall Street Journal reports spot uranium oxide prices are up more than 60% since mid-July, reaching $42.50 per pound last Friday, the highest since 2014.

The shifting market conditions were expected, said ASN CEO Bruce Richardson:

‘The recent increase in the uranium price has been expected for some time and as Anson has continued to invest in the development of the Yellow Cat Project, it is well positioned to take advantage of the renewed interest in this mineral.’

The company is also progressing in its battery test works as it received positive battery test-work results from NOVONIX Ltd [ASX:NVX], which demonstrated that its high-purity lithium makes batteries last longer.

Lithium, uranium, vanadium.

It seems Anson is aiming to have a stake in as many resources of the future as possible.

If you’re interested in further reading on the booming lithium industry, I suggest

The report also goes through three unique lithium companies: a European lithium developer, an established Aussie producer, and a speculative WA miner.

Worth a read!

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here