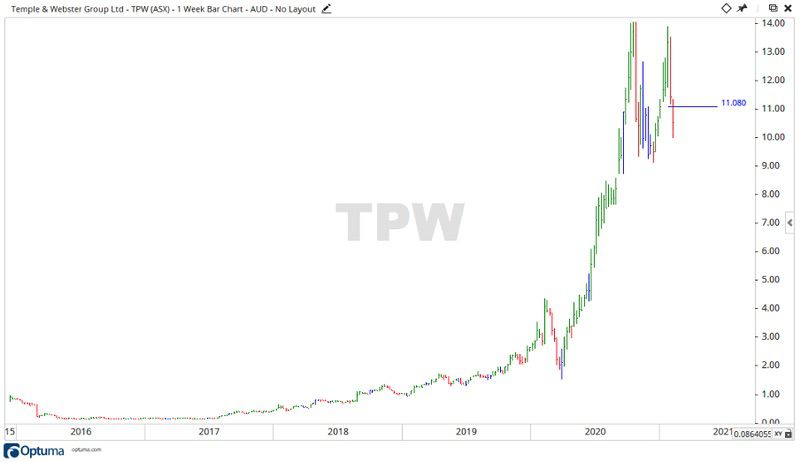

At time of writing the Temple & Webster Group Ltd [ASX:TPW] share price is trading at $11.08, up 5.22%.

Temple & Webster Group experienced a fantastic growth to their share price and fortunes throughout 2020, but is the run over?

Source: Optuma

What Happened with the TPW Share Price in 2020?

2020 will always be remembered for the COVID-19 pandemic and the effect it had on the world.

For companies, some were crippled by the pandemic, while others flourished. Temple & Webster fall into the latter category.

In a recent announcement the company outlined their results for H1 FY2021:

- ‘H1 revenue of $161.6m up 118% year on year

- EBITDA of $14.8m, versus $2.3m in prior corresponding period (up 556%)

- Cash flow positive half with ending cash balance of $85.7m (including proceeds of a $40m placement)

- Active customers up 102% to 687k

- Trade and Commercial division grew 89% year on year’

These results prove once again that throughout 2020 online companies really were the business winners.

Temple & Webster CEO Mark Coulter noted:

‘I am pleased to present a great set of results for the first half of FY21. While 2020 remained a challenge for the country, we are proud that many Australians continued to turn to Temple & Webster for their furniture and homewares needs.’

While this all looks good on paper and is nice to talk about, the share price may be starting to tell a different story.

Temple & Webster and 2021

Pre-pandemic the share price of the company started to move up, before falling into the March low of 2020.

From there it shot through the roof, moving up over 824% to the high of $14.05 in October 2020.

As can be seen below:

Source: Optuma

Since the high, the price fell away before trying to move back up — which created a ‘double top’.

It is this double top that may give cause for concern.

Source: Optuma

Once a double top forms, historically the share may fall up to 150%.

Looking at the above chart, the range of 125–150% shows up around previous price clusters on the daily chart.

Should TPW fall in line with the usual double top rules, then the price levels of $7.17 and $6.47 may become the future focus.

For Temple & Webster to be considered bullish again it would have to break the price level of $14.05 and create a new all-time high.

While the company recorded an excellent year for 2020, a lot of the things that got it there are returning to normal or disappearing.

Many people are returning to the workplace and are no longer at home as much, and the government support systems of JobKeeper and JobSeeker are being dialled back as well.

If you haven’t got in to trade TPW already, you may have lost the chance of a massive run-up for now.

Our publication Money Morning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning

Comments