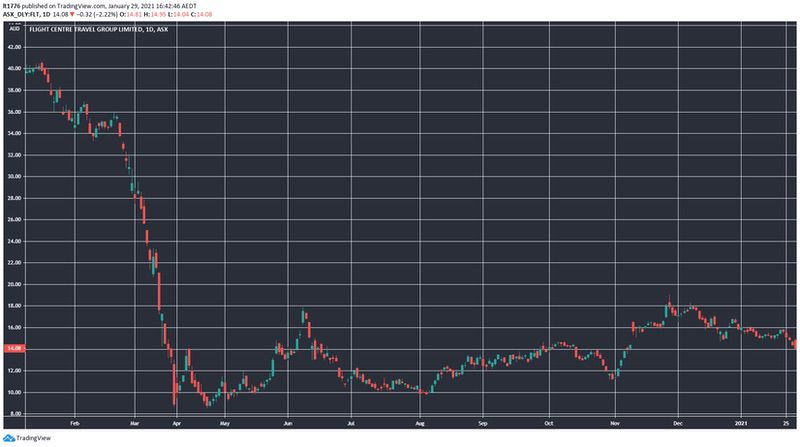

At time of writing, the share price of Flight Centre Travel Group Ltd [ASX:FLT] is trading at $14.08, down 2.22% today.

In a 12-month window the FLT share price shed around 60%.

Source: Optuma

The state of the travel industry

Pre-COVID-19 travel had become a very accepted part of life.

Flights were a reasonable price, there were unlimited destinations to explore, and typically once winter arrives in the southern states of Australia, everyone makes a beeline for the European summer.

Then COVID-19 hit, and everything changed.

The disaster that unfolded as global lockdowns were put in place were fast and savage.

For companies such as Flight Centre the scramble for survival was on.

The company reacted quickly to find cash. Selling their Melbourne-based headquarters for $62 million in May 2020, along with a capital raise of $700 million

Crown Resorts Ltd [ASX:CWN] found themselves in the same boat.

Both suffered massive drops in their share price.

What the future may look like

By any measure the last 12 months was grim. The pandemic affected every part of life as we know it.

Like all problems though, everyone is looking for a solution. When that solution arrives, life as we once had it may return.

That may present an opportunity for patient investors.

Once the travel bans are lifted and people once again feel safe, the attention may return to Flight Centre as people get itchy feet.

Source: Optuma

As can be seen from the chart above, the share price for the company is sitting down around the low of 2010.

Flight Centre still knows how to run a business and their business is travel. The only thing missing right now from the equation is the people to travel.

It now looks like we are moving closer and closer to a vaccine.

If we can take control of the virus, travel restrictions may lift, which could pump money back into the likes of Flight Centre.

With the share price so low at present there’s a legitimate case to be made for a long-term buy and hold here.

As the recovery slowly takes place the market could present some good chances to get in and make a profit.

Right now, Flight Centre looks like it may be one for those with the longer-term view. All that is required is some patience.

If you are looking at trading more volatile stocks, risk is important to wrap your head around.

Our chart guru Murray Dawes has a great report with insights into technical analysis strategies.

Get that report, right here.

Regards,

Carl Wittkopp,

For Money Morning

Comments