The Appen Ltd [ASX:APX] reported disappointing H121 results, while also announcing the acquisition of Quadrant.

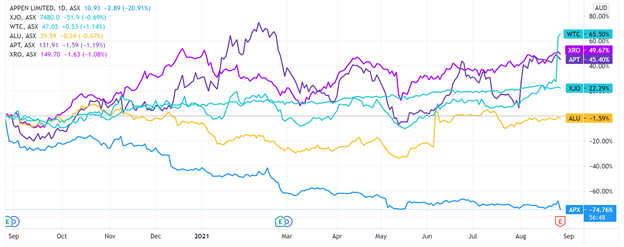

Appen Ltd [ASX:APX] share price was down 20% in afternoon trade, trading at $10.97 a share, nearing Appen’s 52-week low of $10.65.

Appen is in a protracted slide this year, with the stock down 74% over the last 12 months.

Let’s examine why investors are selling off Appen shares today.

Appen’s 1H21 results

The company reported that group revenue was down 2.0% to $196.6 million, primarily driven by reduced services revenue and the heavy skew in project timings.

Gross margin also shrunk due to Appen’s customer and project mix, as large legacy project volume growth slowed.

However, Appen’s Actual Contract Value (ACV) did rise 16% to $119.6 million, with revenue in China growing at a compound rate of 60% in the last five years.

The company said it spent 10.8% of its revenue on product development to explore expanding markets and enhance productivity.

Despite the ACV growth, Appen’s underlying EBITDA was down 14.3% to $27.7 million.

But that wasn’t the biggest fall.

Appen’s underlying NPAT fell 35.0% to $12.5 million and statutory NPAT sunk further, down 55% to $6.7 million.

This was driven by increased amortisation associated with investment in product development.

The company did report no debt and a cash balance of $66 million as at 30 June 2021.

Lastly, the board agreed upon an interim dividend of $4.5 cents per share, 50% franked.

Appen’s Chief Executive Officer Mark Brayan said:

‘As expected, our first half results were impacted by our global technology customers’ focus on new AI products and applications, as they broaden their revenue base outside of digital advertising and respond to data privacy changes.’

Appen to acquire Quadrant

Appen also revealed today that it’s set to acquire the location intelligence data provider, Quadrant.

APX will make an upfront cash payment of US$25 million and a potential additional payment of US$20 million in Appen shares to acquire 100% of the share capital of Quadrant.

The upfront cash payment will be funded from existing cash reserves and the transaction is expected to close in September 2021.

Appen share price outlook

Investors were disappointed with Appen’s results today.

A stock doesn’t often drop 20% in a day on good results.

But did today’s half-yearly leave anything for the bullish investors?

Bulls may point to Appen’s aggressive investments to expand its operations, especially the Quadrant acquisition.

With the Quadrant acquisition, Appen could be tapping into a growing location intelligence market.

APX said today that the global location intelligence market was valued at US$11.9 billion in 2020, but is expected to grow at a 14% CAGR and reach around US$29.8 billion in 2027.

While some may be disappointed by Appen’s recent performance, it’s clear that technology like AI and machine learning is here to stay.

And if you’re interested in small-cap stocks that have the potential to disrupt industries with fresh and pioneering ideas, I suggest reading the latest report from our market analyst Murray Dawes on seven exciting small-caps he’s found.

Recommended reading.

Regards,

Kiryll Prakapenka

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here