Banks tightening up lending standards. A slowing economy. Property markets suffering larger-than-expected falls. RBA Governor Phil Lowe is indicating interest rates are headed higher. How much higher? He (and the rest of us) don’t know.

On the surface, markets appear relatively calm…moving a few points in either direction. But, underneath the composed outer veneer, all is not well. Rising interest rates have altered the risk versus reward equation.

With US Government two-year bonds paying 4.6% per annum, US investors now have an alternative to ‘no and low’ yielding stocks. Repricing of markets awaits.

All these factors have raised anxiety levels a notch or two.

How do I know this?

Through social contacts…especially millennials with mortgages.

The anger with Phil Lowe is palpable. ‘He lied to us’, is a common theme.

They are worried.

And those with savings — who are beneficiaries of rising rates — are also unsettled.

Tonight, I’m holding a live ‘Ask Me Anything’ chat with members of The Gowdie Advisory.

Questions have been coming in ‘thick and fast’ on a number of topics.

However, the one question that dominates member emails is: How safe is my cash in the bank and/or super?

I’ve not witnessed this level of concern for a number of years.

Some members are merely inquisitive.

While others are seriously questioning whether they should be heading for the hills…armed with guns ‘n gold.

Even some family and friends have been asking me about how the $250k Government Deposit Guarantee works.

Anecdotally, it would appear people are quietly going about the business of protecting their capital.

There’s a whiff of September 2008 about this…prior to the Government Deposit Guarantee.

As reported in the Sydney Morning Herald on 14 September 2013, five years AFTER the Lehman Brothers collapsed (emphasis added):

‘Westpac boss Gail Kelly has described scenes of customers arriving at bank branches with suitcases looking to withdraw their cash as the global financial crisis hit its nadir five years ago.

‘In the first account by a major Australian bank chief executive, Ms Kelly says: “They [depositors] would want to pack their money into the suitcase and take it away with them.”

‘The panic in the community in the four weeks following the collapse of Lehman, before the government stepped in to guarantee deposits, was palpable.

‘“People were reading what was going on around the world, they were seeing other people losing their money, seeing banks collapse — so naturally people were thinking, ‘I had to protect myself first’.”

‘Reserve Bank governor Glenn Stevens was monitoring the flow of banknotes that were physically being taken from bank accounts. In September 2008 the RBA reported printing an additional 24 million $100 notes.’

At the time, this ‘flight to safety’ was kept quiet.

There was no media coverage.

People went about the business of protecting their capital…holding the cash themselves.

And it was this steady exodus of cash that eventually forced the government into announcing the Financial Claims Scheme…or as we like to call it, the Government’s Deposit Guarantee.

Even with the Government’s Deposit Guarantee in place, there’s still an air of concern over the safety of money in the bank.

The short answer to the most commonly asked question is: I don’t know. You can only take the government on its word.

The reason for my hedged response is that none of us know how severe the next economic crisis is going to be.

If it’s your regular garden variety recession, then everything should be OK. The system should be robust enough to handle it.

However, if we enter a fully-fledged depression — the likes of which none of us has ever experienced or could even envisage — then who knows which banks might fall over (especially with so much overpriced residential real estate on their balance sheets), and how the government of the day responds.

In a world with record levels of private and public debt, sky-high asset prices, and trillions of dollars committed to unfunded promises, if it all goes pear-shaped, who knows how all this could play out.

Since the now almost forgotten events of 2008/09, Greece has been the only template we have of what happens to a banking system on the verge of collapse.

The answer to ‘how safe is my money in the bank’ is one I’ve addressed many times. However, considering the recent wave of concern, it is timely to revisit the lessons.

This is an edited extract from The Gowdie Letter published in August 2019:

‘The Greek Experience

‘Anarchy. Chaos. Riots. Money is worthless. Gold is priceless.

‘We are guessing as to what this type of world might be like. None of us really know.

‘To try and see what it might be like we can look to Europe.

‘Up until late 2018, the citizens of Greece had been living with capital controls — restricted access to cash.

‘An article published by Reuters in May 2017 provided an insight into those restrictions:

“Depositors can withdraw up to 840 euros in cash every two weeks, but face no limit on money they have deposited in banks after July last year.”

‘During the period when capital controls existed, Greek depositors still had money in their bank account/s. The problem was they could only access it in bite size amounts.

‘According to Reuters (29 July 2017) the EU was considering similar restrictive access measures in the European Union…

|

|

| Source: Reuters |

‘Here’s an extract:

“European Union states are considering measures which would allow them to temporarily stop people withdrawing money from their accounts to prevent bank runs, an EU document reviewed by Reuters revealed.

“The plan, if agreed, would contrast with legislative proposals made by the European Commission in November that aimed to strengthen supervisors’ powers to suspend withdrawals, but excluded from the moratorium insured depositors, which under EU rules are those below 100,000 euros (US$117,000).

“Under the plan discussed by EU states, pay-outs could be suspended for five working days and the block could be extended to a maximum of 20 days in exceptional circumstances, the Estonian document said.”

‘[As of February 2023, these measures have not been introduced].

‘The current policy, in the event of an imminent European bank failure, is to enable access to deposits below the guarantee of €100,000.

‘The proposed (but as yet, not adopted) measures are to freeze access to all deposits for up to 20-days.

‘For the sake of this exercise, let’s assume the EU’s proposed model is the one that APRA (Australian Prudential Regulation Authority) decides is appropriate for our banking system.

‘This means deposits — up to $250k per taxable entity per Authorised Deposit-taking Institution) — is guaranteed.

‘However, you’ll only be able to access, say, $100 to $200 per day.

‘And, be prepared for access to be frozen for up to three weeks or more.

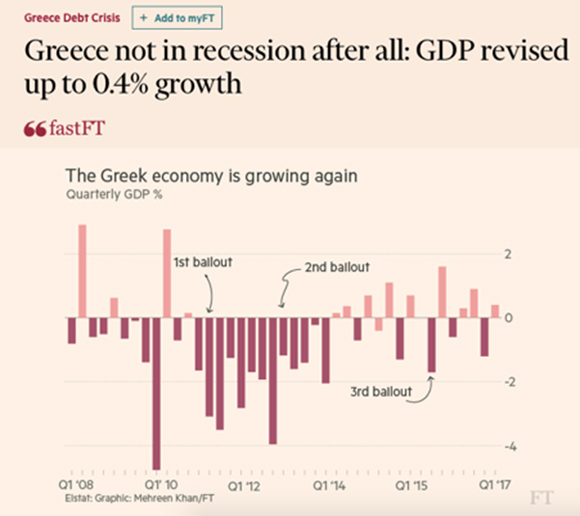

‘On 2 June 2017, the Financial Times published the following article:

|

|

| Source: FT |

‘The Greek economy went through a sustained period of shrinkage in 2011 to 2013…but then started to stumble its way to a recovery…of sorts.

‘So what can we glean from this information?

‘The Greek economy — in spite of restricted access to bank accounts — still managed to function…albeit with periods of contraction. The worst contraction was 5%, which means 95% of the economy was operational.’

It’s important to not go too far down the doomsday rabbit hole.

While things can get tough, the lesson from Greece is the world doesn’t come to a grinding halt.

Commerce still continues…albeit at a slightly lesser level.

That’s a critical point to remember.

Also, nothing lasts forever.

Bad times do give rise to better times.

Surviving the tougher conditions with capital intact is our priority.

Followed by how to capitalise on the discounted opportunities that inevitably present themselves when speculation is replaced by disbelief and misgivings.

Next week, in Part Two, we’ll look at how to achieve the primary aim…protecting your capital by understanding how the Financial Claims Scheme operates.

Until then…

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia