The AnteoTech Ltd [ASX:ADO] has signed a distribution agreement for its EuGeni reader and SARS-CoV-2 rapid diagnostic test in the Philippines.

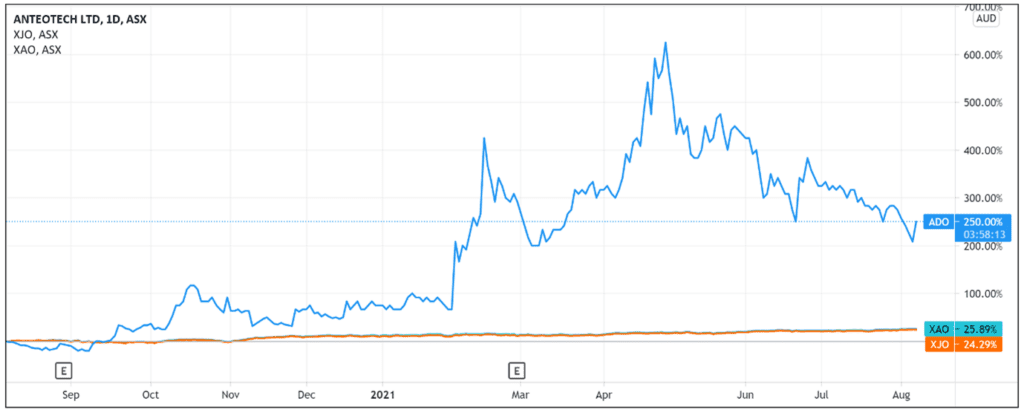

ADO share price is up as much as 18.9% in early trade, peaking at 22 cents.

Today’s gains somewhat offset ADO’s recent downturn, which has seen the stock trade well down from its 52-week high of 49.5 cents.

ADO signs distribution deal

AnteoTech — the surface chemistry company — today pleased shareholders by announcing a distribution deal with UC Biosciences Inc for the distribution of its EuGeni product in the Philippines.

Under the arrangement, UC Biosciences will become the exclusive EuGeni distributor in the country.

For reference, AnteoTech describes its EuGeni Rapid Diagnostic Platform as a ‘fast, accurate, and compact solution for rapid point-of-care testing.’

The platform’s first use-case — a 15-minute SARS-CoV-2 antigen test — has been approved for the EuGeni platform, with a saliva-based test currently ‘in validation.’

According to AnteoTech, the EuGeni platform allows for ‘rapid screening and identification’ of the SARS-CoV-2 antigen.

The company holding the exclusive Philippines distribution rights to ADO’s platform specialises in supplying diagnostic products and medical equipment to hospitals, laboratories and government agencies.

AnteoTech said UC Biosciences can supply products to ‘all customers throughout the Philippines archipelago.’

Terms of the distributions deal

The agreement starts on 5 August 2021, with AnteoTech reporting there are no conditions precedent attached.

The arrangement is for exclusive sales into the Philippines.

And the initial term of the distribution deal runs for three years, renewable after that on a year-on-year basis.

What next for AnteoTech Share Price?

AnteoTech said it and UC Biosciences will work together to seek and evaluate any government or enterprise tender opportunities for EuGeni.

And ADO CEO Derek Thomson noted that over the ‘coming weeks’ AnteoTech will work with UC Biosciences to secure the ‘required regulatory approvals to commence selling into the Philippines market.’

Mr Thomson also pointed out the country has a population of 100 million people and has used rapid antigen testing as part of its pandemic response.

In April 2021, the Philippines Department of Health released a Health Technology Assessment update on the use of rapid antigen test kits for the diagnosis of the virus.

The government body reiterated its past recommendation that these rapid antigen tests are ‘most useful in immediately identifying COVID-19 cases and can therefore be used to initiate contact tracing, epidemiological surveillance and clinical management.’

However, it did not recommend the use of rapid antigen tests for indiscriminate use in mass screening.

Rapid antigen tests are currently recommended only for ‘very specific purposes’, like targeted screening and diagnosis of suspected and probable cases of COVID-19.

Today’s news comes after AnteoTech signed a United Kingdom distribution agreement for EuGeni last month. That agreement commenced on 1 August.

Having burned through $2.8 million in cash in the June quarter, investors will likely turn their attention to how the distribution deals translate to sales.

That said, the rise today in ADO’s share price suggests investors are bullish on EuGeni’s commercial prospects in the wake of the distribution deals.

If you’re looking to read more about small-caps like ADO, then feel free to check out Money Morning’s free 2021 small-caps report.

The report discusses four small-cap stocks and outlines why now could be a good time to delve into the small-caps sector.

Check it out for yourself in our free report, right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here