Shares bounced for Anson Resources [ASX:ASN] on Thursday morning after the miner announced new discoveries of ‘lithium-rich horizons’ at its Cane Creek 32-1 well.

Earlier in the day, investor sentiment was low, showing a 10% decrease not long after the press release appeared on the ASX — however, over the next few hours, Anson’s share price shot up more than 10%.

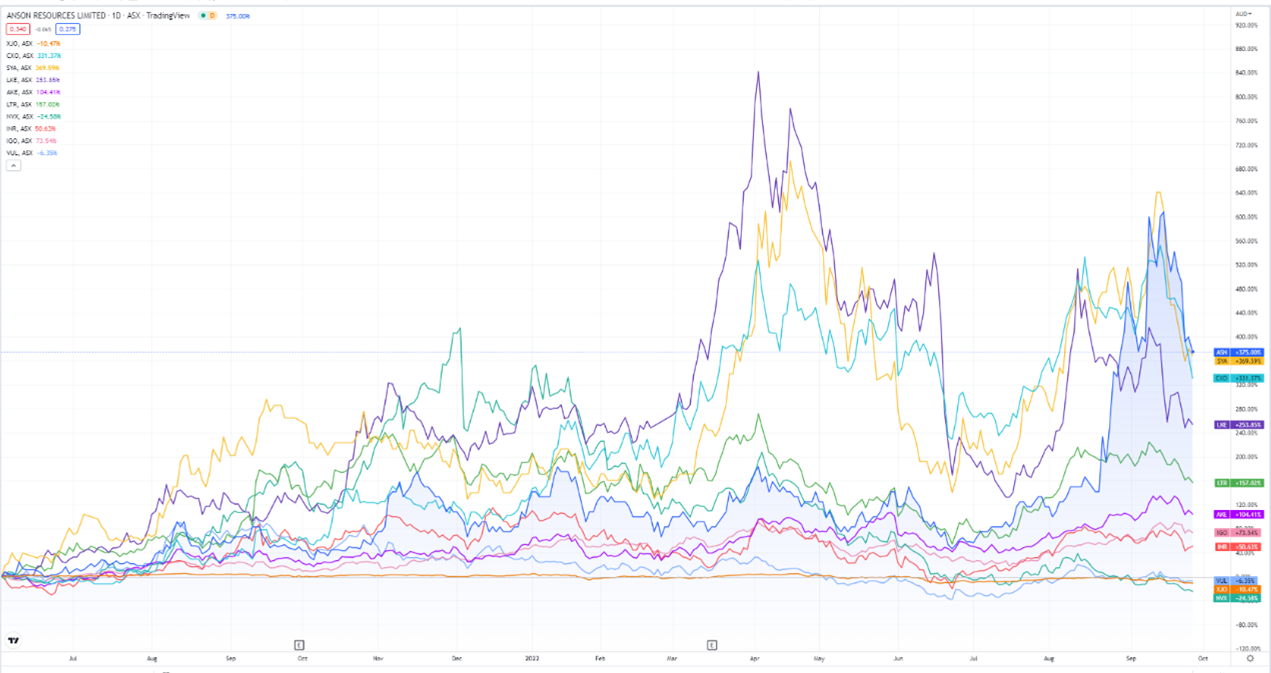

Over the past 52-week cycle, Anson has still seen a strong rally in share prices by increasing 262% and 257% in its sector.

It has been a similar story for junior lithium miner Sayona Mining [ASX:SYA], which fell 100% in the past week, yet up 73% in the year so far.

Core Lithium [ASX:CXO], too slipped 22% in the week, although it is still up by 182% in the last 12 months.

www.tradingview.com

Anson’s latest assay for Paradox Lithium Project

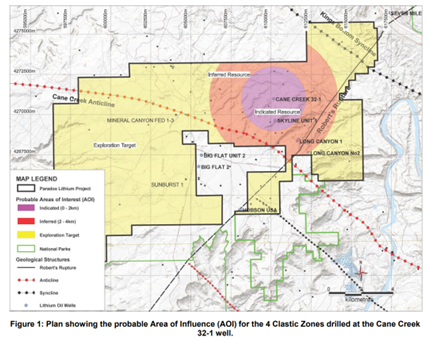

The lithium miner this morning decided to update markets on a variation of new lithium-ich discoveries at its Paradox Lithium Project in Utah, the US.

The discoveries were found across clastic zones 45,47, 49, and 51 at the company’s Cane Creek 32-1 well, adding to lithium-rich brines already found at clastic zone 43.

These were the highlights of the most recent discoveries:

‘The ‘assay result from Clastic Zones 43, 45, 47 and 49 average 100ppm Li’ — which is ‘17% higher than average grade of Clastic Zones 17, 19, 29 and 33 included in the recent Resource upgrade’ taken from Long Canyon No.2

‘The new Clastic Zones were intersected during drilling to the deeper 121m thick Mississippian Units at Cane Creek’ with ‘results from Mississippian Units are pending’

‘The supersaturated brines are chemically similar to those of the previously sampled Clastic Zones in other wells which already have Indicated and Inferred JORC Resources’

‘Drilling is coQmplete at Cane Creek and assays from the new Clastic Zones plus pending assays from the Mississippian units and are expected to deliver a significant further JORC Resource upgrade.’

Clastic zones 45,47, 49, and 51 intersect with Anson’s extension drilling for existing wells by Mississippian units, around 500 metres below the zones.

Anson believes these discoveries could add ‘tonnes’ to the existing Indicated and Inferred Resources of lithium-rich supersaturated brines, providing an upside to the company’s current Exploration Targets to Indicated and Inferred JORC estimates.

The assays will also add to ASN’s existing geological information on its brine horizons and general project area, as well as data for future JORC resources calculations, targets, and exploration.

Source: Anson Resources

ASN’s Paradox Prospects

Anson remains confident that its Paradox Lithium Project will boost its standing in the US battery-grade lithium market. Especially with Paradox’s recent DFS suggesting an initial 13,074 tonnes of lithium carbonate could be mined annually for the first 10 years of mine life, continuing at lower commercial levels leading up to 23 years.

Revenue for Phase 1 was estimated to reach about US$5,080 million with a pre-tax NPV of US$1,306 million.

And with lithium touted as a critical mineral by the US, Anson has reaped interest from multiple international and US offtake partners.

What’s more, Paradox is fast approaching the production phase and is anticipating initial production to commence in 2025.

Thanks to a $50 million capital raising earlier in the month, Anson also believes it’s now fully funded for the fast-tracked development of its Paradox Project and expects a Final Investment Decision to take place in Q2 2023.

Lithium, battery tech, and the race for supply

Lithium is front and centre in investors’ minds as the world races toward electric vehicle (EV) adoption.

And while lithium stocks have seemingly peaked, for now, the battery tech sector hasn’t.

A world where most of us drive EVs is a world hungry for battery tech metals — whether that be lithium, graphite, cobalt, nickel, or copper.

The race to secure critical battery tech metals is on.

But how does one play this?

Our small caps expert, Callum Newman, has just published this report on three battery material stocks he believes are flying under the mainstream’s radar.