The rise of electric vehicles (EV) is pitting automakers into a competition to get enough critical minerals to meet their EV production targets.

And both automakers and battery makers alike have been busy making deals to secure supply.

For example, since the beginning of the year we’ve seen:

Tesla sign an agreement with Magnis Energy Technologies [ASX:MNS] for active anode material and change the terms of their deal with Piedmont Lithium [ASX:PLL] to floating lithium prices…

…carmaker Stellantis reach a deal with Alliance Nickel [ASX:AXN] for the supply of battery-grade nickel and cobalt sulphate from their NiWest project in WA…

…Volkswagen say they are going to start investing in Canadian miners directly to get more control over their battery supply chains…

…LG Energy Solution buy a 7.89% stake in GreenTech Metals [ASX:GRE] to have access to 25% of its lithium production for five years…

…and more recently, Ford’s been busy making a bunch of deals with the likes of Albemarle, SQM and Nemaska Lithium for battery-grade lithium.

I mean, much has been said in these pages already about the astounding number of materials we will need for the energy transition and the looming deficit.

But securing supply doesn’t always mean digging up stuff from the ground…

‘Closing the loop’ on EV batteries

As you may remember, last week I shared this handy chart on how the EV battery supply chain looks like:

|

|

| Source: RMI |

While there’s been lots of emphasis on the mining, midstream and downstream processes, an often-overlooked piece of the puzzle is the bottom part of the chain.

I’m talking about recycling EV batteries, or what’s also known as ‘closing the loop’ on the supply chain.

Recycling already plays a large role in copper. In fact, much of the copper we use today comes from recycled copper.

Not so much for EV battery metals…yet.

But recycling will play a role in supplying critical minerals.

As more EVs on the streets reach the end of life, recovering valuable materials such as lithium, nickel, cobalt and graphite from spent batteries — allowing them to be used in new battery production — will be crucial.

Recycling reduces the need for mining and having to process all those materials, which is very energy intensive.

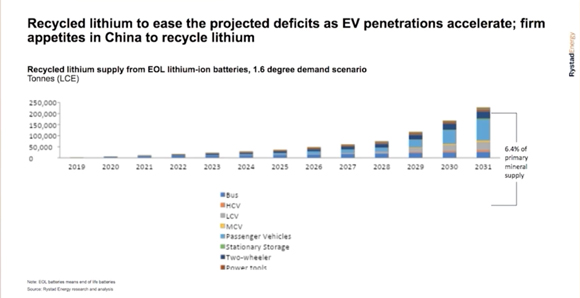

Global recycled materials are expected to grow quickly in the next decade.

Rystad estimates recycled cobalt could not only make up 11% of primary mineral supply by 2031, and that recycled lithium could make up 6% of lithium supply as you can see below:

|

|

| Source: Rystad Energy |

We could see a lot of growth in the battery recycling sector

In fact, we’ve also seen companies involved in the EV supply chain make a bunch of deals with battery recyclers.

For instance, BMW has made a deal with China’s Huayou Recycling to reuse its electric vehicle batteries and get raw materials to build new cells.

Glencore has invested US$200 million in US battery recycler Li-Cycle Holdings Corp. The two companies also have plans to develop what could be Europe’s largest lithium battery recycling plant in Italy. Li-Cycle is also a preferred partner for LG Chem and LG Energy Solution.

Ford, Volvo, Toyota and Volkswagen are working with battery recycler, Redwood Materials — a company set up by Tesla’s ex-chief technology officer JB Straubel.

Honda has signed an agreement with US-based Ascend Elements to recycle Honda’s EV batteries in the US.

As Honda put it in a statement:

‘Through this collaboration, Honda will seek to obtain a consistent supply of nickel, cobalt and lithium that Ascend Elements reclaims from recycled lithium-ion batteries.

‘Honda will then utilize these resources in its battery supply chain for electrified vehicles produced by Honda in North America.’

Over in Australia, we’ve also seen a few deals.

For instance, Neometals [ASX:NMT], through its joint venture Primobius, has a partnership Mercedes-Benz to design and build a lithium-ion recycling plant in Germany. Meanwhile, Lithium Australia [ASX:LIT] has also penned a deal with LG Energy Solutions.

While miners will still shoulder most of the load, battery recycling will play a part in providing some relief to the critical mineral shortage.

And it could grow to be quite a large market. McKinsey & Company estimates that battery recycling could be a US$95 billion-a-year business by 2040

So, make sure to keep an eye on it.

Best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments