It’s been quite a fortnight. I can still remember the afternoon of Monday, 21 February, when I took my two-year-old son to play in the local park.

After an hour or so, storm clouds started to gather, so I ushered him back into the car. Within 10 minutes, thunder started to rumble and big drops of rain began to fall.

Little did I know that was the start of the fortnight-long deluge here in NSW.

The rains have cleared for now, at least. But it will take some time for many people to get back to normal given the damage from flooding and wild winds.

You would have heard commentators saying how this fortnight’s weather was a ‘one-in-a-1,000-year’ event, or something to that effect.

And yet, the last two years saw February deluges of a similar magnitude…

Our distorted perception of risk

Our human perception of risk can be distorted due to emotions and recency bias. This can affect our decision-making and cause us to take a course of action that does not yield the best outcomes.

You know the main idea of investing is to ‘buy low and sell high’. But many will end up doing the reverse because they tend to buy close to the top and sell around the bottom. They weigh their decisions on new information as well as watching how the crowd behaves. The fear of missing out can cause our risk perception to fog up.

The way to reduce the risk of succumbing to herd mentality is to have information that can help us anchor our decisions. But we also need to possess an intuition to discern useful information from the noise and emotions.

This is easier said than done, though.

Mood hangs heavy in the global economy

There’s no doubt everywhere you look the signs are negative in the global economy.

Last night, the US Bureau of Labor and Statistics released the February data on consumer prices and inflation. The annual inflation rate from February 2021 to the same period in 2022 is 7.9%, or around consensus expectations.

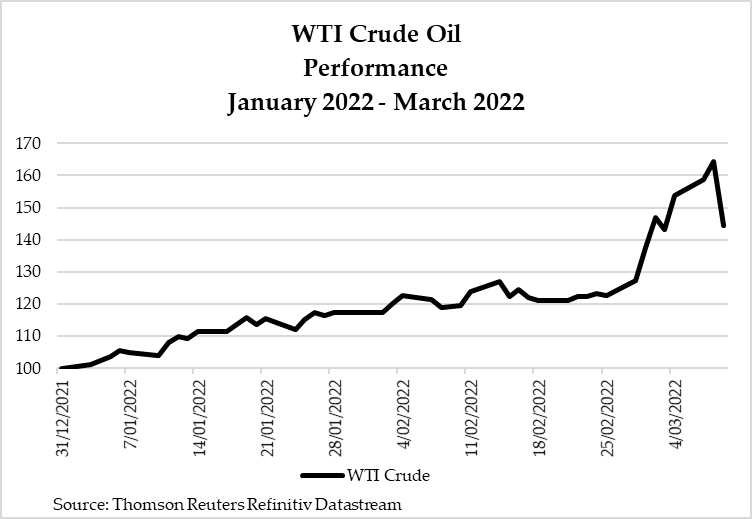

Inflation will likely linger, thanks to the rising price of oil. It has actually risen by almost 50% since the start of the year, as shown below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The Federal Reserve is likely to raise rates for the first time in over three years next week, but it looks to be less than what the market initially expected. This is doing little to help alleviate the tension in the markets because everyone is expecting it will hike faster and sharper in the coming months.

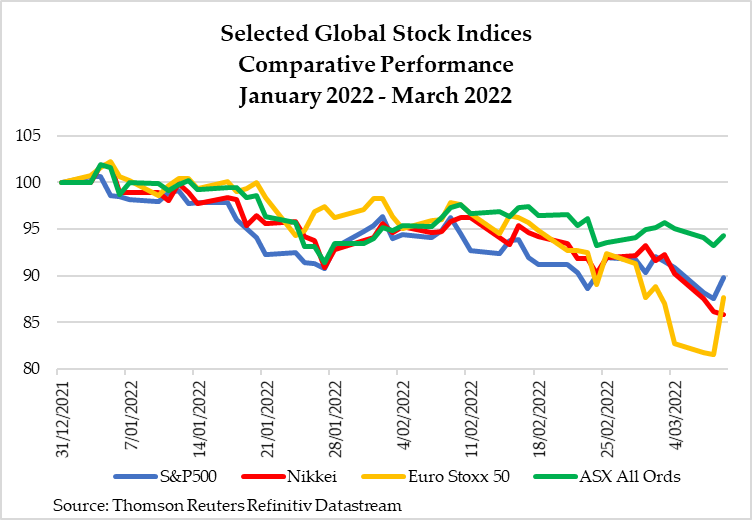

Here’s a chart showing the performance of the major market indices in the US, Europe, Japan, and Australia:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

It goes without saying the markets are feeling rather bearish and subdued.

And if the past tells us anything about the Fed’s rate hike cycle and the effects it has on the broader markets, we’re in for something quite serious and downright nasty.

Shelter from the storm

The commodities market is one of few places where prices are rising. Precious metals, oil, nickel, and certain base metals have headed up quite markedly since the conflict began.

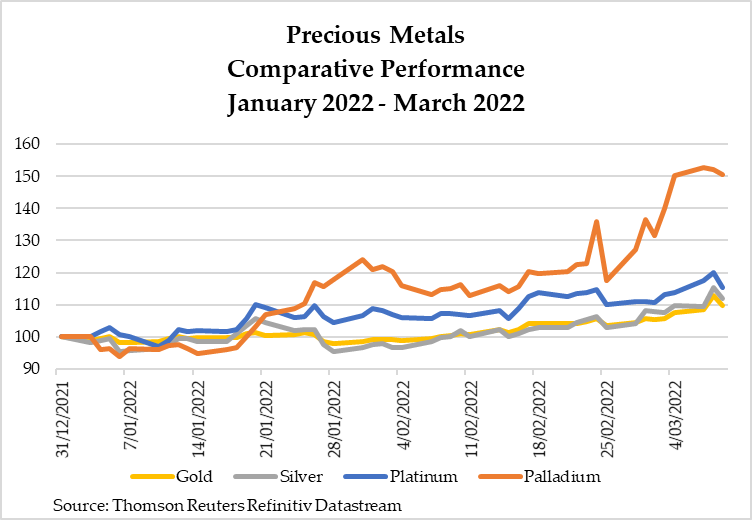

Have a look at precious metals and how they’ve performed since the start of the year:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

That looks pretty attractive to me!

If you have the stomach for risk, you could stake your luck with gold and silver mining companies. Some of them have had a good run since the end of January 2022.

The rally is not broad-based, though. Established producers are making sizable gains. The smaller and speculative end of the market is still struggling to gain much ground.

I suspect the current bearish sentiments and the elevated oil price are keeping the speculators from jumping in on the explorers.

And this is where you could seize the opportunity to hunt for bargains. Unlike producers, smaller explorers with a good project and a solid cash balance will offer you the opportunity to make a quick buck.

Why?

Because when the market starts tumbling once the rate hike gets underway, precious metals are going to rally further on the safe-haven trade. I showed you two weeks ago how gold has reclaimed its status as the pre-eminent safe haven. And companies searching for gold will buck the trend of the broader market after the initial panic sell.

If you have the stomach for a punt to make big returns, I have something just for you.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia