Do you remember what you were doing on the evening of Saturday 3rd January?

I was at a bayside park in the eastern suburbs of Kowloon in Hong Kong. My son, Cyrus, was playing with the daughter of a good friend from university.

The weather was getting a little crisp as the sun started going down, disappearing behind the iconic Victoria Peak.

It was just another day for an ordinary Hong Kong-er. My friend and I parted just after sundown. Cindy, Cyrus and I headed off to our next gathering across the harbour.

Contrast this with what was happening halfway around the world in Caracas, Venezuela.

The US Delta Force, aided by the military, executed a daring yet unconventional raid on the fortified compound belonging to the President Nicolas Maduro.

He and his wife, Cilia Flores, became captives and were flown by helicopter to New York.

President Maduro faces the following charges from the US Trump administration:

Narco-terrorism conspiracy;

Cocaine importation conspiracy;

Possession of machine guns and destructive devices; and

Conspiracy to possess machine guns and destructive devices against the US.

This shocking event just changed the entire state of play in the global order. History will record this as a major turning point in our times, irrespective of how you view this.

As juicy as the raid is, I’m not going to delve further. The event is fresh. There is a significant ‘fog of war’ that promises more twists and turns, making further analysis now a little premature.

Instead, what’s worth discussing is the potential impact on financial and commodity markets.

So let’s get to it!

A breathtaking close to 2025… but

2026 ramps up the drama

I remember signing off Fat Tail Daily last year with a warning about how 2026 would be wild.

I want to make a disclaimer that I hadn’t known the specifics of what could happen. Nor could I imagine how much more dramatic and shocking things have become so early on.

Let me be forthright about that article – I’d written it a week before Christmas, ahead of the office closing. You probably gathered that from the prices of precious metals I quoted in there.

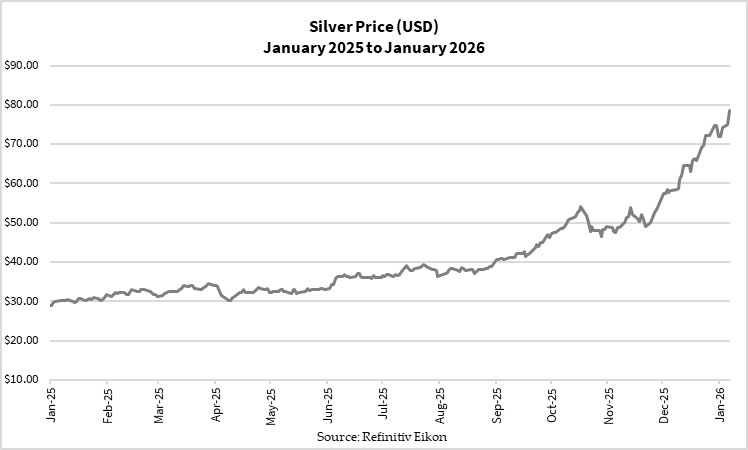

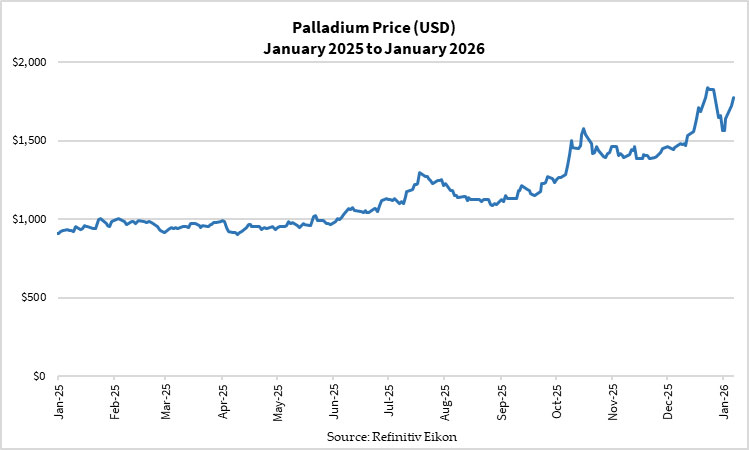

You saw how silver and platinum group elements (PGEs) staged a jaw-dropping rally in the final ten days of the year, after I penned that article.

Sure, a precious metals bull market was underway in 2025. But this move was phenomenal! Silver, platinum and palladium made a mad dash for the finishing line in the final days to compete to be the year’s best performing commodity:

Well, silver won… delivering a 149% increase. It beat platinum (~122%), palladium (~72%), and gold (~65%).

While 2025 will go down as a year of precious metals, 2026 has seen them continue to thunder ahead. Geopolitical events and rumours about physical shortages might fuel their rally further.

Operation Absolute Resolve, which culminated in Maduro’s capture, may have helped boost precious metals. That is a geopolitical catalyst and won’t spur the rally for more than a few weeks.

A more powerful force is at play with a longer lasting impact on precious metals, and resources in general.

Position well for as the tide

changes in this geopolitical contest

I’ve discussed in the past how we’re witnessing a change in the global order.

Some perceive it as the West vs the East, or democratic republics vs authoritarian regimes. Others see it as a contest between Anglo-Christian nations vs the Islamic nations, and so on.

Regardless of who is at the table, one thing is clear. There’s a fight to control resources globally. The Trump administration just showed the world a new gambit in this game.

Beyond Venezuela, the Iranian Ayatollah regime is looking unstable with each passing day. Meanwhile, the balance of power in North, West, and Central Africa may shift too. This is in addition to the conflicts in the Middle East and Ukraine that feature regularly in the news.

All these places hold vast amounts of mineral wealth, but they’re as rich as they are unstable. For decades we’ve seen the larger countries use these places for proxy wars to tilt the chance of ownership of their resources. The unwanted consequence is the large scale death and destruction that carves a deep scar on the people and their land. The final outcome I mentioned can last for generations and foment hatred and a desire for vengeance that begets more destruction.

We just witnessed the campaign for undeveloped resources has just elevated to a new level. The contest is to control these regions, and the big nations will strain their brains and mobilise their forces to secure their win.

Capital will flow from technology and financial transactions, to raw, untapped riches. Let’s hope it won’t come with as much bloodshed and turmoil as we’ve seen in the past century.

I’d like to help you position yourself for this pivotal period. My colleague, James Cooper, was a geologist and now a resources investor. He will identify the commodities with the best growth potential and use his knowledge as a geologist to assess the companies with the right deposits and team to create value.

You can check out his presentation here.

How 2026 will play out, time will tell. But we’ve seen it clearly, things are going to be wild. It’s time to have a clear plan lest you leave yourself open to unpleasant surprises when they occur!

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

Comments