Fear and pessimism are due to hit the markets this week as the fallout from the coronavirus continues.

If my Twitter feed has got it right, the ASX200 is due for some pretty steep falls to start the week.

We’ll see…

Of course, the financial engineers are working hard on their response.

In an effort to stem the red, China’s central bank announced last night they will inject 1.2 trillion yuan (US$174 billion) via ‘reverse repo operations’.

Code for: ‘we’ll just print out more money’.

Anyway, expect to see counterparts in the US, Europe, and all over the world do similar if things get worse.

Which funnily enough, could mean markets go up sooner!

But my gut says this coronavirus alarm will blow over in a few weeks. It will still be there, but we’ll get it under control.

Call me an optimist maybe.

Bank Busters! Three Aussie tech plays outsmarting the ‘big four’ banks.

But I like to think of myself as an optimistic realist.

Because to my mind, the reality is the world is pretty good at getting over problems and improving things.

No matter where you look, from economic growth and technological advances, to freedom, health, and global educational standards, there’s no denying it:

The story of the 20th century was one of relentless improvement.

And it’s clear that free markets have been central to that.

It was a point my countryman Adam Smith realised two and a half centuries ago.

His seminal work, The Wealth of Nations, was published in 1776, the same year as the US’ Declaration of Independence.

And it’s no coincidence the US’ rise and Smith’s doctrine have gone hand in hand. But free trade has been great for most.

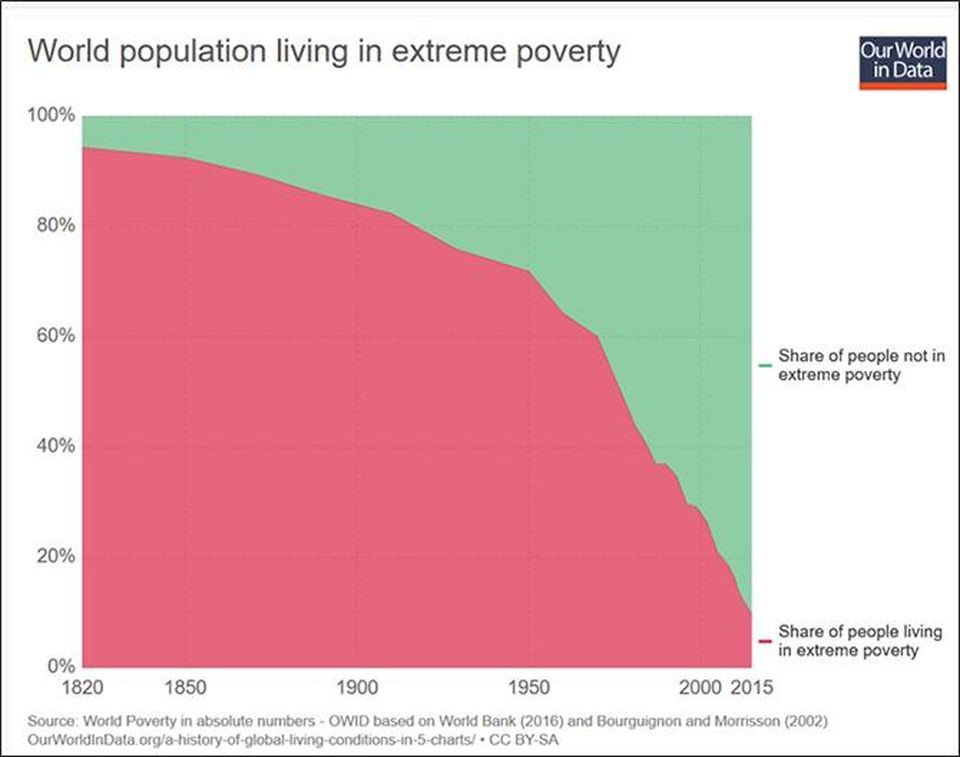

Free trade and enlightened self-interest have indeed dragged large parts of the world out of poverty. Just as Smith said it would.

|

|

| Source: World Bank |

The point is, the world’s doing pretty well.

And yet most people think it’s getting worse.

A survey published in Forbes a couple of years back estimated nine out of 10 people thought the world was getting worse.

It seems us humans are programmed to worry, no matter what the reality is.

But if you’re like me — a realistic optimist — this fact throws up some incredible opportunities…

[conversion type=”in_post”]

It’s never paid to bet against free markets

As long as the free markets exist, you can invest in stocks with some degree of comfort, knowing that you’re on the right side of a three-century-old uptrend.

Trends don’t come much stronger than that!

Life will get better, technology will get better, and humanity will get better. That’s what the last few centuries of progress have taught us. And I believe that this will continue.

Funnily enough, it’s the same optimistic outlook that underpins Warren Buffett’s investing strategy too.

He’s often said:

‘It’s never paid to bet against America. We come through things, but it’s not always been a smooth ride.’

I read America here as ‘free markets’.

The US has always been a beacon for free markets and its defining achievement has been in exporting that mentality to the rest of the world.

But the second point Buffett makes is also worth pointing out. Indeed, it’s not always a smooth ride.

It’s why I’m a bit nervous today. And if you’re close to retirement (or in retirement) you should be too.

The fact is, while the long-term trend is relentlessly up, in the short term there can be some quite significant downs.

If you’re close to retirement and have a nest egg to preserve, you need to account for that.

Or even if you’re just an investor who wants to make sure you’ve got the spare cash at hand to invest in bargain basement stocks if and when there is a crash, timing matters.

Here’s the trick though…

When will a crash occur?

How can you be ready for it?

And how will you know when to dive back into the market again?

That’s something my friend over at the Rum Rebellion, Vern Gowdie, has spent a lot of time thinking about.

As an award-winning financial planner, he’s worked through three huge market crashes — the ‘Black Monday’ crash in 1987, the 2000 dotcom bust, and the 2008 GFC.

Such experience is priceless. You need to take advantage of it.

He’s recently updated his pretty extensive research on the subject of market downturns.

Long story short, he thinks a market crash is imminent.

Now to the signal that’s making me nervous…

The key indicator you have to watch

Myself, I’m not sure a crash is so close.

Like I said before, I’m more of an optimist.

And I think in this time of rapid change, there’s opportunities to find compelling stocks no matter the market’s mood.

But I have to admit, one signal I recently came across does have me a little worried about the broader market.

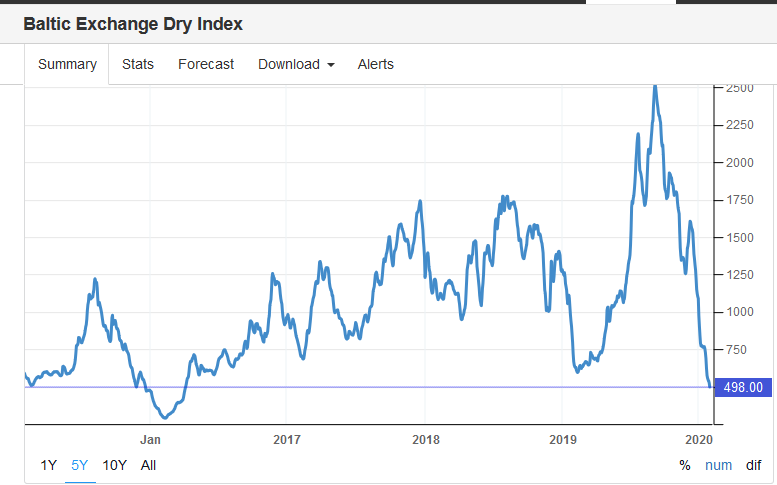

It’s something called the Baltic Dry Index (BDIY).

The BDIY is down a whopping 80% from its peak in September last year and is now at a four-year low:

|

|

| Source: Trading Economics |

The BDIY is a proxy measure for the health of the world’s shipping industry.

A fall this steep suggests that the shipping market is doing quite badly. The fear is that this index is reflecting an emerging slowdown in global trade.

If that’s true, it’ll show up soon in economic growth figures. And then into markets, as well as real-life things like jobs and profits too.

With coronavirus and bushfires also to contend with, the BDIY could be a warning that 2020 will indeed be the down-market Vern Gowdie envisions.

I say remain optimistic, but trade carefully.

And make sure you allocate your investments in such a way that you can sleep at night, come what may.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments