Dear Reader,

There’s something unfolding in Africa, and it deserves your attention.

And this matters whether or not you’re invested in mining stocks.

You see, wars and conflicts throughout history have revolved around resources, specifically securing access by controlling commodity supply chains.

And events today seem to be pointing towards a repeat of this situation.

No doubt you’ve seen it.

Resources are caught in a global crossfire of geopolitical stoushes, from rare earths export controls to ships laden with natural gas stranded in transit as contracts fall apart.

There are geopolitical flashpoints everywhere, much of which is rooted in natural resources.

And the risk right now is that we could be heading towards an unstoppable escalation.

Let me explain…

I recently published a special report for my paid readership group detailing what I believe is America’s plan to gain safe access to a critical resource… Copper.

In a place that holds one of the last underexplored frontiers for copper discovery.

It’s known as the Central African Copper Belt.

I worked here in 2010, with a small Australian company called Equinox Minerals.

But the key thing is this…

Right now, the US is working with a handful of small African nations to revamp an old, disused railway line.

It’s known as the Lobito Railway Corridor.

A name that could become much more familiar in the months to come.

What’s going down in the Deep Heart of Africa?

America wants to take advantage of Africa’s vast mineral wealth.

Specifically, the Central African Copper Belt that runs through Zambia and the DRC, approximately through the middle of the continent.

However, to do that, the ore must be transported from these mines to the ports on the continent’s West Coast.

From there, the US will be able to ensure safe passage of copper concentrate into American ports.

So, how will they achieve it?

The mines are located in the middle of Africa. They are remote, undeveloped, and contain virtually zero infrastructure.

I know, I worked there as a geologist for three and a half years.

This abandoned railway line provides the critical link, where valuable ore can be transported to Africa’s West Coast, specifically ports in Angola.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

From there, it’s a relatively safe passage to the US East Coast.

But it won’t just be Angola, I suspect the US is cosying up to a bunch of countries along Africa’s West Coast.

Remember when I told you Trump invited three leaders of tiny, unknown countries in West Africa?

They were personally invited to attend the White House for a one-on-one meeting with Trump.

An honour that hasn’t been bestowed on long-term allies of the US, including Australia.

And that’s telling.

You see, I think the White House views West Africa as one of its most important links in its critical mineral future.

And it all comes down to geography.

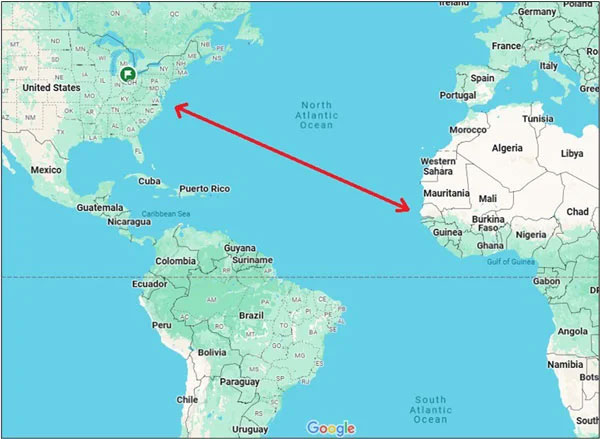

Check it out:

Source: Google Maps

There’s a clear geographical advantage here for the US.

West Africa offers direct shipping access in the event of major global supply disruptions.

It’s perhaps a ‘last resort’ strategy in the event of war or some other terrible event that disrupts global trade.

Because no matter what happens to the rest of the world, the US should be able to ‘contain’ the waters within its own neighbourhood, the Atlantic Ocean.

That would mean continual safe access to Africa’s vast mineral wealth.

Again, this is why I believe America is extending personal invitations to unknown leaders in West Africa and forming new and vital allies.

Meanwhile, billions are being invested in upgrading the continent’s decrepit railway lines.

Pay close attention to what happens here over the coming months… America could be laying the foundation for its future mineral security.

Let’s hope it doesn’t ever need to use this ‘last resort’ measure, but it is worth watching.

But also note:

The US isn’t the only major economy vying for control over the Central African Copper Belt.

A similar ‘railway rebuild’ strategy is playing out on the other side of the continent, one that could kink America’s supply chain strategy.

This could be the flashpoint for something much bigger. I’ll explain what I mean in our next edition.

Stay tuned.

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

PS: If you’re looking for more commodity insights like this, plus actionable investment ideas from someone who’s worked on the ground as a geologist, you can check out all of James’s work here.

Comments