It’s been another big day for pot stocks. With the sector enjoying a surge of late.

Last week of course we saw the stark reclassification from the UN. Which you can read about right here.

Then came a fresh vote from the US House of Representatives — looking to decriminalise cannabis. A bill that is unlikely to pass the Senate, but still showcases what sort of stance we may see from a Biden Presidency.

Today though, Althea Group Holdings Ltd [ASX:AGH] is the big winner. With its share price trading 2.75% higher at time of writing — thanks to some impressive sales results…

Booming business in the UK & Aus

Althea, who currently markets in both the UK and Australia, is doing very well for themselves. Furthering their growth agenda in both markets.

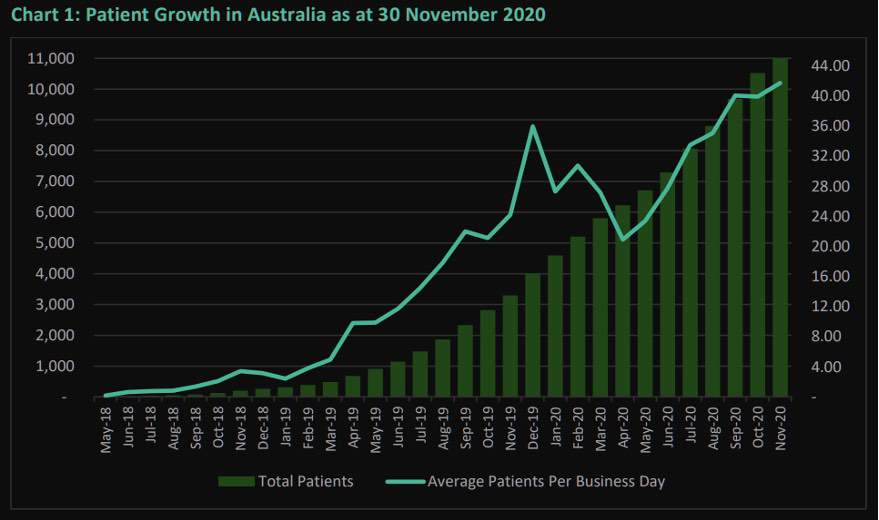

For the month of November, the company pulled in $847,499 worth of sales. With the vast majority ($737,121) coming from Australian patients. A subset that has seen consistent growth over the lifetime of the business:

Despite the dip in average patients per day earlier in the year – largely due to the pandemic – the total number of patients has remained strong. Highlighting the incredible growth of the company, and its resilience in the face of an unprecedented challenge.

This has brought the company to a point where their average number of new patients and new prescribers, per day, is at an all-time high. Sitting at 41.71 and 2.24 respectively.

A huge boon for this emerging cannabis pioneer.

It’s a similar story in the UK too. With Althea enjoying a 48% increase in revenue month-on-month in the region. Totalling $110,378 worth of sales for November.

Granted, this figure is relatively small compared to local sales.

That doesn’t detract from the incredible growth in such a short time frame, though. Which, if sustainable, could see the UK fast become a market with equal or even greater sales volume than Australia.

As Althea’s CEO, Josh Fegan, comments:

‘I recently relocated permanently to London with my family to oversee the growth of the Althea brand in the UK and EU. With our market access strategy starting to resonate with UK prescribers and regulatory headwinds well and truly behind us, it is great to see our many months of hard work beginning to pay off.

‘Our established Australian business continues to perform strongly, and we are looking forward to entering 2021 with fantastic momentum.’

What’s next for the Althea Group share price?

As Mr Fegan notes, Althea is in a prime position. Their only objective now is to further their growth strategy to new highs.

If they can do that, in both the UK and Australia, then investors will have little to worry about. Capitalising on what may be a second wind for the pot stock boom.

At the very least, the industry is enjoying a very purple patch.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

PS: For more small-cap investing insights and news, check out our daily e-letter: Money Morning. Bringing avid investors the stories they need to know about, seven days a week. For more information, and to sign up today, click here.

Comments