Lithium producer Allkem [ASX:AKE] surged on Friday after providing a lithium and spodumene pricing update.

AKE shares were up 8% in late afternoon trade.

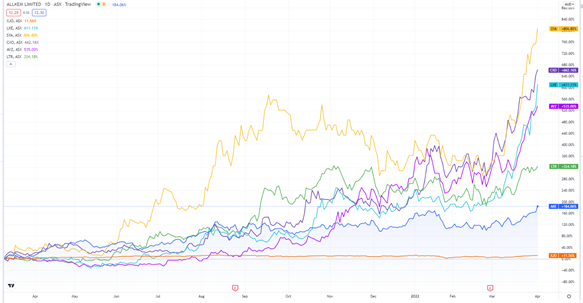

Allkem is riding strong interest in the wider ASX lithium sector, with AKE gaining 150% in the last 12 months.

But Allkem wasn’t the only lithium stock rising on Friday.

In afternoon trade, Lake Resources [ASX:LKE] was up 14% to a fresh all-time high. LKE shares have risen nearly 600% in just one year, showcasing just how hot the lithium story still is in 2022.

Arizona Lithium [ASX:AZL] was up 14%.

Firefinch [ASX:FFX] was up 9%.

Core Lithium Ltd [ASX:CXO] was up 8%.

Sayona Mining [ASX:SYA] was up 8%.

And Pilbara Minerals [ASX:PLS] was up 7%.

Source: Tradingview.com

Allkem provides lithium market update

AKE reported that market conditions remain strong for lithium carbonate, benefiting Allkem’s Olaroz lithium project.

The lithium producer estimates that the average price for lithium carbonate will be around US$35,000 per tonne in the FY22 June quarter, on sales of around 3,500 tonnes.

That would approximate to about US$122,500,000 in gross sales.

In its most recent half-yearly, Allkem registered US$65.6 million in revenue from Olaroz on sales of 5,915 tonnes of lithium carbonate, on average pricing of US$11,095/t.

This just goes to show how rapidly the lithium market is moving as demand continues to outpace supply.

In fact, Allkem’s preliminary FY22March quarter sales price was 9% higher than previously guided.

Allkem also provided an update on the spodumene market.

AKE sees ‘similarly strong’ conditions for spodumene, with pricing in the June quarter expected to reach US$5,000 per tonne for SC6% CIF on sales of about 50,000 tonnes.

These figures would suggest a gross revenue total of US$250 million.

Again, June quarter prices are expected to be well above the March quarter. AKE said March quarter sales of spodumene concentrate were completed at a price of about US$2,218/t for SC6% CIF.

Reviewed and finalised prices will be released on 14 April 2022 as part of March quarterly report.

In February, Allkem released its half-yearly results for the period ending 31 December 2021.

Group revenue totalled US$192.3 million, which included revenue from the Olaroz project in Argentina and the Mt Cattlin project in Western Australia.

Allkem share price outlook: how long can the lithium boom last?

As an established producer, Allkem can take advantage of elevated lithium prices right now.

Since the rising need for battery metals like lithium is no longer a secret, prospecting miners are rushing into the sector.

But many lithium stocks are still exploring or developing their projects, with production years away.

By that time, lithium prices could stabilise.

So Allkem’s ability to ramp up production today could see it benefit the most from a very hot lithium market.

That said, it’s the junior lithium stocks like Lake Resources and Sayona that are capturing investor attention.

Both LKE and SYA are up more than 500% in the last 12 months, with producers like AKE lagging behind.

But both LKE and SYA have a long way to go before they start shipping the white metal and capturing profits.

So the question is, how much of those future profits are already reflected in the price of hot stocks like Lake and Sayona?

Are there lithium stocks the market is overlooking?

According to Money Morning’s latest research report on the sector, yes.

In fact, the research report profiles three of them.

To find out more, access the report here.

Regards,

Kiryll Prakapenka,

For Money Morning