Alliance Aviation Services [ASX:AQZ] operators of Alliance Airlines has seen shares soar today, up by 13.43% to 38 cents per share in a remarkable recovery for the regional airline.

This comes after the company released an earnings and business update today that showed FY23 Net Profit Before Tax is now expected to be $56.9 million, up from the previously estimated $50–55 million.

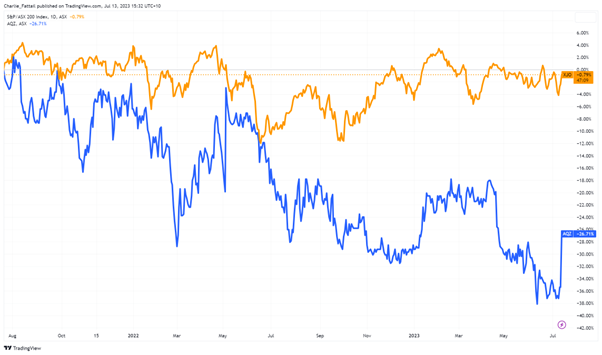

Today’s dramatic share price upswing has renewed interest in the fly-in, fly-out charter operator. Its considerable fleet expansion has clearly built out its market and helped recover the share price, which has seen its value slide for the past year, down by 6.96%.

Let’s cover what else the company announced today and what it means for the share price.

Source: TradingView

Alliance Airlines profits beat FY23 guidance

In an update today, Alliance Airlines confirmed its unaudited underlying FY23 Net Profit Before Tax had surpassed the top end of guidance by $1.69 million, pushing the share price up by 13.43%.

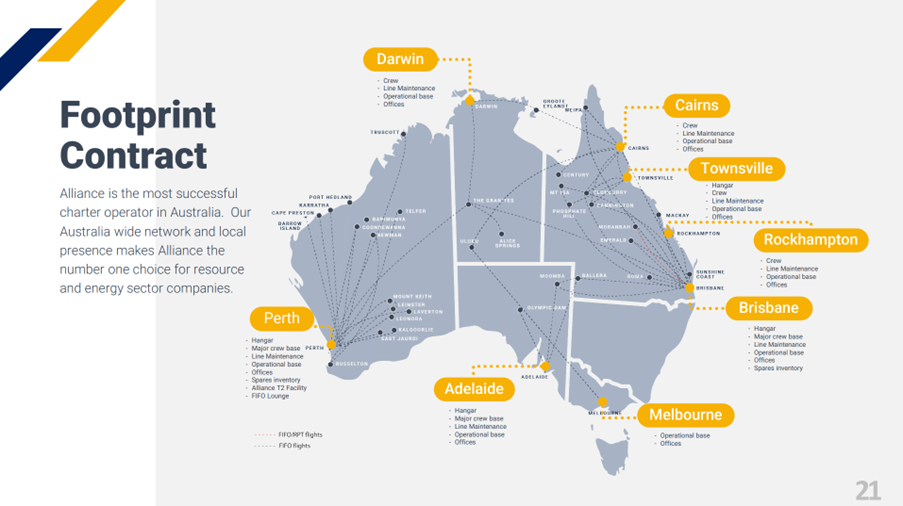

Alliance Airlines is one of Australia’s leading fly-in, fly-out (FIFO) charter operators. It serves the mining, energy, and tourism sectors, and provides specialist aviation services to clients and other airlines.

Its potential growth and headline interest have only been curtailed in the past through large decisions brought down by the ACCC, Australia’s competition watchdog.

In 2021, ACCC blocked a cooperation agreement with Virgin in competing for FIFO contracts. While in April this year, Qantas was denied its $611 million takeover bid of Alliance, citing competition concerns in both cases. This left Qantas holding a nearly 20% stake in its rival.

Though bigger contracts and joint ventures have been disrupted, the company has persisted with long-term FIFO contracts with mining and energy companies throughout Australia.

Source: Alliance Airlines

Today, Alliance confirmed the penning of a five-year contract with Incitec Pivot [ASX:IPL] to provide eight weekly flights from mine operations in Northern QLD. This contract will extend the QLD mine service to 27 years of continuous service by Alliance.

Alliance’s Managing Director, Scott McMillan, commented on the extension today, saying:

‘The long tenure of this contract is attributable to our superior operational capability, which is focused on delivering safe, reliable and on-time services. Longevity of customer relationships based upon the high standards we provide is the cornerstone of our success in the FIFO sector.’

In February this year, Alliance announced it had entered into a contract with AerCap Ireland to acquire 30 additional Embraer E190 jet aircraft. This expands its fleet from 33 to 63 and is scheduled to begin delivery in September, with the final delivery in January 2026.

Since then, Alliance has seen a faster-than-expected post-COVID recovery. Consequently, they have ordered four additional E190 airframes to assemble in Costa Rica and bring into operation by mid-2024.

The expansion of Alliance will be bolstered by a new line of credit secured in the second half of FY23. Alliance secured private funding of $100 million from Pricoa, the private debt and investment division of PGIM — the global investment management giant with approximately $ 1.27 trillion under management.

The company says the facility can be drawn down to fund future aircraft settlements and working capital requirements.

Alliance’s outlook

Today’s share price reflects the renewed optimism investors feel for Alliance.

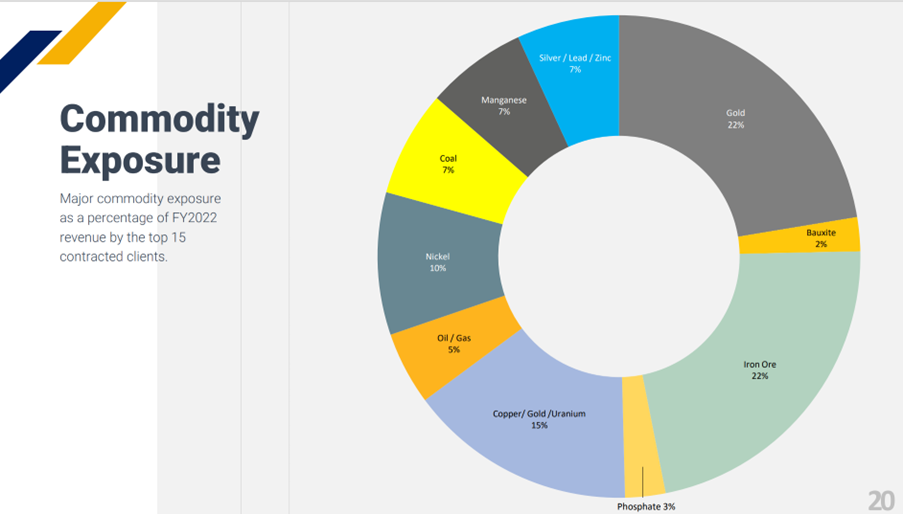

In the short term, Alliance has shown that its contracts are diversified enough between commodities to give it a sense of security in a weaker commodity environment.

Source: Alliance

In the long-term, it’s clear the line of credit is a nod to future expansion by the company as it extends its fleet and continues its wet-lease operations, where staff and capital are rented to other airlines across Australia and the Pacific.

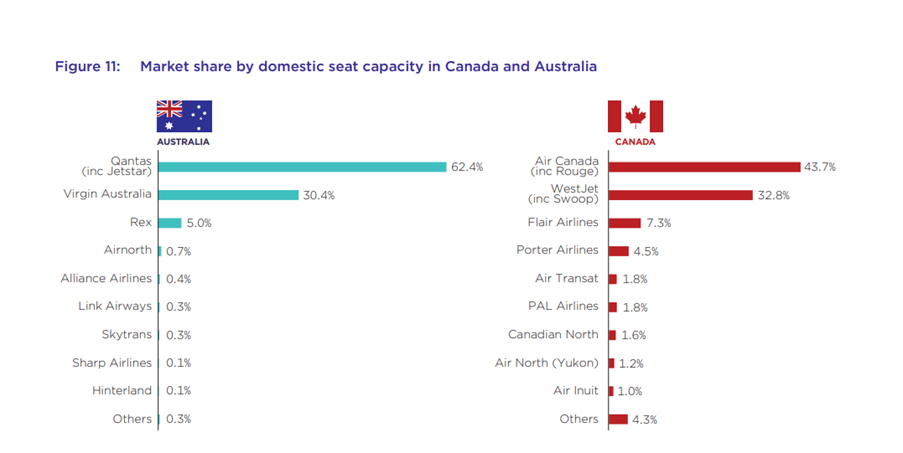

Long-term expansion by the company may eventually have to move outside of the FIFO model and begin to step into the domestic consumer base, bringing it into larger competition with Qantas and its low-cost carrier Jetstar.

This could be a challenging space to push into as the concentration of domestic providers is very high, even for countries with similarly limited major carriers.

Here is an example from 2022, highlighted by the ACCC in its most recent report.

Despite the similarity in concentration, smaller carriers still hold a larger market share. This benefits consumers by providing cheaper flight options. It also creates opportunities for new airlines to enter the market.

The stars are aligning for Alliance in the short term, and their growth from here should be one for investors to watch. However, the ceiling for domestic carriers in Australia is something to be concerned about in such a concentrated market.

The company has said it will release its full FY23 results, post-market close on 9 August 2023. Until then, this could be one to file in potential growth stocks.

But in turbulent markets, savvy investors need to be finding more than just growth stocks.

In uncertain times defensive positions often mean looking for companies that will weather the storm and provide dividends.

Finding dividends that are worth your time

The market has roiled stock investors for the past year — steady ground has been rare.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you need to consider making a smart play.

Click here to learn more about what that looks like.

Regards,

Charles Ormond

For Money Morning