The Atacama Desert is one of the driest places on Earth. It’s a remote area, where nothing grows.

In fact, I hear it kind of looks like Mars. Conditions are so similar that NASA is using it as a practice area to test its Mars Rovers.

But the desert is also home to one of the most important lithium production areas in the world, the Salar de Atacama.

This salar (which means salt flat in Spanish) is the largest in Chile. Here, companies use the burning Sun to evaporate brine from the ponds. The substance left behind is lithium.

Atacama, which holds the world’s largest lithium reserves, has made Chile the second-largest lithium-producing country in the world, after Australia. Together, the two countries produced 77% of the world’s lithium in 2021.

But recent news coming out of Chile has sent shockwaves through the mining industry.

Chile sees lithium as a huge growth opportunity it doesn’t want to miss out on. So they recently launched its National Lithium Strategy.

While there isn’t a huge amount of detail out there yet, the plan is to create a State-owned lithium company that will be involved in Chile’s entire lithium production cycle. From exploration to value-adding to the lithium supply chain.

The idea is to turn Chile into the largest lithium producer in the world — Chile lost first place to Australia in 2017.

Stock prices for lithium companies Sociedad Quimica y Minera [NYSE:SQM] and Albemarle [NYSE:ALB] fell on the news and are trading 17% and 20% down, respectively, from last month.

You see, they both operate in the area and while their contracts don’t end until 2030 and 2043, the Chilean Government has said it’s hoping the companies will be open to accepting some sort of government participation before the contracts expire.

The whole thing has brought in a lot of uncertainty on the future of lithium production in Chile…which could mean more investment flowing into the lithium sector in Australia.

But it shows there’s still plenty of competition to secure critical materials.

New energy era geopolitics

Of course, lithium — along with plenty of other materials like copper and nickel to name a few — are crucial for electric vehicles (EVs), especially as numbers on the road continue to explode.

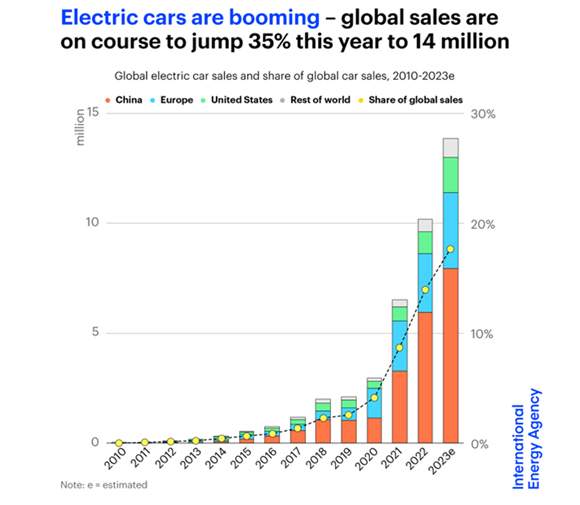

The latest EV outlook by the International Energy Agency showed that EV sales hit more than 10 million in 2022. In other words, 14% of all new cars sold were electric up from 9% in 2021. But sales are expected to increase 35% to reach 14 million this year.

China is the big market here, with around 60% of global electric car sales, followed by Europe and the US, as you can see below:

|

|

| Source: International Energy Agency |

But this is about more than just EVs.

The growth of green energy is about lower costs and energy security.

As we’ve been reminded of with the Russia-Ukraine war, fossil fuel supply chains are very centralised, and the world is very dependent on fossil fuel producers.

In contrast, renewable energy is more decentralised and almost every country — and individual — can, in some capacity, produce renewable energy.

But it’s also about getting a piece of the pie when it comes to being a leader in the energy market of tomorrow.

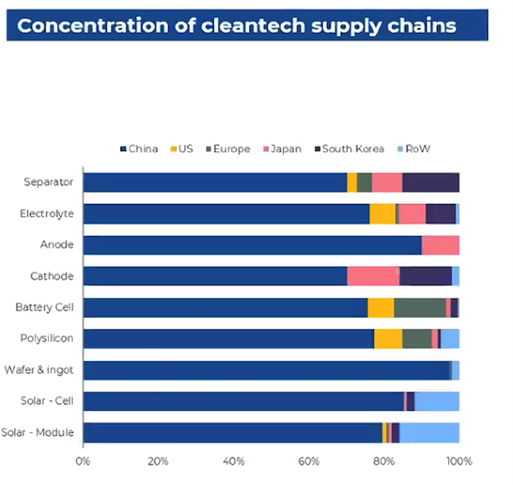

At the moment, China dominates not only when it comes to lithium-ion battery production, but also in the whole clean-tech supply chain:

|

|

| Source: Benchmark Minerals |

There’s a new era of renewable energy geopolitics that’s shifting and redrawing the old lines as key energy resources change.

At the centre of all this is mining.

Solar panels…anodes…cathodes…for all this, you need mining.

As we move forward with the energy transition, miners will play a huge role.

As author and energy expert Daniel Yergin put it recently:

‘“Big Shovel” will compete with “Big Oil” as mining ramps up to supply the vast increase in a wide range of minerals that energy transition requires. But getting everything that will be needed will be tough.’

Indeed, the industry has a daunting task ahead.

Not only does it need to mine and produce more, but they also need to decarbonise their operations. Mining is quite energy-intensive, so miners are under a lot of pressure to reduce emissions.

It’s why we are seeing a move from miners to shift to renewables, not only to lower emissions, but lower costs.

And then, of course, not only do we need more supply but also more processing and refining facilities for these materials. At the moment, much of that is happening in China, who’s the largest refiner and processor of critical minerals in the world.

So plenty of money will continue to flow into the mining sector to develop capabilities.

It’s a great place to be at the moment.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities