Pick a business editorial, any editorial, and it’s all about when interest rates are going UP.

It’s no longer a matter of IF, but WHEN, central banks start lifting rates off the mat they’ve been pressed against for the past few years.

The popular narrative is: Inflationary pressures are, sooner or later, going to force the central banker’s hand.

With a federal election looming, front-runner, Anthony Albanese is making political mileage out of the rising cost of living:

‘Labor pledges to grow wages with economy.’

The Australian, 3 February 2022

Surprise, surprise…a politician telling workers exactly what they want to hear.

But if elected, will Albanese be able to honour this pledge?

I harbour serious doubts.

There are dynamics well beyond our shores that influence Australia’s wage and economic growth.

In playing to the crowd, Albanese is either ignorant of or is ignoring the interconnectivity of global financial markets and economies.

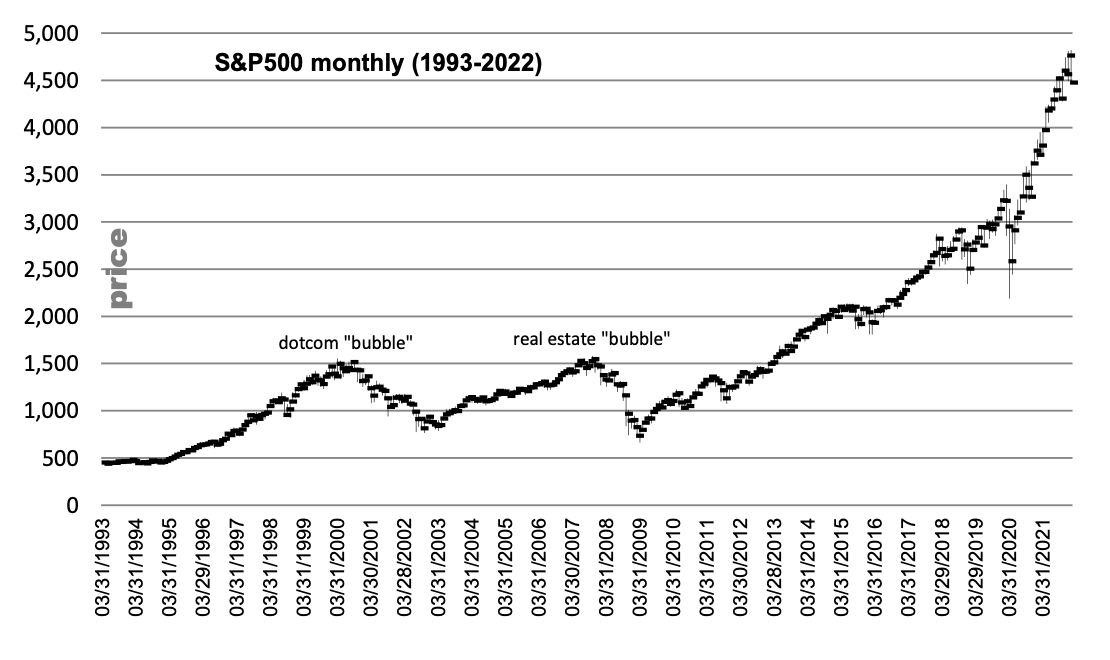

The most obvious risk to wage and economic growth is this…the greatest asset bubble ever blown:

|

|

| Source: MSA |

When, not if, this mother of all bubbles pops, all bets on growth are off.

The last Labor leader to oust a Liberal PM was Kevin Rudd.

He was elected in late 2007, just as the US housing bubble fully inflated.

What followed was the worst credit crisis since the Great Depression.

Rudd’s grand election promises on wage and economic growth were scuttled by events unfolding half a world away.

Albanese would do well to brush up on his history.

Then again, he is a politician.

Should the bubble burst on his watch, no doubt he’ll hide behind the predictable line of…‘no one saw this coming’.

Sadly, most people will be gullible enough to believe him.

However, even if this massive bubble somehow avoids its pin, our alternative PM should look at why wage stagnation has become an almost permanent fixture.

There are powerful global deflationary forces at play.

To name a few:

- China’s financial pressures directly and indirectly impact upon us. Unlike Rudd, Albanese won’t have a Chinese spend-a-thon to rescue our economy.

- Technological advances — robotics and artificial intelligence — in Germany, the US, and South Korea, are imported to our shores.

- Cheap labour rates in Asia put downward pressure on our wage growth.

In addition to these universal wage suppressants, there’s a legacy of debt — from more than four decades of excess and overpromise — to deal with.

Once upon a time, global debt was the ‘wind beneath the wings’ of the economy.

In the good old days, a dollar of debt generated an equal dollar of economic output.

But that fairy tale growth story had a not-so-fairy-tale ending some time ago.

These days, global debt is a ‘millstone around the neck’ of the economy…it now requires around US$5–6 of debt to generate US$1 of GDP growth.

The cost of paying the interest on a global debt pile of (at least) US$300 trillion — at a 2.5% interest rate — is US$7.5 trillion…and that’s without factoring in any principal repayments.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The maths on this doesn’t lie…

More debt = more repayments = less private sector spending.

This debt load is why any upward movement in interest rates is going to be minimal and…fleeting.

All these wage suppressant factors are baked into the global economic cake.

I know most people are concerned about inflation and cost of living pressures.

Yes, there are supply and distribution issues creating pricing pressure.

Yes, there appears to be a labour shortage putting upward pressure on wages.

The recent pop in CPI numbers reflect these immediate supply and demand imbalances.

All the news on inflation makes it easy to pound the table on wage growth…but it ain’t that easy.

The inflationary spikes we’ve had are the road travelled, not necessarily the one that lies ahead.

Believe it or not, the deflationary forces in the system are far greater than we realise.

And they are starting to make their presence felt.

90% probability of a global recession

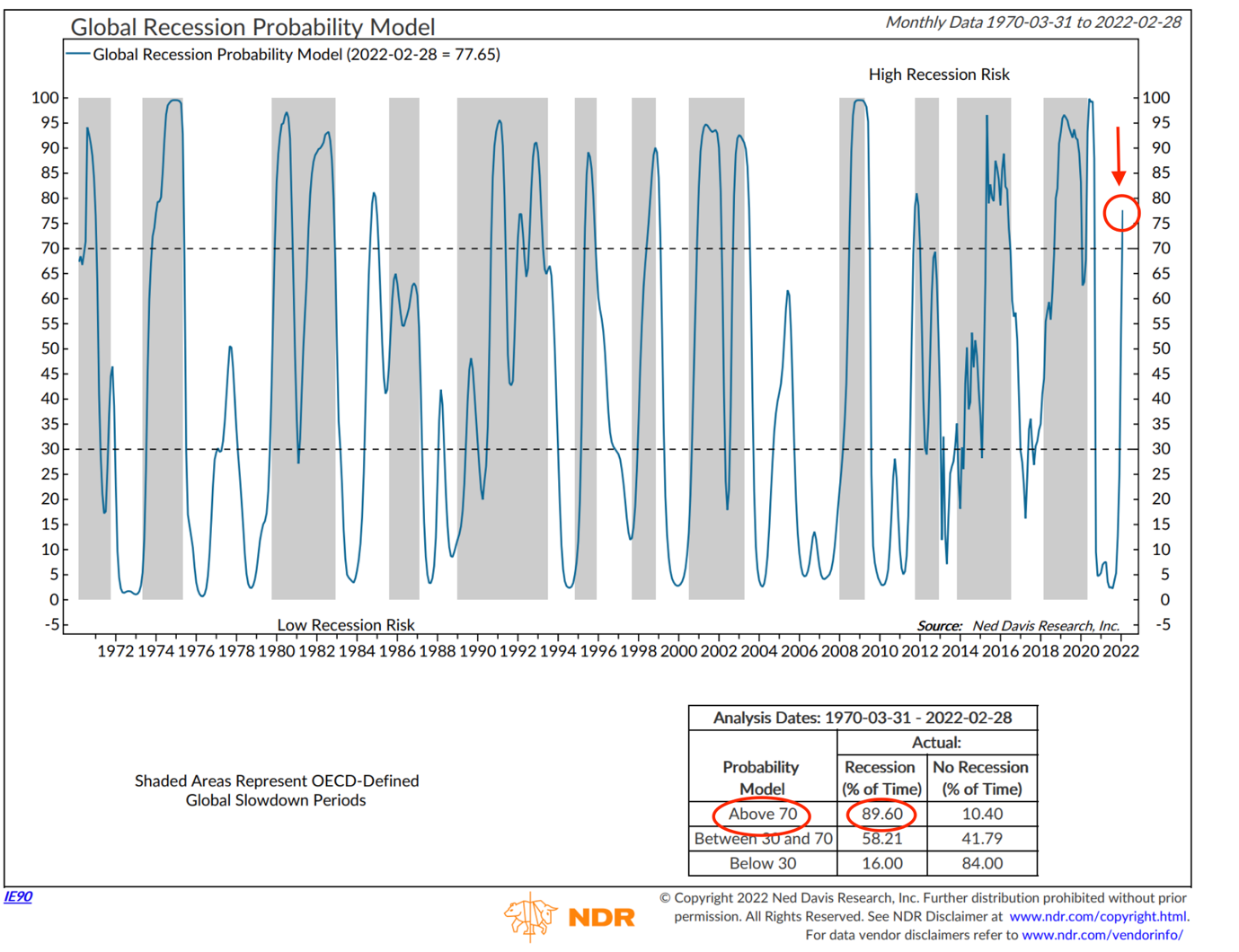

Ned Davis Research (NDR) produces a Global Recession Probability Model.

The model is constructed from several leading economic indicators — manufacturing production, building permits, money supply, yield curves, consumer and business sentiment etc. — from 35 countries.

A score of 70 or above indicates the risk of a global recession is HIGH.

The grey shaded areas are OECD-Defined Global Slowdown Periods.

The latest reading is 77.65.

Over the past 50 years, this model has an impressive 89.6% accuracy record:

|

|

| Source: Ned Davis Research |

Throw a bust of the ‘Everything Bubble’ into the mix and this already downbeat outlook gets even more gloomy.

What will a depressed economy and falling asset prices do to boomer retiree consumption?

In the US, the next big/huge/massive pressure point that’s on the verge of exploding is in pensions…not age pensions, but employer-based pension schemes.

The global economy has boomed in recent decades due to the Western world’s insatiable appetite for consumption.

Dave Ramsey described it perfectly when he said:

‘We buy things we don’t need with money we don’t have to impress people we don’t like.’

Buying things — other than the necessities of life — can only happen if you have sufficient surplus income, savings, and/or access to credit.

Every year, millions of boomers — the generation largely responsible for creating this period of excess and overpromise — are moving into retirement. They have long-established spending patterns.

In Europe and the US, many of these boomers are expecting to receive — in addition to an age pension — an employer pension. The combined income streams are being counted on to maintain consumption habits. This is what millions of retirees have been promised.

In the world’s largest economy — the US — personal consumption expenditure constitutes approximately 70% of GDP.

Therefore, any expansion or contraction in US consumption will be exported to the rest of the world.

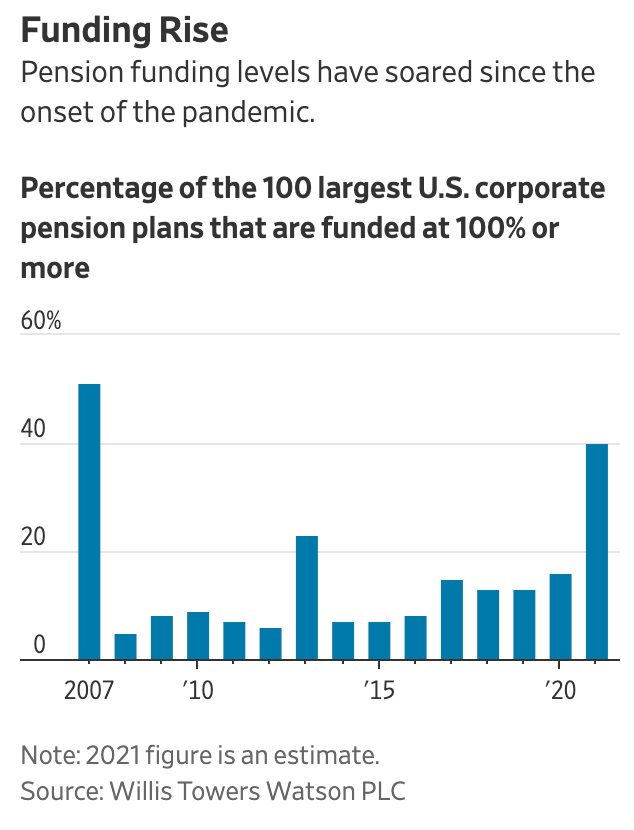

The surge in asset markets in 2021 was good news for some employer plans.

Now, 40 of the top 100 US Corporate Pension Plans have sufficient assets to meet obligations:

|

|

| Source: WSJ |

However, if I was a member of one of the recently fully funded plans, I wouldn’t get too excited.

In 2007, at the height of the US housing bubble, around half the plans were fully funded. A year later, that figure fell to just…five.

As the Wall Street Journal article (published on 23 January 2022) stated (emphasis added):

‘…overfunded pensions could become underfunded again if market declines reduce pension asset values, corporate advisers said. Roughly 60% of Fortune 1000 companies’ defined-benefit plans remain in deficit, Willis Towers data showed.’

The difference between 2007 and now is the ranks of retirees (collecting their promised indexed pensions) have swelled…and are living longer. Placing more strain on the underfunded plans.

What will a 50%, 60%, or even 70% collapse on Wall Street do to the asset position of these funds? Carnage.

When, not if, the market collapse happens, it’ll herald in a prolonged period of sub-par growth and possibly, deflation.

Private and Public pension funds are going to be faced with one of three options:

- Reduce pension payments.

- Increase contributions to cover the shortfall, which in the case of local, state, and federal governments, means raising taxes and corporate pensions, diverting more profits to the pension scheme and less towards shareholder dividends.

- A combination of 1 and 2.

Whatever way you ‘slice and dice it’, there’s going to be much less disposable income for consumption.

If you want an insight into how serious the pension problem is in the US, here’s the link to an interview conducted in 2019 with the producer of Frontline’s ‘The Pension Gamble’.

When the US consumer goes into full scale retreat, the repercussions will be felt worldwide.

Decade after decade we have come to believe that growth was our divine right. But that growth was based on an equation of more people going into more debt. At some point, you run out of ‘more’ and then it becomes a case of less…much less.

Deflation is a very real threat…one that very few — especially politicians — are privately or publicly considering.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.