The Airtasker Ltd [ASX:ART] published its latest quarterly report today, demonstrating ‘strong marketplace performance’ in Q4 and the strength of its business model to date.

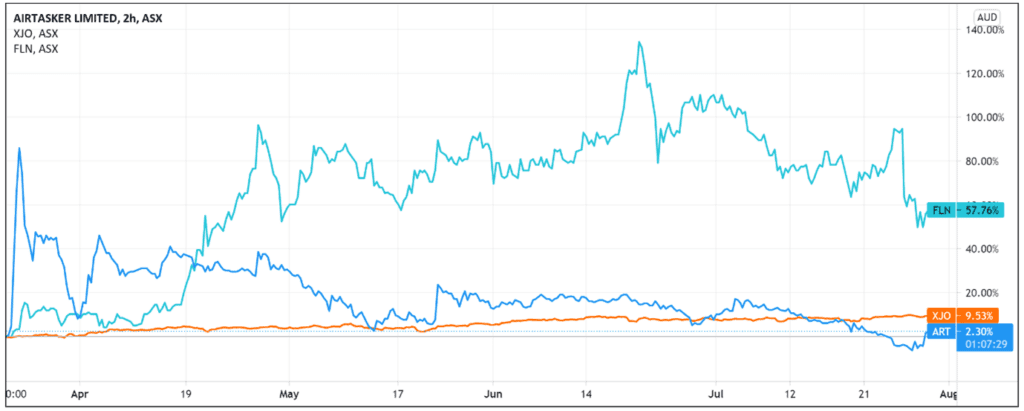

At the time of writing, Airtasker’s share price trading for $1.02 a share, up 6.7%.

Airtasker has long been established as a leading global platform for people and businesses to outsource tasks, and it’s clear from this morning’s announcement that the company is showing no signs of slowing down anytime soon.

Just earlier this month, Airtasker announced its Gross Marketplace Volume (GMV) of $153.1 million had exceeded a prospectus forecast of $143.7 million and an upgraded guidance of $148 to $152 million.

So what were the highlights of today’s announcement?

Management pleased about FY21 numbers

Despite lockdowns in both Sydney and Melbourne last financial year, the company has managed to achieve excellent marketplace performance in terms of both cash flow and operating performance.

Compared to the prospectus forecast of $0.1 million, Airtasker’s FY21 operating cash flow (excluding IPO costs) was $7.4 million, with statutory operating cash flow of $5.5 million.

International expansion plans going smoothly

Back in May, Airtasker announced it had acquired Zaarly, a US local services marketplace not unlike Airtasker in model.

As a result, more than 597,000 registered users and over 900 verified service providers are now accessible to Airtasker, further accelerating the company’s international growth.

What’s next for the Airtasker Share Price?

Airtasker has a strong focus on user experience and developing its core product.

There’s little reason for investors to assume right now that this strategy won’t yield high rewards, particularly considering the company’s strong FY21 results.

However, with lockdowns persisting as an ongoing and unpredictable interruption, more cautious investors may choose to consider how this could affect Airtasker’s performance in the coming months…

The latest lockdown has already impacted the start of Q1, with weekly GMV down roughly 12% compared to pre-lockdown numbers.

If you’re interested in exploring other stocks that could potentially soar this year, our small-cap analyst Ryan Clarkson-Ledward has discovered four little-known stocks that look too exciting to ignore…

You can access this report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here