Artificial intelligence (AI), once a futuristic concept, has quickly fused itself into the fabric of our daily lives.

From personalised recommendations on our favourite streaming platforms to self-driving cars…AI has begun reshaping the internet and the economy.

However, the unexpected launch of Chat GPT by OpenAI in November 2022 brought a new kind of AI to the fore. This marked the beginning of Large Language Models (LLMs), AI that could understand and generate human text.

Next came generative AI, which was able to create new content that did not exist before.

But its next revolution could see it take on the economy and reshape almost every industry.

As we start 2024, a crucial question arises: how will the next wave of AI development impact the world?

The Rise of Generative AI

Generative AI — capable of creating new text, images and video — holds the potential to change how businesses operate in 2024.

This technology will see growth across sectors, including:

Marketing and Advertising: AI tools will analyse user data and behaviour to create relevant marketing.

Personalised marketing messages, targeted content, and dynamic ad designs tailored to individual preferences will become commonplace.

Text-to-video technology like Pika 1.0 is already available and will improve in 2024 to support this.

Privacy concerns aside, this could increase marketing efficiency and improve return on investment.

Product Development: Generative AI will design and test new products. This can optimise production processes and predict market demand more accurately.

This allows businesses to innovate faster and cheaper, providing a competitive edge to the first movers in the space.

Financial Services: Large hedge funds have used AI for years to crunch vast amounts of data behind closed doors.

Their application has expanded from high-frequency quant trading to a plethora of uses.

But the next generation of AI assistants could democratise these efforts.

AI can reshape the financial sector by automating complex financial analysis tasks. It could also assist with personalised financial reports or develop new financial products.

This will make financial services more accessible and personalised while improving customer experience.

The Catch

The rise of generative AI also presents many challenges. I don’t have the space to outline each issue, but here are some of the problems that need our attention:

- Data Privacy: As AI models process more sensitive data, robust data security measures and laws will be key to protecting privacy.

- Misinformation: Generative AI can create deepfakes and other fake content for malicious purposes.

- Bias and Fairness: AI models can perpetuate existing biases found in their training data, leading to unfair outcomes.

- Safety: AI has the power to be an existential threat to humanity if developed wrong.

- Sustainability: The environmental impact of running AI models is worse than many imagine.

- Cost and Accessibility: Advanced AI infrastructure is still too expensive for smaller organisations.

The Evolution of AI Infrastructure

At the heart of the recent explosion in AI was a 2017 paper called ‘Attention is All You Need’.

The paper outlined a new AI architecture that allowed AI to focus on specific words to understand text and language better.

In the example below, we can see how it relates words to one another to understand sentences better.

| |

| Source: Jesse Vig |

With this breakthrough, AI could now grasp complex concepts. This opened the doors to learning at a rate previously thought decades away.

Despite its immense potential, AI development is still limited by hardware constraints and algorithm design.

In 2024, we will likely see algorithm breakthroughs replacing the old attention-style design.

A paper released early December dubbed ‘Mamba’ already hints at what this could look like.

The next generation will be better at comprehending larger portions of data and choosing what to focus on within a sentence.

So in 2024, you’ll likely be able to have long conversations or share vast sums of data with these AI.

But to action that data, we need development in the second issue.

The Chip Bottleneck

To train AI models to a Chat GPT standard, companies need thousands of powerful Graphical Processing Units (GPUs). Each one of these costs between US$25,000–40,000.

Big companies are fighting for shipments due to the massive demand for these powerful GPUs like Nvidia’s [NASDAQ:NVDA] H100. Lead times for new shipments are up to a year.

This demand has sent Nvidia’s stock on an incredible 171% rise this year.

| |

| Source: Toms Hardware |

Significant advancements in AI hardware will come next year, paving the way for further innovation.

2024 will see big movements from players like Intel, Apple, AMD, and Microsoft. All are making their own chip designs and trying to take some of Nvidia’s market share.

Meaning the supply bottleneck should not last as Nvidia’s competitors catch up.

I predict big announcements from these companies in 2024 that could shake up the space to the detriment of Nvidia.

AI Goes to the Cloud

The development of specialised AI chips designed for AI tasks will enable faster and more efficient AI training.

At the same time as hardware improvements, we’ll also likely see shifts to more online computing.

Cloud-based AI platforms allow access to AI resources without expensive hardware investment.

This will democratise access to AI technology and empower smaller companies to compete in the AI-driven market.

AI processing will also shift closer to the source of data. Known as Edge AI, these systems enable real-time decision-making and shorter latency.

This will be useful in applications that need quick response times, such as autonomous vehicles and smart factories.

Speaking of factories, my next prediction is a bit bleaker.

AI-led Job Losses

Over the last year, Meta [NASDAQ:META] has garnered plenty of attention from investors thanks to its renewed focus on ‘efficiency’.

Over the last four-quarters, Meta has reduced its workforce by 24% while more than doubling its operating margins from 20.4% to 41.4%.

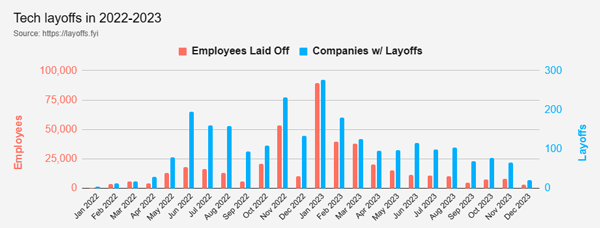

But this story extends far beyond Meta. Since the beginning of 2022, more than 422,500 people have lost their jobs in the tech industry.

| |

| Source: Layoffs.fyi |

But it’s not just tech that is at risk with the advancement of AI. Customer service is likely the major job at risk in the new year, as well as designers and illustrators.

Goldman Sachs predicts that the advancement of AI could ‘expose the equivalent of 300 million full-time jobs to automation’.

It’s not all doom and gloom of course. Jobs will be made in other places and new industries will emerge. But the transition could be a painful one for many.

Looming Backlash

The word Luddite tends to be thrown at people opposed to a technological transition. But it’s often with a misunderstanding of what the movement fought against.

Despite the popular view, Luddites were not against new technology— most were highly skilled workers. What the group opposed was the lowered working conditions.

Merchants were able to ignore their old worker’s pleas for better conditions. Instead, they replaced them with lower-skilled, and underpaid workers who operated the new machines.

Lower-quality, mass-production machines replaced workers’ years of honing their craft.

The Luddites expected consumers to complain about the lower-quality garments. But perceptions simply shifted. This is similar to the wave of cheap and low-quality goods from China in the 2000s.

Similar changes could happen as AI real-time translation improves and internet connectivity spreads.

Lower-skilled workers in developing countries could become the new labour force for white-collar jobs with AI help. Starting the Luddite cycle over again.

Government Steps In

Any one of the challenges mentioned could spur governments to action in 2024. Governments will need to develop new regulatory frameworks to address the ethical and legal implications of AI.

The EU is, thus far, ahead of the game with its latest regulation in December.

But more is needed, particularly regarding data privacy, AI safety, and potential job displacement.

These frameworks will play a crucial role in shaping the future of AI development and ensuring its responsible use in the world.

Whether through public backlash or proactive policy, 2024 will likely be a busy year for government regulation.

No matter what, get ready for an eventful year of change.

Regards,

|

Charlie Ormond,

For Fat Tail Daily

With over a decade of fintech experience, including stretches in critical roles at budding startups and tech titans like Microsoft, Charlie is squarely focussed on investment opportunities in emerging sectors. Interestingly, his academic foundation in zoology provides an unexpected edge! He applies his scientific training with his analytical mindset to figure out tomorrow’s winners and losers. While traditional institutions stick with ‘safe’ stocks, Charlie goes straight for seismic shifts in crypto and AI. He’s an early adopter of both technologies.

Now he’s on a mission to empower everyday investors. He decodes groundbreaking developments in technology stocks before they grab mainstream attention. So, if you seek an unconventional perspective to help capitalise on what’s next in fintech: look no further.

![Nvidia’s [NASDAQ:NVDA] stock price](https://fattail.com.au/wp-content/uploads/2023/12/FTD20240103_img03.png)

Comments