The Afterpay Ltd [ASX:APT] share price went as low as $73.68 today, before clawing back a large part of the losses.

As it stands, the APT share price is down just 2.93%, trading at $81.63.

You can see how APT shares performed in intraday trading so far:

Source: tradingview.com

All of this happened on the back of PayPal announcing its own buy now, pay later (BNPL) service.

We look at what competition means for Afterpay and its peers in the Aussie BNPL sector.

PayPal’s move makes sense

On a day when the Australian recession was made official, there was a broad sell off for BNPL providers on the ASX.

Zip Co Ltd [ASX:Z1P], Splitit Ltd [ASX:SPT] and Sezzle Inc [ASX:SZL] were all down significantly, to name a few.

For so long, these different BNPL providers were leaping ahead into a greenfield opportunity created by technology.

Now an old player in the digital payments space (PayPal) is threating to muscle in on their growth.

With PayPal’s established relationships with online merchants and 286 million users, you can imagine they will leverage their existing strong points.

The entrance of this kind of competition was inevitable.

Goldman Sachs recently tipped APT’s user base to grow threefold through to 2030.

Whether that number is revised in the coming quarters will be interesting to watch.

And after going below $75, it’s possible some investors may’ve taken the opportunity to snap up APT shares at a supposed discount — such is the faith in their growth.

Has the BNPL bubble popped? APT share price support levels and the Gartner hype cycle

I’d be hesitant to say that BNPL is a bubble — it certainly isn’t the Dutch tulip craze.

Fundamentally, the technology/service is valuable.

It re-jigs the world of the credit we were used to for so long.

That being said, Afterpay is still not profitable — and Z1P recently generated an operating cash inflow of $14.6 million — not much against a market cap of greater than $3 billion.

In the coming months it is possible traditional credit providers may finally bite the bullet and like PayPal, and introduce their own offerings.

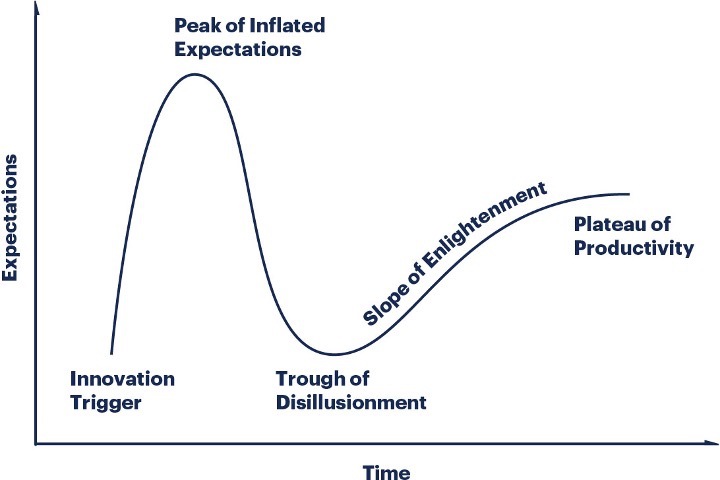

For those not familiar with the ‘Gartner hype cycle’, it could be relevant to what’s about to unfold with APT shares and other BNPL providers:

Source: Gartner

We may just have seen the peak of inflated expectations today and a ‘trough of disillusionment’ may follow.

Maybe not cataclysmic falls for BNPL providers, but that slope of enlightenment could involve more competition in the coming quarters.

Let’s check out the long-term APT share price chart for possible levels of support:

Source: tradingview.com

I’ve got levels marked out at $68, $60, $52 and $40.

Should the rout continue, an APT share price that falls below $68 could indicate the drop is on.

Risk is an important thing to wrap your head around with these kinds of hype stocks.

I’ve previously called the phenomenon the ‘contrarian Uber-driver portfolio analysis signal’.

I’m not denigrating the potential trading prowess of the drivers, I am merely pointing out that when many of these friendly types tell you they are buying APT shares, you may want to at least consider a stop-loss.

I cover potential stop-losses using a tool called a Fibonacci retracement in the following video:

If you want to learn more about risk-management in the context of BNPL stocks, I’d highly recommend watching it.

Regards,

Lachlann Tierney

For Money Morning

Comments