The Aerometrex Ltd [ASX:AMX] share price rise 18% after Google signs purchase order for downtown San Francisco 3D model.

At time of writing, AMX shares were exchanging hands for 90 cents.

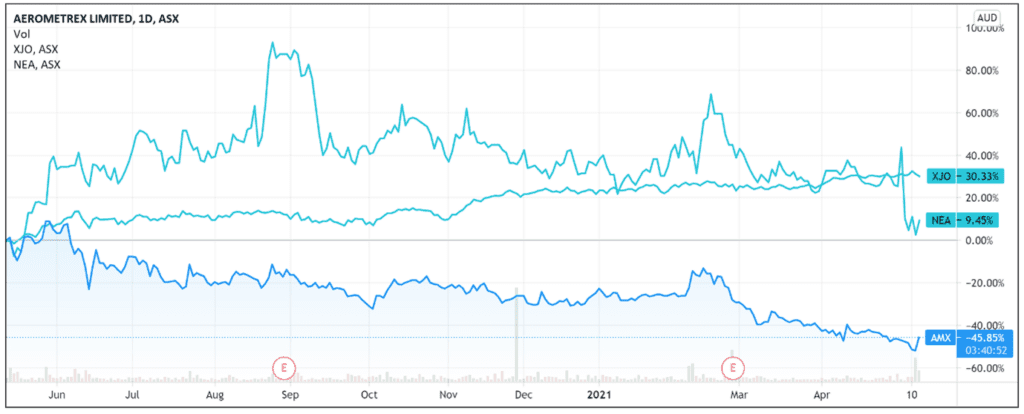

Despite today’s double-digit jump, the Aerometrex share price is still down 27% year to date.

AMX has underperformed the ASX 200 benchmark by 75% over the last 12 months and is down 50% from its 52-week peak.

Fellow aerial mapping business Nearmap Ltd [ASX:NEA]is also up today, gaining 6% at noon.

It follows Nearmap falling by 13% over the last week on the back of patent infringement complaints lodged against NEA by a competitor.

Aerometrex background

Listing in December 2019, Aerometrex is a geospatial technology business focusing on aerial imagery subscription services, photogrammetry, LiDAR, 3D modelling, and data analytics.

While a recent member of the ASX, AMX was established all the way back in 1980 and has mapped 3,900 square kilometres since inception.

In FY20, the aerial imaging firm posted $20.1 million in operating revenue with available cash of $22.2 million.

These five AI stocks could potentially follow in the footsteps of BrainChip’s meteoric 3,133% price spike. Click here to learn why.

Aerometrex lands Google contract

AMX announced today that Google signed a purchase order for a 3D model of downtown San Francisco.

Aerometrex will consequently capture 3D model data of the area, adding it to its 3D data archive.

While it will provide Google a data licence for its 3D model, AMX will retain full intellectual property ownership of the model.

For reference, Aerometrex sells a proprietary modelling service implementing the massive multi-ray matching photogrammetric method.

AMX’s 3D models are high resolution (2cm pixel) and accurate (5cm in XY and Z).

Aerometrex reported its 3D service has become a mainstream option for ‘high-value capital projects as well as high-value investment centres such as capital city CBDs.’

The contract with Google to map San Francisco builds on smaller 3D projects AMX conducted in FY20.

Aerometrex conducted the 3D modelling of the City of Pau in France, Fishermans Bend in Melbourne, and Western Sydney for NSW Dept of Spatial Services.

These 3D modelling projects formed the basis of ‘Digital Twin’ or ‘Smart Cities’ programs for each location.

This year, AMX has constructed 3D models for the cities of Denver and Miami.

Aerometrex Managing Director Mark Deuter commented:

‘I am very encouraged by our developments in the US market and believe that the purchase order with Google endorses our strategy and our 3D data capture capabilities.

‘We are gaining greater attention from large organisations whose operations cover multiple US cities and municipalities and we see significant potential to contract with these types of organisations moving forward.’

What does this contract mean for the AMX share price?

The market’s reaction to the news was strong.

Investors are potentially pricing in further contracts from major companies or are taking the involvement of Google as social proof of AMX’s product offerings.

However, there are caveats.

Aerometrex stated that the revenue amount from Google’s 3D model order is ‘not material’, abstaining from revealing a dollar amount.

This could suggest the order was not significant, meaning the contract itself isn’t expected to boost the company’s financial position.

AMX does, however, think that the Google order ‘demonstrates demand for these products from very large corporations.’

Additionally, the company flagged ‘further demand for the same dataset, the IP of which is retained by Aerometrex, is being received from several organisations with interests’ in San Francisco.

However, if the revenue amount from today’s order is not material, some may wonder what volume of orders from very large corporations would constitute a revenue sum material enough and whether AMX can attract a sufficient number of such orders.

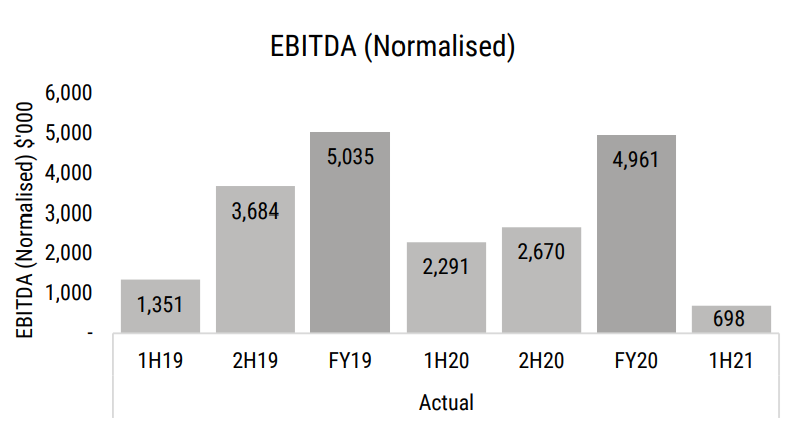

Investors may also scrutinise AMX’s 1H21 revenue and EBITDA, with EBITDA coming in significantly lower in the half than 1H20 and 1H19.

Notably, AMX’s 3D revenue for 1H21 totalled $711,000. This was down from 1H20 3D revenue of $1,695,000 and down from 1H19 3D revenue of $864,000.

Its biggest growth segment was its Metromap offering, with revenue up 727% in 1H21 from the previous corresponding period, totalling $1,506,000.

AMX did flag in its latest investor presentation that it will continue discussions with a ‘number of large global companies in the US in respect of their 3D opportunities’ to boost its 3D sales.

It also outlined opportunities in applying its 3D products in growth markets of gaming and VR.

If you’re interested in the potential return opportunities from small-cap stocks like AMX but are unsure where to start, then I suggest reading our free high-value small-caps report.

There, our market analyst Ryan Clarkson-Ledward analyses four undervalued stocks that could potentially soar in 2021.

Regards,

Lachlann Tierney,

For Money Morning

Comments