This morning was busy on the ASX commodities front, with Adriatic Metals [ASX:ADT] posting an update for its first quarter highlights, gold miner Newcrest Mining [ASX:NCM] extending a contract, though, its shares fell by 2%.

Fellow gold miner Regis Resources [ASX:RRL] posted a lower ore production rate in the quarter, subsequently plummeting 12% in share price, and lithium miner Lake Resources [ASX:LKE] also announced the achievement of a new milestone at Kachi.

LKE’s Kachi achievements saw the lithium explorer surging more than 18% by the afternoon, ADT was not as lucky, dropping by nearly 4%.

Compared to the S&P 200, ADT remains above the wider market by 40% and NCM remains up by 5%. However, RRL has dropped more than 8% below the wider market, as has lithium stock LKE, by a whopping 70%:

Source: TradingView

Adriatc’s first quarter

Precious base metals producer Adriatic Metals provided the latest highlights for its Vares Silver Project, an underground mining project in Bosnia and Herzegovina.

The miner said project construction is now more than 70% complete, thanks to some rapid progress.

Rupice’s extension and infill drilling also continues with a new MRE report due in July.

Ore development is slated for the second quarter, and agreements have been signed with Bosnia and Herzegovina Railways for lease of land. Discussions for the cost of transport should be concluded in Q2 2023.

The second $30 million tranche of Orion Mine Finance debt is drawn, and the group posted a cash balance as at 31 March 2023 of $87 million.

First concentrate production is now scheduled for November this year.

Lake announces Kachi milestone

Clean lithium developer Lake Resources and extraction tech partner Lilac Solutions have announced the production of 2,500kg of lithium carbonate equivalent (LCE) at their shared Project Kachi in Argentina.

Having delivered on its promises, Lilac has increased its ownership of the Kachi Project from 10% to 20%.

The project is now on track to move from its pilot phase into commercial-scale development, which will make it the first lithium brine project in South America to produce lithium at commercial scale without evaporation ponds.

The 2,500kg of LCEs was extracted at Kachi with 80% lithium recovery, 90% plant uptime, 1,000 times less land compared with evaporation ponds, and 10 times less water compared with conventional aluminum-based absorbents.

Once fully developed, the Kachi project is expected to produce 50,000 annual tonnes of battery-grade lithium products.

Newcrest’s Canadian contract and Regis’ low gold count

A 12-month contract extension has been shared between Newcrest and Perenti Limited’s subsidiary Barminco for the Red Chris mine located in British Columbia, a 70:30 joint venture partnership between Newcrest and Imperial Metals.

This extension enables Barminco to continue underground development works and is expected to deliver approximately $90 million of revenue over the 12-month contract term.

Meanwhile, fellow gold miner Regis Resources posted a dismal March quarter, reaching 103,728 ounces of gold.

Having said that, the group increased cash and bullion balances to $204 million by the end of March.

Regis said the lower-than-expected gold production was driven by a slower ramp up of the Duketon Garden Well South underground, unplanned maintenance events at Rosemont, low performance at Tropicana, and wet weather issues.

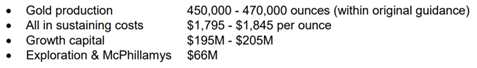

The group updated its FY23 production and cost guidance to:

The drilling boom Australia

There’s an industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

In fact, the drilling business is booming…or will be.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts definitely say so — but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia