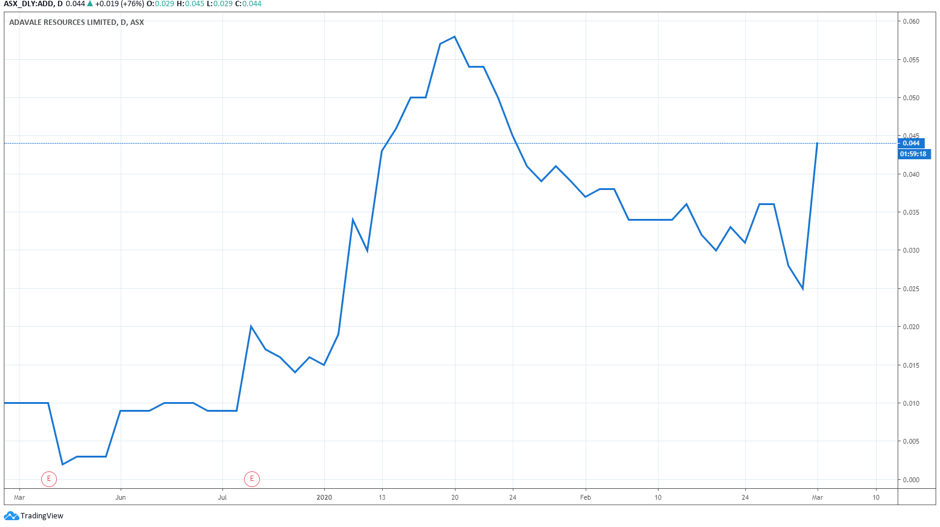

The share price of Australian-based uranium explorer Adavale Resources Ltd [ASX:ADD] has soared 60% this morning, as the company announced it had been granted tenements adjoining one of the largest undeveloped high-grade nickel resources.

Source: TradingView

At the time of writing, ADD shares were trading 1.5 cents higher at four cents per share.

The share price has performed strongly in the opening months of the year, with prices reaching highs not seen since October 2014.

Battery market renews nickel interests

In an announcement made today, Adavale revealed it has been granted two new nickel sulphide tenements adjoining the world-class Kabanga nickel project in Tanzania — previously held by mining giant BHP Group Ltd [ASX:BHP].

The miner submitted applications over the Kabanga tenements at the beginning of January as part of the company’s new direction to target highly prospective projects to feed into the ‘New Energy’ sector of lithium-ion batteries.

The Kabanga Nickel Project holds a JORC Resource of 57 million tonnes @ 2.62% Nickel, with approximately 70% of the resource in measured and indicated categories (at the top end of geological confidence scale). Adavale stated that data from the area suggests high-quality mineralisation with low-risk sulphide metallurgy producing low impurity nickel.

Glencore plc [LON:GLEN] and Barrick Gold Corporation [NYSE:GOLD] were the most recent operators of Kabanga, together spending more than US$250 million on advancing the asset before suspending operations when the nickel prices crashed.

Kabanga came up for grabs in early 2018 after the Tanzanian Government cancelled 11 retention licences on projects in the country.

ADD secured approximately 400 square kilometres of the project from the Tanzanian Government, beating out several top-tier mining companies in addition to some of the world’s largest nickel producers.

Several higher-grade targets have been identified for testing after reviewing historic data that includes an airborne radiometric survey conducted by BHP.

Adavale stated it is currently in discussions with potential joint venture partners regarding tendering for the Kabanga Nickel Project proper.

The current nickel deficit could keep prices at attractive levels for miners and explorers, with the increasing demand for lithium-ion batteries and stainless steel helping bolster prices too.

While the pipeline of nickel supply remains dry, thanks to surplus stockpiling over the past decade, battery and electric vehicle manufacturers may continue to target miners and explorers directly to guarantee nickel supplies.

Regards,

Lachlann Tierney,

For Money Morning

PS: If you’re interested in how nickel will play out in 2020, be sure to check out our video report on what could be the next battery boom. View here.