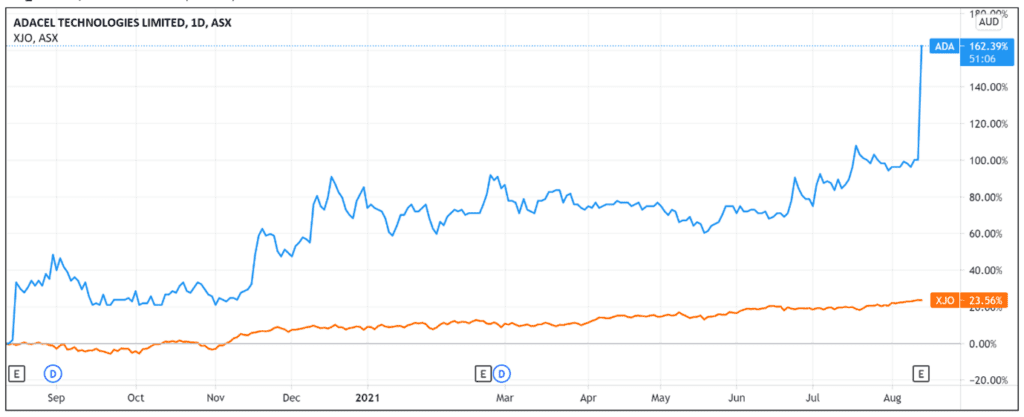

The Adacel Technologies Ltd [ASX:ADA] share price have soared by nearly 40% today after the company released its FY2021 report.

This marks a 52-week high of $1.43 for the stock. Over the last two months alone, the share price has risen by 150%.

So what’s driving the ADA share price so high and who is Adacel?

Adacel Technologies is a global technology company that creates and implements air traffic management software.

It’s headquartered in Melbourne, Victoria.

Founded in 1987, the company has acquired an international clientele of major airline giants, showing resilience over what has been a trying year for many businesses in the travel industry.

Did Adacel have a successful fiscal year?

Several highlights of this morning’s report indicate that Adacel’s performance is improving.

Key metrics such as revenue, gross margin, EDITBA, and net profit (both before and after tax) all saw a jump from 2020 to 2021.

Let’s look at some of these numbers…

Revenue increased 1.1% to $40.2 million.

Gross profit margin increased by almost five points to 40.1%.

Interest, taxes, depreciation, and profit before amortisation (EBITDA) increased 117.6% to $9.8 million.

Net profit after tax in FY2021 reached $7.3 million, more than double the previous FY2020 of $3.6 million.

As of 30 June 2021, ADA’s net cash balance was $11.6 million, compared to $5.2 million recorded at FY2020 year end.

Big growth usually means bigger dividends, and this is likely also why the share price is responding positively today.

During FY2021, a total of $3.2 million (FY2020: $0.8 million) was paid as dividends to shareholders.

The final dividend (unfranked) is 3.25 cents per share.

These are strong results for Adacel, but what is the long-term outlook for ADA shares?

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

COVID clouds on the horizon…

Although Adacel is primarily a technology company, its dealings are in the air travel industry.

It’s no secret that lockdowns, border closures, and airline redundancies are making an ugly mark on this space right now.

The problem is, we have no idea how long this will go on for…

Could this potentially slow down Adacel’s growth?

The answer isn’t clear, but there’s certainly no denying that Aracel is in a great position on the back of a profitable FY2021.

However, we believe there are several other companies on the ASX worth looking at in 2021. Our small-cap analyst Ryan Clarkson-Ledward has discovered four undervalued stocks that could potentially skyrocket this year…and Adacel wasn’t one of them.

To find out more details, download your free copy of his report ‘Four High-Value Small-Caps to Capitalise on for 2021’ here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Along with your report, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities straight to your inbox seven days a week. Click here to get started.