Consumer prices are rising. Real wages are falling. Investors are panicking. Productivity is dropping. The trade deficit is getting worse. Mortgages and car payments are rising.

And here comes the ace pilot, Jerome Powell, in for a landing:

Our subject today is incompetence. So much of it is on display, we gasp…and wonder; when God created man, did he overestimate his abilities?

From MarketWatch:

‘The productivity of American workers and businesses sank at an 7.5% annual pace in the first quarter — the biggest drop since 1947 — in a reflection of ongoing supply shortages and other drags on the economy.

‘The amount of goods and services produced, known as output, fell at a 2.4% rate in the first three months of the year. Yet hours worked rose at a 5.5% annual rate, the government said Thursday.’

Yep…another sign that the 21st century, so far, has been a flop. MarketWatch continues:

‘Unit-labor costs surged at 11.6% annual pace in the first quarter. Over the past year these costs have risen at the fastest clip in 40 years.

‘Unit-labor costs reflect how much a business pays an employee to produce one unit of output — say a ton of steel or a box of cookies.

‘Hourly compensation, or the amount of wages and benefits paid to employees, increased by 3.2%.

‘Yet adjusted for inflation compensation fell 5.5%, underscoring that rising prices are hurting breadwinners. Wages aren’t keeping up with inflation.’

Productivity — how much you can do per hour (time is limited) — is the key to wealth. In rich nations, productivity is high. In poor ones, it’s low. When productivity goes down, people get poorer.

New technology…along with the Fed’s careful piloting…was supposed to speed up productivity, not decrease it. What went wrong? The internet…the blockchain…new vaccines…self-driving cars — were they all such disappointments?

We have a dictum to explain it: technical genius is no match for political imbecility.

Send in the clowns

Looking back, the incompetence of federal policymakers is staggering.

Bernanke’s bailout of Wall Street was supposed to make US markets stronger; instead, they’re more fragile than ever.

The Trump/Biden trade restrictions were supposed to reduce trade deficits; now they’re bigger than ever.

Money printing was supposed to make a stronger economy with higher wages…but real disposable personal income is falling hard, and the economy is getting smaller.

Ultra-low interest rates were supposed to push the inflation rate up to an ideal 2%…instead, the CPI is almost 9%; the Fed missed the mark by 350%.

What a bunch of clowns.

The Fed’s financial and economic policies over the last 21 years have been a disaster: The lowest interest rates in the last 500 years. More money printing than ever before. Meddling…tinkering…controlling — and deficits, deficits, deficits! — all of which have only squandered real wealth, slowed the economy and added some US$50 trillion in debt to the US economy.

People borrowed. People spent. The spending produced business profits. Stock and bond prices went up. The rich got richer.

And now, inflation has slithered in like a snake at a teenage slumber party. Shrieks of terror have caused the central bankers to ‘pivot’ to a hard-line, hard-assed, hard-nosed policy stance.

But these are the same people who caused today’s inflation…who didn’t see it coming…who denied it had come…and claimed it would go away soon (with no need to take action). And now, they can no longer duck it or dodge it. So they say they have the ‘courage to act’.

What do you think? Have they got it right this time? Jerome Powell has the hoe in his hands; will he bruise the head of the serpent…with higher interest rates and QT (quantitative tightening)? Or…faced with a bear market and a recession…will he fumble the job again?

Here’s Charlie Bilello:

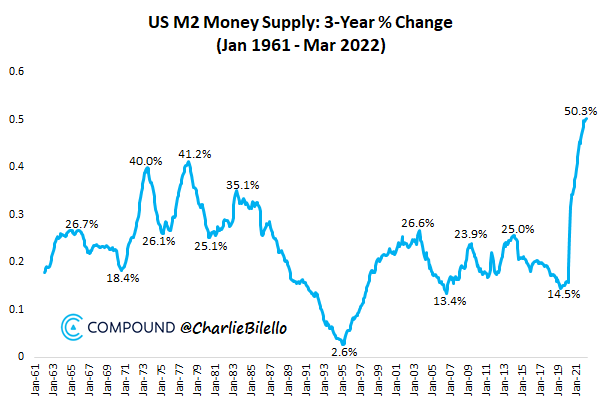

‘The US Money Supply has increased by over 50% in the last 3 years, the largest 3-year increase ever.

‘The only other times when Money Supply increased by [greater than] 40% in a 3-yr period: 1973 & 1977-78.

‘Both were followed by high inflation, recessions (1973-75, 1980, 1981-82) and bear markets.’

|

|

| Source: Compound |

Stay tuned…

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia