The A2 Milk Company Ltd [ASX:A2M] share price continues to fall after the fourth guidance downgrade following the weak daigou trade.

The company also announced that Peter Nathan — chief executive of A2M’s crucial Asia-Pacific division — has resigned.

At the time of writing, A2M was trading for $6.30, the company’s lowest level since October 2017.

Today’s slump accentuates A2M’s prolonged slide, with A2M shares well down on their 52-week high of $20.05.

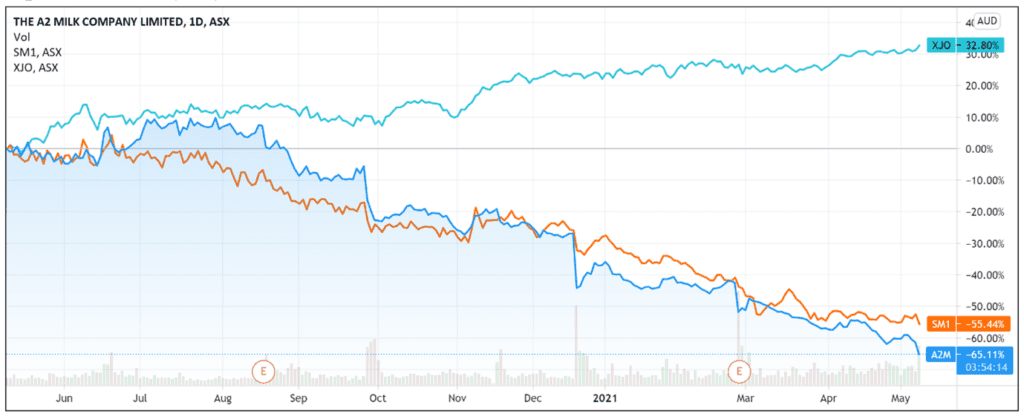

Year-to-date, the stock is down 44% and down 65% over the last 12 months.

A2 Milk has underperformed the ASX 200 benchmark by 98% over the 12-month period.

Dairy processor Synlait Milk Ltd [ASX:SM1], who supplies A2M, also saw its share price fall 6.4% at time of writing.

A2M issues another downgrade

The milk and infant formula company lowered its annual earnings forecast for the fourth time since September 2020, as COVID’s macroeconomic impact continues to ravage the company’s daigou channel.

The daigou channel refers to consumers buying products outside China to import them informally for Chinese consumption.

This sales stream has dried up due to a fall in tourists and international students in Australia and New Zealand following strict travel restrictions.

A2M Chief Executive David Bortolussi acknowledged that ‘actions taken to address challenges in the daigou and cross-border e-commerce channels will not result in sufficient improvement in pricing, sales and inventory levels to meet our previous guidance.’

A2M found little success in its 3Q21 initiatives to boost sales and daigou trade. The company reported its strategies in the period had ‘limited impact’ or are expected to have a ‘delayed impact.’

Consequently, the company revealed that its April sales result and outlook for 4Q21 are ‘significantly below plan.’

A2M’s inventory imbalance

Contributing to A2M’s predicament are problems with inventory.

Speaking on the matter, CEO David Bortolussi admitted that channel inventory levels are ‘higher than had been anticipated.’

The issue is urgent enough that the dairy producer’s board believes it is ‘imperative that the company takes the necessary action to address inventory imbalances urgently in order to stabilise the current situation.’

To address the problem, A2M will cease its daigou margin support program and will work with its distributors to improve inventory dating.

A2M will also continue cutting the sell-in to its daigou channels through 4Q21 and possibly into 1Q22.

The aim is to reduce customer and distributor inventory to ‘target levels.’

The upshot, however, is ‘significantly reduced sales for FY21.’

A2M’s updated outlook

The dairy producer now expects 2021 revenue to come in between NZ$1.20 billion and NZ$1.25 billion.

This is down from its earlier forecast of NZ$1.40 billion.

a2 Milk is also expecting a ‘significantly lower’ EBITDA margin outlook.

The EBITDA margin downgrade reflects:

- ‘The lower than expected sales in 4Q21 versus prior plan and the further actions being taken to rebalance the channels by actively reducing sales in May/June.

- ‘A stock provision of approximately $80 million to $90 million which is in addition to the $23 million stock provision recognised in 1H21. This includes costs to dispose of excess inventory in a controlled and sustainable manner.

- ‘One-off costs of approximately $8 million associated with the implementation of the Company’s new cloud-based enterprise resource planning (ERP) system.’

The downgrades are also partly a consequence of A2M planning ‘more aggressive’ actions in 4Q21 to turn the tide.

For instance, marketing will increase in 4Q21 and into FY22.

The company reported a ‘high level of marketing investment’, with a ‘significant’ marketing campaign in China slated for 4Q21.

Importantly, A2M admitted that it will take ‘some time’ to rebalance inventory levels and restore channel health.

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

A2M does not expect an ‘immediate recovery’.

A2M commences review

A2M’s board admitted that the company ‘needs to change its approach’ considering its recent downgrades.

To that end, the board announced a ‘comprehensive process to review its growth strategy.’

The decision reflects the company’s recognition its market growth in China is being impacted by things like a decline in birth rates, new product innovation, shift towards China label infant nutrition, and increasing ‘competitive intensity.’

The review will primarily focus on A2M’s brand, product, and channel strategy in the China infant nutrition market.

A2M share price outlook

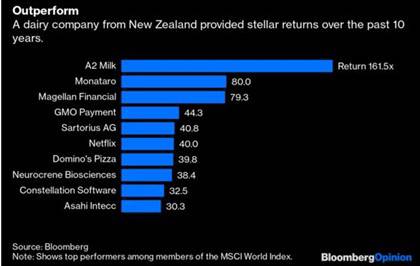

In December 2019, Bloomberg ran the following headline — ‘Raise a Glass to the Decade’s Best-Performing Stock’.

At that point, A2M was the world’s best-performing stock in the MSCI World Index, notching a 16,150% return.

But even back in 2019, there were signs that A2M could be stretching valuations.

The laudatory Bloomberg article did note that by the end of 2019, A2M was starting to look expensive:

‘With a price-earnings ratio of 38-times, it looks more like a tech stock (Alibaba trades at 32-times) than a food company. Its price-sales ratio of 8.4-times is more than double that of Vietnam Dairy Products JSC (3.7-times) and Fonterra (0.3-times).’

Fast-forward to today and Fonterra’s P/S is largely unmoved at 0.28. Ditto for Vietnam Dairy Products, with a current P/S of 3.81. A2M’s supplier Synlait Milk has a current P/S of 0.51.

And A2M?

The company now has a P/S ratio (based on trailing 12 months) of 2.96.

So, while macro factors are hurting its sales, the recent sell-down could also reflect a valuation correction as the market begins weighing A2M more as a food rather than a tech company.

As I’ve covered last month, the outlook for a2 Milk right now is cloudy at best.

However, its strong brand and sturdy balance sheet may invite some bargain hunting if A2M’s share price falls further.

After all, A2M has a substantial cash position of $776 million on a dwindling market capitalisation of $4.6 billion.

CEO David Bortolussi concluded that the company’s current challenges are ‘short-term setbacks.’

Management is still confident in the ‘long-term potential for infant nutrition and other opportunities we have in China.’

A2M went from the best-performing stock globally in a decade to one of the worst performing stocks on the ASX in 2021.

If that whips up one’s uncertainty about entering the stock market, then I think I have a great resource for you.

If you are looking for how to navigate this wild and low interest rate environment or are smarting from going long on A2M shares, I recommend watching Greg Canavan’s ‘Life at Zero’ presentation.

There are plenty of great insights there and he also shares his favourite stock for 2021.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here

Comments