Dear Reader,

There’s tension hanging over the world right now.

This week, our world witnessed the most powerful nation on Earth, and its sycophantic media, talk up a war between Russia and Ukraine.

They even gave a date for it, two days ago.

The strange thing is that the two countries have told the world that it’s not happening.

Russia conducted military exercises on the border and have announced that some of their troops are leaving. Ukraine announced that they learnt that there would be a war on the day the US government and the media called it.

Except Ukraine must have gone to sleep the night before and forgot to set the alarm, so it missed the action.

To top it off, both nations are now trolling the US and their bullhorns, asking them to produce a comprehensive list of their predictions of the upcoming war.

They made an ass of the Biden administration, the intelligence agencies, and the media.

As we woke up this morning, there are stories floating that Ukrainian rebels fired shots inside Ukraine.

Maybe there really is a war happening?

I mean, both sides involved have said that there is no war. Hey, maybe the unnamed military insiders in the US know better than Russia and Ukraine!

Because these days, it is not the participants in a fight who know whether they will fight.

And the fear factor rises up a notch…

Market woes and the Russia–Ukraine tensions — who’s on first?

Last month, the financial markets suffered what appeared to be a cardiac arrest. Cryptocurrencies and the NASDAQ Index led the fall (which was quite a plunge), while the broader equity markets tumbled.

Gold tried to stage a rally in the midst of it but also took a beating.

The markets appear to have found some footing this month, although volatility remained.

The Russia and Ukraine fiasco-not-fiasco did take the stock markets for a roller coaster ride. Big drop one day, solid bounce the next.

This event has helped put the rising inflation levels in the US and around the world on the left side of the stage, as if to avoid the spotlight.

Those of us who are on the ball know how much trouble we face on the economic front. The hyped-up tension between Russia and Ukraine is actually the real sideshow.

Don’t discount the hyped-up tension rising further first before it fizzles away.

However, the markets are taking the bait now.

Neither has gold, it appears.

While gold surged in the recent week, it appears that the movement coincides more with Russia and Ukraine rather than because of fears that inflation is now running rampant.

Gold is within an inch of US$1,900 an ounce this morning. Market commentators attribute this to rising alarm on the latest events on the Russia–Ukrainian border. Expect gold investors to take this as the cue when making their trades.

I wrote last week that the price of gold is driven by central banks and their associates to further their goals. It seems like they’re up to their same tricks again, this time using Russia and Ukraine as their cover story to divert attention from their failing system.

Ignore economic inflation and rising uncertainty about the stability of the financial markets. It’s Russia and Ukraine, stupid!

So you now know how not to fall for this trick.

What can you make of this insight?

Opportunity in buying gold stocks

In this current market, almost every asset class is trading at eye-watering levels. It reflects a combination of investor exuberance and the insanity of our fiat currency system.

However, gold stocks are now trading at a deeper discount relative to the gold price. Last year saw them grind down and hence, they are offering better value.

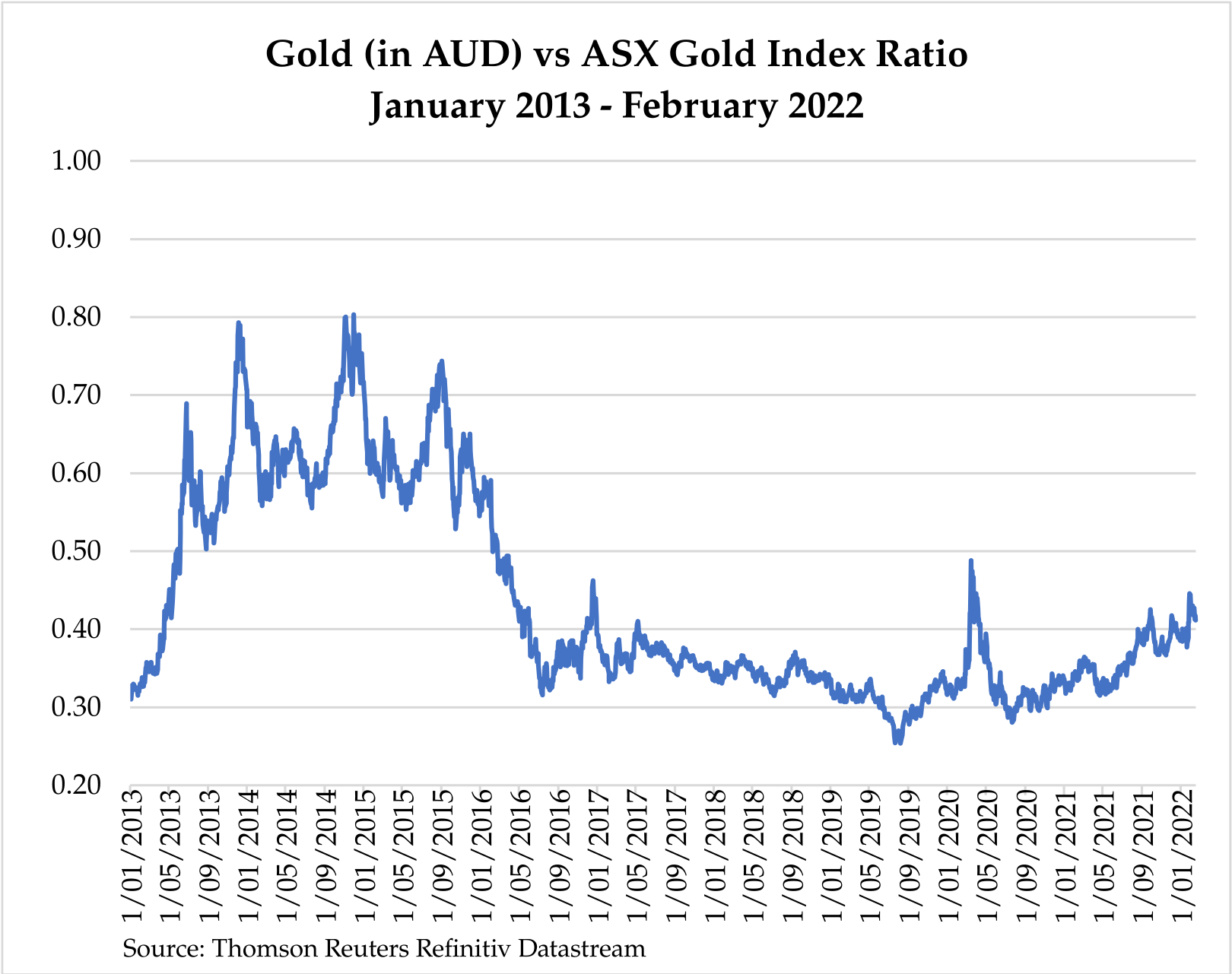

I recently analysed the relative price of the ASX Gold Index [ASX:XGD] and gold in Australian dollar terms from 2013 till today and found something interesting. Check out the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

This graph actually surprised me. I’d been thinking gold stocks were undervalued last year and hence poised for a significant rally. It was disappointing to not see a sustained rally materialise.

What this graph is telling me is that gold stocks are becoming more attractive now.

It gets better from here in light of the prevailing economic and geopolitical developments.

Consider getting into gold stocks right now. The tide seems to be in its favour.

Now which ones should you buy? Let me help you with that!

You will be glad to know that we have a special offer for you coming up on my gold stock investment service, so keep your eye out for that.

Have a great weekend!

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments