Last week, Microsoft Corp.[NASDAQ:MSFT] quietly eased past Apple Inc. [NASDAQ:AAPL] to become the world’s most valuable public company.

Both of these tech behemoths are hovering around US$2.88 trillion.

But Microsoft has just pipped Apple at the post — by a mere US$1 billion (or US$0.001 trillion).

As you can see here, the value of Microsoft has been pulling away from Apple over the past year:

| |

| Source: Trading View |

It’s up 36% compared to just 13% for Apple.

Quite the difference…

And this isn’t a mere reshuffling of the board taking place.

In my opinion, it’s a big clue that 2023’s ‘breakthrough moment’ is fast becoming 2024’s tech battlefield.

Understanding which stocks to back in this ongoing fight could be key to making great gains in the stock market over 2024.

So what’s going on?

Let me explain…

Microsoft are all in AI

It all comes down to artificial intelligence (AI).

Microsoft’s rise to the top is in large part due to its US$13 billion investment in OpenAI.

This is the Sam Altman founded company that created the ChatGPT AI-powered chatbot that took the world by storm in 2023.

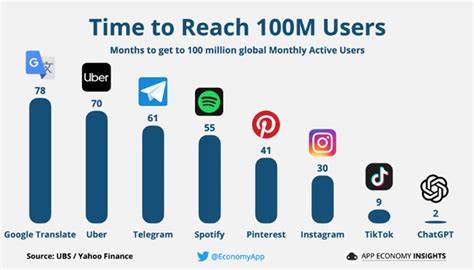

In case you need a reminder of how big a moment that was, check out how fast ChatGPT gained popularity:

| |

| Source: UBS |

Under CEO Satya Nadella, Microsoft is pushing ahead with a strategy to help integrate the tools of generative AI into every company in the world.

And their Azure OpenAI platform will be pivotal in this.

One big name partnership already lined up is with global telecom giant, Vodafone.

As reported:

‘This 10-year strategic partnership, valued at $1.5 billion, aims to enhance Vodafone’s customer experience through Microsoft’s AI tools.

Nadella expressed enthusiasm about applying cutting-edge cloud and AI technology to improve services for Vodafone’s vast customer base in Africa and Europe. This collaboration extends beyond AI integration, aiming to revolutionize Vodafone’s digital and financial services, particularly for small and medium-sized enterprises.’

As you can see, this partnership is about more than just one big customer.

It’s really about setting up the distribution channels to take AI to the masses.

There’s a fast developing ‘AI supply chain’ evolving and the race is on to see who can gain market share in it.

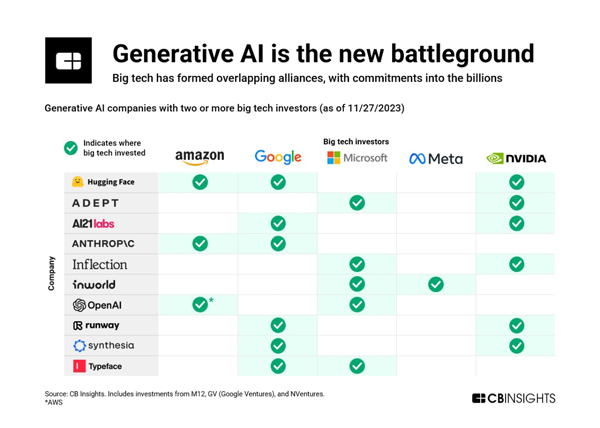

Competition is fierce and Microsoft isn’t the only big tech company investing heavily in AI.

Google, Nvidia, Amazon and Meta are all laying down big bets on an AI-led future.

In some cases, they’re even backing the same companies.

Check out this chart which shows generative AI start-ups with two or more big tech companies backing them:

| |

| Source: CB Insights |

But what about Apple?

Why are they falling behind here?

Apple are investing in AI, like the other tech giants — a rumoured AppleGPT chat bot is apparently close to release.

But they’ve also been distracted by some other issues of late.

On Tuesday the US Supreme Court refused to hear an appeal relating to payments on the App Store. This ruling means the company must allow developers to offer alternative payment methods — beyond just Apple Pay.

The day after that, a federal court ruled against the phone maker on an appeal relating to their blood oxygen feature on the Apple Watch. This feature is likely to be discontinued.

And there’s also rumours the Justice Department could be about to sue Apple on anti-trust grounds as soon as March.

Couple these legal dramas with weakish iPhone sales — especially in China — and the short-term look outlook is bumpy.

Still, you’d be a fool to write off Apple.

They have a legion of loyal fans who won’t be quick to drop the brand.

Rest assured, they will fight back.

And AI could be the key…

As a note in The Information put it (my emphasis):

‘To really jump-start growth, Apple probably needs a new device, such as its Vision Pro mixed-reality headset, to go on sale next month, or the addition of generative artificial intelligence to the iPhone, which could spark a bigger replacement cycle.

It’s a good bet that early sales of the Vision Pro will be unexceptional, given the high price point ($3,500) and the usual teething issues with a new device, such as its weight.

To persuade consumers they need a new iPhone sooner than they might think, Apple probably needs to add more AI capabilities. If it can do that this year, it can turn 2024 into a winning streak after all.’

Do you see what’s happening here?

AI isn’t some flash in the pan fad.

It’s a transformational tech that no company — even one as big as Apple — can afford to ignore.

Now multiply that across the entire global economy…

What should you do about it?

I’ve just released a special presentation that lays out the opportunity in AI, as I see it, for 2024.

I’ve pinpointed five stocks in five unique segments of the AI space, I think are ‘must own’ stocks for anyone wanting to jump aboard this AI train before it really gets started.

And I bet you’ve never heard of any of them!

Find out more on that presentation here…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital Premium, and Crypto Capital Foundation

Comments