It’s a sea of red out there.

Overnight, markets finished lower after the US failed to once again pen a deal on the debt ceiling, with concerns of a recession continuing to grow.

Oil prices — a good indicator of economic activity — are down 12% in the last month.

Natural gas prices are also down more than 70% year on year. This is quite a change from last year when prices soared as Europe headed for a long winter and supply from Russia was uncertain.

There’s now talk that the gas market is oversupplied after a mild winter, and Europe was able to fill up its storage deposits with LNG imports.

Still, things are looking a bit tight in the oil and gas space.

The conflict with Russia, a global oil and gas producer powerhouse, still rages on, and there’s very little gas flowing from Russia into Europe.

Things could also turn around quickly in this space if demand from China picks up or cold temperatures hit the Northern Hemisphere later this year.

It’s something we will continue to keep an eye on.

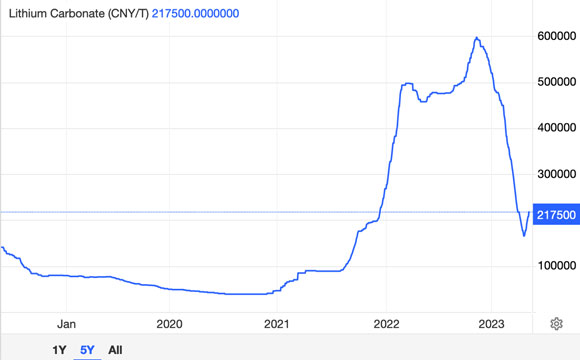

But things have definitely turned in another corner of the energy market: lithium.

Lithium prices are waking up

By now you’ve likely heard lithium prices are recovering.

Even Morgan Stanley, who’s traditionally been quite negative on lithium, agrees.

As they said in a note recently:

‘Although China’s EV sales and battery production are back in growth mode after a lacklustre start of the year, cathode and battery cell producers are still not fully back buying in the spot market, but sentiment is clearly improving and their lithium inventories appear to have eroded.

‘Unlike for nickel and cobalt, we still model a full-year lithium market deficit for 2023, and we expect the recently oversupplied lithium market to become tighter again for the remainder of 2023.

‘Therefore we think the market can stay relatively right for 2023, but the shortfall will be much less than last year.’

As the bank noted, Australian spodumene production came in below expectations during the first quarter of 2023. Exports from Chile, the second-largest lithium producer in the world, also weren’t great.

What’s more, there’s been some uncertainty coming out of Chile when it comes to future lithium production.

And then mergers and acquisitions have been heating up in the lithium space.

Allkem [ASX:AKE] and Livent recently announced they’ll be merging to form a massive $16 billion market cap company to take advantage of the strong demand of lithium.

Also earlier this year, Tianqi, in a joint venture with IGO [ASX:IGO] made a bid for Australian lithium explorer Essential Metals [ASX:ESS], an offer that got rejected.

And then Albemarle tried to buy Liontown Resources [ASX:LTR] and was turned down…three times. Albemarle hasn’t given up, though the company says it’s still looking around to snap up opportunities in the lithium space.

So there’s still a bit of a frenzy when it comes to securing lithium supply.

It’s been a roller coaster ride for lithium prices

Chinese lithium carbonate prices dropped around 70% at the beginning of the year, as you can see below:

|

|

| Source: Tradingeconomics |

The falls though are starting to reverse and lithium prices are up 16% for the month.

It’s starting to flow into lithium stocks. Lithium producer Pilbara Minerals [ASX:PLS], for example, is up 26% for the month.

Truth is that while lithium prices have dropped, they are still higher than previous years, and lithium producers could continue to make a bundle.

Prices should continue to remain strong as demand for lithium continues.

For one, EV sales are recovering.

Even with the end of EV subsidies in China, the largest EV market in the world, sales continue to grow. In the first quarter of the year, EV car sales were up 25% from the same period last year.

Automakers are still in a frenzy to secure raw materials and secure market share in the EV space.

On the supply side, it takes time to find lithium, get permits, and build a mine.

Lithium needs to be processed before it’s used in lithium-ion batteries. And while most mining happens in countries like Australia and Chile, battery production is very much concentrated in China.

Although the US and the EU are trying to catch up when it comes to growing their onshore lithium-ion battery production, having much of the production in one place could cause hold ups.

So overall, lithium’s future is still looking quite exciting indeed!

Of course, according to my colleague James Cooper, there’s another commodity worth keeping tabs on.

In fact, it could be the next resource to ‘do a lithium’, so to speak.

And there are only four days of it stockpiled globally. Find out more here.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments