‘In my career in this game that is now spanning some 25 years, I’ve never seen a market so hard to make money in.’

These words come from small-cap investor Andrew Chapman last week.

I’ll back him up too!

The small-cap sector in Australia is suffering. Put it down to caution and a murky global outlook.

The Chinese say it best…from crisis springs opportunity!

Why even bother with small stocks?

Let’s look at this situation from a different angle.

This week I attended a webinar that Auscap fund manager Tim Carleton hosted. Tim always delivers good value.

He shared some insight into the Aussie big banks that are compelling…and cautionary.

You see…

Big bank stocks are a mainstay of most Aussie portfolios, and I’m assuming yours.

I get it. They’re big, secure and pay decedent dividends.

What they aren’t doing is going up.

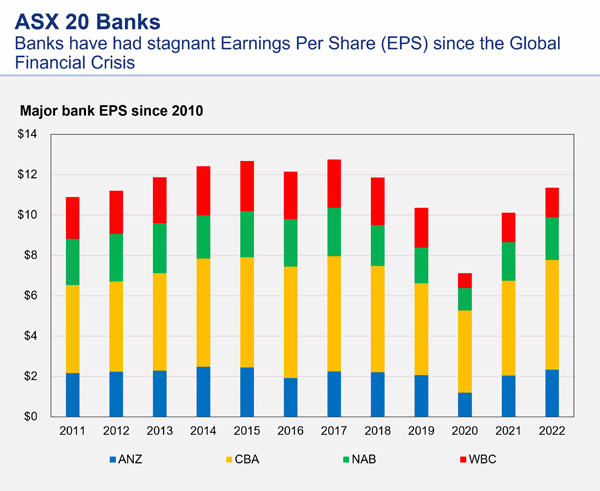

Tim Carleton showed us why. They’re not growing their earnings!

| |

| Source: Auscap |

Their return on equity is also falling away.

In other words, if you’re looking for capital growth, the Aussie big banks are unlikely to deliver it in a powerful way, if at all.

You might also need to consider what UK bank Virgin Money [ASX:VUK] told the market this month.

Virgin took a hit to profits after saying they’ll spend $250 million to protect their clients.

From The Australian Financial Review …

‘“Large language models with the power of quantum computing puts the threat on a whole other level,” Virgin Money CEO David Duffy told The Australian Financial Review.

‘“The power of it is rising exponentially. And whether it’s deep fake video and voice, or it’s just authenticity on email, or text — whatever it is, it’s rapidly growing in its sophistication and threat level.

‘“So I think you just have to get to a point where you’re staying ahead of the curve rather than catching up.”

‘Mr Duffy said he expected to see other banks in Britain and overseas, including in Australia, similarly boost their investment.’

In other words, it’s all another cost eating into bank profitability.

Aussie banks already trade on rich price-to-earnings multiples relative to banks overseas.

That means to go higher they need to grow their earnings.

However, they have more competition than ever before. They also have the threat of big tech muscling into their space.

You might not want to leave your money in a challenger bank that you’ve never heard of.

But Apple? Most people would do it in a flash if Apple can clear the regulatory hurdles.

All this is to say that big banks aren’t going to deliver the envious capital growth they did 20 years ago to now.

I’m not saying it’s all a train wreck.

But if you’re looking for capital growth, small and mid-cap stocks can deliver what you’re looking for.

Take small telecommunications firm (and one of my recommendations) Tuas [ASX:TUA], for example.

Tuas doesn’t even make money yet. And consider the quote I began this article with.

Yet look at the chart of the share price since the start of the year…

| |

| Source: Yahoo Finance |

It’s been a ripper.

That’s because the market can see the juicy profits ahead.

In other words…Tuas has the drug that drives the market…growth!

Of course, not all small caps have done something like this. Some have done the opposite.

But what the current dud period for small caps did deliver was a VERY cheap look at Tuas earlier in the year.

You have to know a bit about the stock to see why this was so exciting.

Billionaire David Tuas is the man behind Tuas. He built TPG into the beast it became.

And now he’s replicating the same business strategy in Singapore.

We had an exciting company trading cheaply because of a bunch of macro concerns.

None of them have much to do selling mobile subscriptions in Singapore.

The point of all this is not to pitch Tuas to you as a stock.

It’s to say that there are small-cap stocks all over the market like Tuas.

The sector sell down is like Arnie in Terminator 2 blasting all the cop cars from the fifth floor.

No one escapes the collateral damage!

If you’re hungry to (potentially) bag a big winner in 2024, don’t look to bank stocks. Look to the small-cap market!

You can find some ideas to get your started here.

Best wishes,

|

Callum Newman,

Editor, Fat Tail Daily