It was just a couple of regional banks, they will say.

The cracks are starting to appear though…

Anyway, here’s the story via Bloomberg:

‘Just since the past month, worried savers have descended on three banks to withdraw funds amid rumors of cash shortages that were later dismissed as false. Over the weekend customers rushed to a bank in the northern Hebei province to take out money, prompting local regulators to publicly vouch for the soundness of its lenders as the police halted the run.

‘Confidence in the $43 trillion banking system is eroding among the nation’s more than 1 billion account holders, threatening a cornerstone of China’s rise into an economic powerhouse. After several bailouts and the first bank seizure in more than two decades last year, the coronavirus outbreak and its economic fallout have exacerbated an already shaky situation in the world’s largest banking system.’

Imagine if police arrested people trying to pull their money out in Australia?

Now, this is almost certainly not going to happen.

And the Chinese authorities’ response was typical fare for the country.

But let’s dig into what’s happening in the world’s largest banking system.

Dividend disaster! Find out why bank dividends could be under serious threat

China’s financial system and Chinese Banks in context

Understanding the Chinese financial system is by no means an easy task — and Chinese debt ratios flow through to strains on their banks.

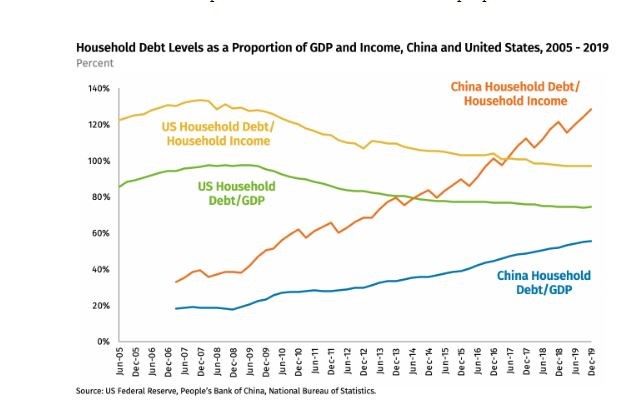

By Western standards, China’s household debt-to-GDP ratio was modest — pre-COVID.

It stood at 55.2% as of January, something Chinese financial regulators would trumpet I’m sure.

This is a misleading figure though, because the ability to pay back a mortgage and hence the strength of the residential property market, hinges on your income.

Not the grand total of goods and services produced by the state.

You can see the trend pre-COVID in household debt relative to income below:

|

|

| Source: Rhodium Group |

So, things are shaky on that front.

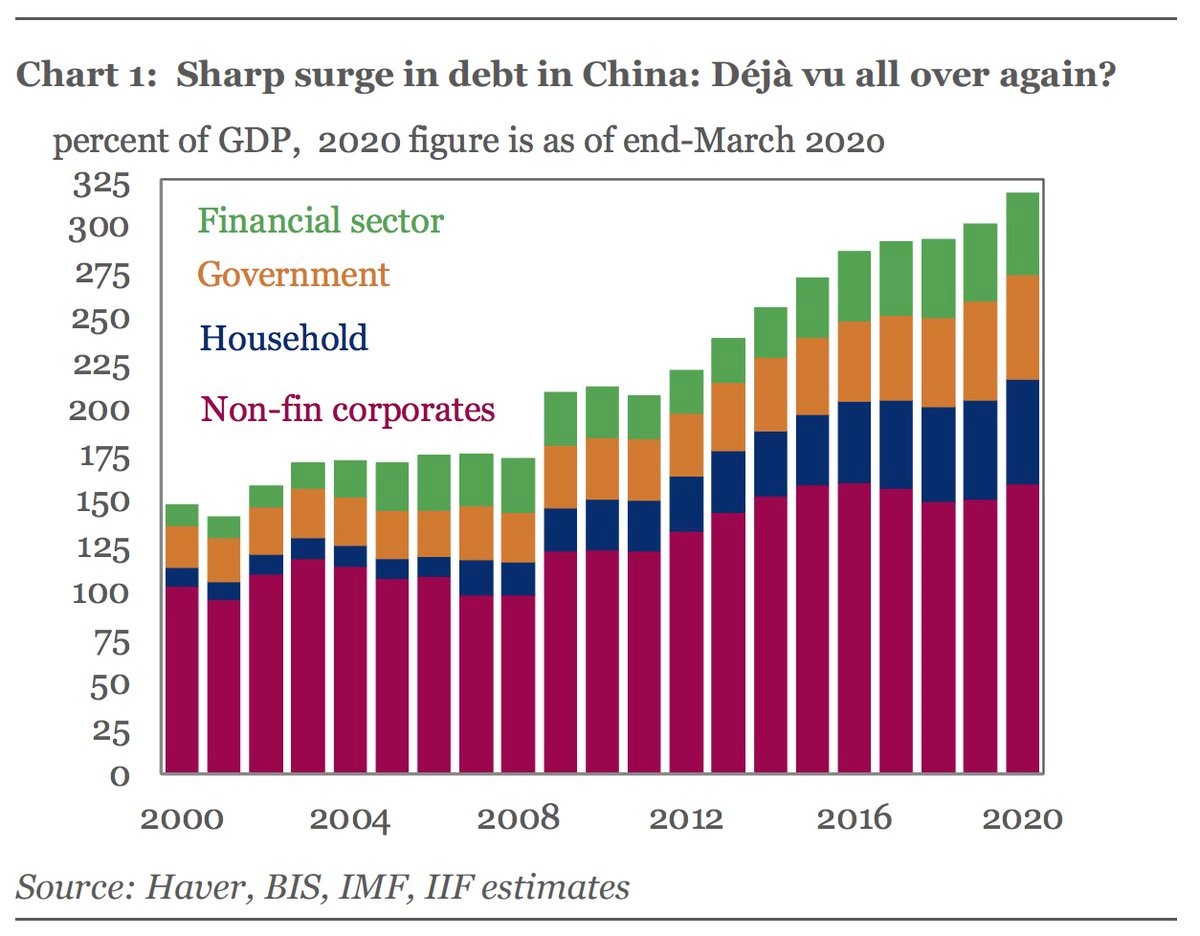

Corporate debt is even more concerning, making up a huge chunk of the total debt:

|

|

| Source: Twitter |

Taking all the different types of debt together, brings the total debt into the country to 317% in Q1 2020.

You can imagine when the Q2 numbers come in it will be worse.

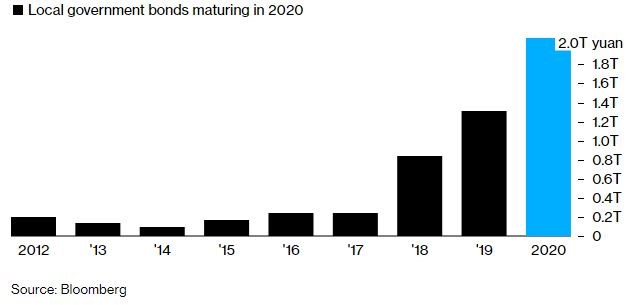

Then you have a municipal bond cliff, which you can see below:

|

|

| Source: Bloomberg |

As you can see, it’s not just one factor that is putting strain on the Chinese financial system.

The human instinct to form narratives and drill down on one factor as the cause of an event, often blinds us to a richer understanding of reality.

With China, it’s no one single thing.

Instead, it’s a multitude of factors that point to significant problems under the hood of the world’s largest banking system.

How the dominoes fall

You can’t strongarm a debt crisis away.

We’ve tried debtors’ prisons before, and they did little to curb the world’s appetite for credit.

This time, you can expect the CCP to pull out all the stops.

And which domino will be the first to fall?

It could start with the Chinese stock market.

You see, the brewing debt crisis is happening in tandem with a massive run up for Chinese stocks.

This is something my colleague Ryan Clarkson-Ledward covered last week.

In that piece, he said:

‘By flooding the market with equity, rather than debt, it provides risk-free money.

‘Because even if a company goes bust, it doesn’t have to pay back its equity. Instead, the value of that equity simply craters to zero.

‘Effectively, they are tricking investors into funding businesses, not banks.

‘Obviously, that’s a terrible deal for investors. At least it is when the money stops flowing.’

Looking ahead, you could see this as the key trigger.

Here’s one scenario.

A Chinese market crash could force retail investors to cash, which they then attempt to pull out.

Meanwhile corporate and municipal debt spirals out of control and regional banks go bust.

Draconian capital controls are put in place, and the world’s biggest ever bailout ensues.

But…

What does this mean for the Aussie investor?

Any debt crisis in China would naturally flow through to the Aussie market.

Particularly, the commodities sector.

Here, I think, a lot hinges on Western demand for finished goods.

This could determine the scope of any future Chinese bailout.

I know the outlook presented here is very much bearish on China’s prospects.

But you should never underestimate the lengths the government will go to protect their cherished growth figures.

Long term, I’m still bullish about certain aspects of the Chinese economy — particularly the growth of the middle class.

This trend should flow through to demand for certain Australian goods and services.

I suggest you watch the Chinese market closely over the next few weeks and if the massive run up reverses, you may see the first signs of what’s to come.

Regards,

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments