In today’s Money Morning…a regime change is imminent…the mainstream always feels safer in the crowd…look out for our ‘New Money Masterclass’ on Wednesday…and more…

We’re witnessing some extraordinary events play out in the financial system right now.

Oil has shot through the roof, as has nickel.

In fact, it seems every commodity is on the rise.

The spectre of stagflation — a situation of stubbornly high inflation even as economic growth slows — is now very real.

Monetary assets are in flux too.

Gold and the US dollar are surging, while local currencies in India, the Philippines, and Korea are at multiyear lows.

What about those imminent rate hikes?

Forget that!

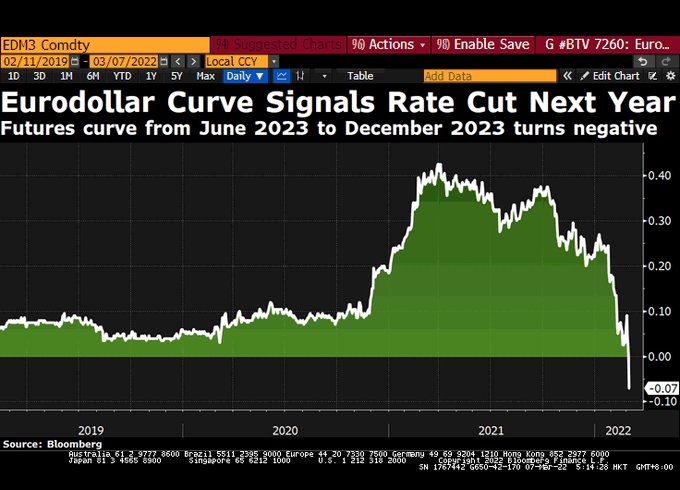

The Eurodollar market — an offshore market for ‘unofficial’ US dollars — is now saying the exact opposite.

A rate CUT has now appeared on the Eurodollar curve between June and December NEXT YEAR. The curve turned negative a week before the Fed even delivered the first hike (it’s due for next week):

|

|

| Source: Bloomberg |

Then, there’s the risk of big defaults.

Last week, it was reported that Russia is now on the verge of total default. The big question on Wall Street right now is who is carrying the can on this debt.

As reported:

‘There is a known $41 billion in Credit Default Swaps (CDS) on Russian debt. There is likely many billions more in unknown amounts. There are also billions more in Credit Default Swaps on state-owned Russian corporate debt and non state-owned Russian corporate debt.

‘In addition to Wall Street not knowing which global banks and other financial institutions are on the hook to pay out on the Credit Default Swap protection they sold in case of a Russian sovereign debt default (or Russian corporate debt default), there is also approximately $100 billion of Russian sovereign debt (whose default is looking more and more likely) sitting on the balance sheets of foreign banks.’

As per the 2008 GFC, the big danger is the risk of contagion in our hyperconnected financial world.

In short, it’s chaos everywhere you look!

Then came this…

A regime change is imminent

Just a couple of days ago, Credit Suisse — a bastion of mainstream financial thought — put out an extraordinary note.

It started with this line:

‘We are witnessing the birth of Bretton Woods III — a new world (monetary) order centred around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.’

I repeat, this is coming from Credit Suisse, not some ‘financial crank’ like me!

The note is worth reading to see how this current situation could play out. But for our purposes today, the last line said it all:

‘After this war is over, “money” will never be the same again…and Bitcoin (if it still exists) will probably benefit from all this.’

Now, the fact this is even anywhere near mainstream thought is quite amazing. Because it’s one thing for me to be saying it for years, but quite another for Credit Suisse to.

Not that I care, but ‘serious, professional’ investors will take note of this far more than they would’ve before.

In a way, it’s professional cover to start exploring the tail events sitting on the edge of the bell curve.

The mainstream always feels safer in the crowd.

And, as I’m sure they’ll all find out when they look properly, they’ll see that Bitcoin [BTC] remains the only asset that is ‘neutral’ in this new world order.

It’s the ‘Switzerland’ of the 21st century.

And we all know how that worked out for Switzerland in the 20st century!

The fact is, if I’m right about this, there’s going to be a wall of old money coming into the new money system over 2022 and beyond.

But amazingly, it’s still not too late to front run it…

Look out for our ‘New Money Masterclass’ on Wednesday

In a stroke of fortuitous timing, we’re running a ‘New Money Masterclass’ on Wednesday.

In it, you’ll get an expert view on the crypto markets and the role they’re going to play in this new monetary world order.

I’ll also reveal my top crypto play for 2022.

It’s a unique way for a beginner to get exposure to a number of leading projects in the crypto space in just one move.

Importantly, I’ll explain why it’s not too late to claim your stake in the world of new money.

Check all that out on Wednesday. It’ll be with you in the morning.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world.