‘Nobody knows the future with certainty. We can, however, identify ongoing patterns of change.’

Alvin Toffler

‘Cheap and forgotten.’ That’s what I wrote about commodities in January 2018.

At the time, there wasn’t much interest in them. We had just gone through a massive crypto boom in 2017 and stocks were rallying. So, it’s not surprising investors set commodities aside.

But change is the only constant in life…and in investing.

There’s been a clear shift in investing since the pandemic. Rising interest rates are driving investors out of growth and tech stocks and into real assets.

Cash isn’t looking all that bad anymore…and one of the big winners has been commodities.

Commodities performed well in 2021 and 2022, with rising energy prices from the Ukraine war and the drive for the energy transition, as you can see below:

|

|

| Source: MarketWatch |

The index hit a high in mid-2022, but has been dropping since though.

Mainly because of market jitters, a strong US dollar, and fears of recession.

But the commodity story is far from over…

The energy transition is supercharging demand for minerals

In the last few years, countries have been increasing their pledges to decarbonise their economies.

And the Ukraine war has made fossil fuels more expensive, exposing the need for energy security, so countries have been boosting renewable power as a way to strengthen their energy security.

What’s more, clean technologies have become increasingly cheaper in the last few years, so shifting to renewable energy makes economic sense.

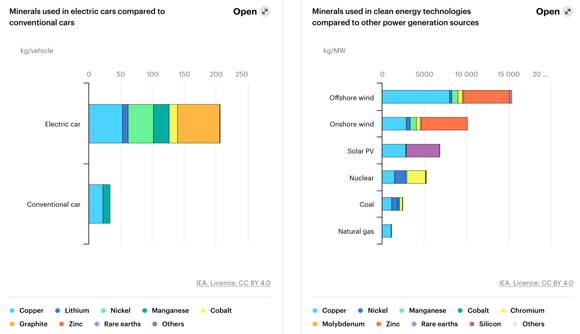

But this energy shift is going to need massive amounts of mining.

You see, EVs, wind mills, solar panels, etc. all use more critical materials than internal combustion vehicles or coal and natural gas power generation:

|

|

| Source: IEA |

It’s why the world is currently in a race to secure critical minerals for the transition. And at the forefront of this race — at the moment — are automakers.

Automakers are in the race to gain EV market share, but a large part of being able to deliver is gaining access to the raw materials needed for manufacturing EVs.

And, as I’ve written in Money Morning before, automakers have been going to new lengths to secure their battery supply chain.

Tesla is mulling over buying Canadian lithium miner Sigma Lithium. And GM has invested US$650 million in Lithium Americas.

And something else on this topic caught my eye this week.

Here’s Mining.com:

‘The merry-go-round of private meetings at an annual mining industry conference at Florida’s Hollywood Beach had a cast of new faces this year: auto sector executives increasingly anxious about surging prices and tighter supply of metals used in electric vehicle batteries.

‘Tesla Inc., Ford Motor Co. and Mercedes-Benz Group AG were among automakers which sent senior staff to mingle with about 1,500 delegates at the BMO Global Metals & Mining Conference, an event normally attended mainly by iron ore and aluminum producers. Their presence underscores the growing popularity of battery-powered cars, helped by a global push toward clean energy.

‘Availability and costs of crucial battery materials like lithium, cobalt and nickel have been key concerns for years among EV makers trying to build out their electric lineups. The issue has gained more urgency in recent months due to rising competition to strike supply pacts with miners and project developers and by wild swings in raw material costs.’

It may look like commodities are losing steam, but automakers are still struggling to secure supply. Commodities for the energy transition are one of the biggest long-term opportunities out there, in my view.

This is only the beginning…

In fact, as my colleague James Cooper recently put it, ‘we’re now entering a new kind of mining boom’.

You may be familiar with James, editor of Diggers and Drillers. He’s spent more than 15 years in the trenches working with both small explorers and big-name producers.

And as he says in his newest presentation, the recent correction ‘is music to my ears’.

Here is James:

‘Those big gains from 2022 have fallen back a bit in the last few months.

‘This is part of a general, worldwide stock sell-off…due to fears the US Federal Reserve is going to keep being really strict on interest rates.

‘It has nothing to do with what’s going on in our mining sector right now.

‘Drilling projects are powering ahead. Exploration investment is going up. Mergers and acquisitions are increasing in frequency.

‘Sometimes, you have to separate the business of mining from the stock prices of miners.’

So, if you’re looking for opportunities in this space, James has chosen six different plays for the coming commodities boom.

These are six of his highest convictions plays and each has an X factor. I recommend you check it out!

You can find out all the details here.

Best,

|

Selva Freigedo,

Editor, Money Morning