The mad rush for critical metals may have created a boon for lithium and rare-earth element (REE) companies.

However, most mining companies in gold, silver, copper, iron ore, and even crude oil have stagnated.

It’s no wonder many who’ve once tried their luck in commodity stocks leave the table, never returning. They joined when it was all the rage, overstayed their welcome, and sold in a panic once the party was over.

It takes a lot of skill for a momentum trader to make a sustainable profit over the long term.

That’s why it’s not my thing, though I’ve got a lot of respect for those who do it and succeed.

I prefer to take the contrarian approach instead.

Now, that isn’t an easy task either. But it’s the potentially handsome rewards on offer that attract me.

And from my viewpoint, I see a lot of opportunities right now.

Tough days for gold behind us

Those following my work know that my preferred haunt is in gold mining companies. And the last 30 months have been a test of my resolve and sanity.

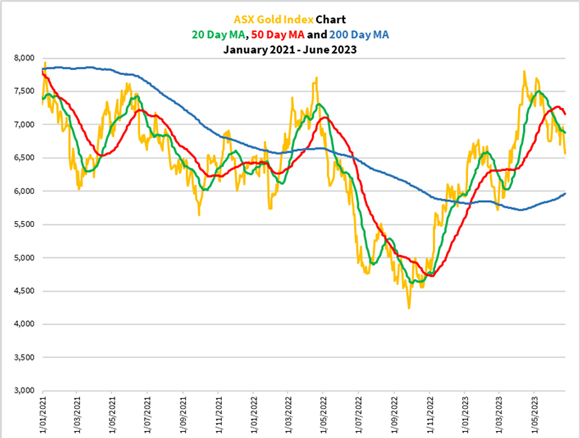

Have a look at how the ASX Gold Index [ASX:XGD] performed during this time:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

There have been several rallies and dips over this period. A real roller coaster ride.

What’s discouraged many investors, even the seasoned ones, is that the index hasn’t broken out to the upside to set new highs.

It tried in April 2022 and again this April (at around the same time too) before retreating.

And that slump last year from April to late September was painful for those who experienced it.

Could it happen again this year?

I believe that it’s unlikely. The reason is that last year’s slump coincided with the US Federal Reserve and other central banks coordinating to raise rates aggressively, combating inflation that they’d all said in late-2021 was ‘transitory’.

For all I know, the rate rise cycle is largely done. The US Federal Reserve Chair Jerome Powell hinted in the most recent meeting this month that there could be one or two more rate rises as inflation remains stubborn.

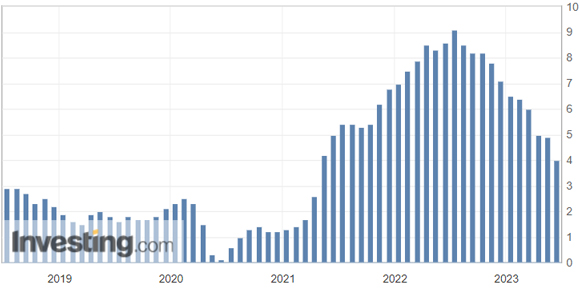

But looking at the headline inflation figures in the US, it’s eased significantly, as you can see below:

|

|

| Source: Investing.com |

That doesn’t mean they’ve solved the problem of inflation. That’s a different story. These headline figures don’t really reflect what we’re paying for on a day-to-day basis.

But based on the trends that we’re seeing with these headline inflation figures; I foresee that there’s much less room for rate rises.

Hence, we’re likely to see better days ahead for commodities.

That’s good news for long-suffering gold enthusiasts.

But there are caveats and opportunities.

Selecting the right gold stocks is the key to success

Mining is a risky business. That’s why when investing in mining stocks you either stick around for the long haul due to the profits or quickly gives up as losses rise.

Success hinges on selecting the right companies, getting in at the right time, and having the resilience to hold on when the going gets tough.

If you look at last year’s operating performance, they’ve seen better days. That’s why the prices slumped so much.

It’s gained back a lot of that since, but it’s not across the board. More than half the producers are still trading significantly below their highs from April 2022.

The good news is that the price of crude oil has fallen around 40% from its highs at the same time last year when it was around US$110–120 a barrel. This should lead to better operating margins.

That said, a few producers have run into significant trouble to the point they needed to either suspend a mine operation (Dacian Gold [ASX:DCN]), halt trading on the stock market (Ten Sixty-Four [ASX:X64] and Navarre Minerals [ASX:NML]), or both (Gascoyne Resources [ASX:GCY] and Wiluna Mining [ASX:WMC]).

That sounds quite bleak, doesn’t it?

Now, not all companies that suspend trading on the stock market will be liquidated. There have been several instances where companies negotiate a funding package and resume trading.

Gascoyne Resources has recently come out of suspension and is now focused on drilling the high-grade Never Never gold deposit, which is showing promising results.

And those producers trading at less than half of what they were at their peak in 2022 might bounce and deliver substantial returns when we get to the second leg of this gold bull market, which started in late-September 2022.

Let me cast back to the gruelling bear market of 2012–14 when I first dived into gold producers and was down as much as 75%. I stuck to my plans, held onto some of the better-run producers, and added more as they fell.

Luck was with me to a large extent as the price of crude oil almost halved in the second half of 2014. So by early 2015, the companies reported better operating results. The market started to jump back into gold producers and then a 20-month bull market followed.

How well did I do?

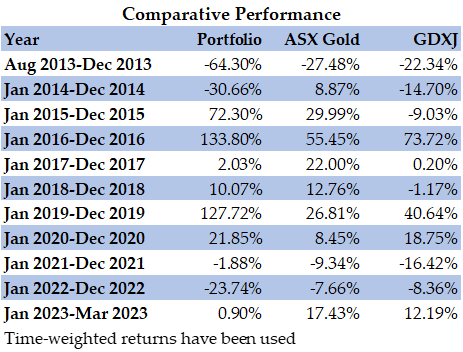

|

|

| Source: Australian Gold Fund |

I’d say my gains in 2015–2016 were pretty sweet. I made back what I lost and more.

It gave me the confidence to stand firm when there was a lull in 2017–18. When the next bull market came in 2019–20, I was there to win another round.

We’re actually in a bull market right now! It just hasn’t felt that way in the last two months.

Over to you!

Rick Rule is well-known for saying ‘bear markets are the author of bull markets’.

Following from this, those who stick around and load up during the tough times could enjoy handsome rewards when the cycle turns in their favour.

Picking the right companies and keeping a steely mindset are essential skills to give you the edge in this space. Of course, knowing to time your trades correctly is a bonus.

Now, you don’t need to have all those skills to win. Leave that burden to me.

My precious metals investment service, The Australian Gold Report, has a tried-and-tested analytical approach to help you through the highs and lows of the gold cycle.

I’m extending an invitation to you. This is a great time to get in as many gold producers are on sale.

Please click here to find out more.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments