I dedicate today’s article to my valued subscribers at Gold Stock Pro and Jim Rickards’ Strategic Intelligence Australia.

Thank you for your graciousness during these tumultuous times. Investing in gold stocks has been a difficult journey the past two years.

Like fellow troopers in a war against the enemy — the central banks, government cronies, and the banking cartels — we’ve taken a lot of hits.

Right now, the war against gold seems to be on the balance.

While we have gained much ground, the recent battles have seen a few crushing defeats with heavy losses.

Still, I can sense that morale is high. No grumblings, just encouragements and assurances among our ranks.

Forging ahead to claim victory

Many of us haven’t fought in a real war on the field. Those who have would know the mentality it takes to win.

With investing, the consequences may be less dire, but the impact isn’t insignificant.

Investing is a lot about emotions and how you control them. Your success depends on the ability to make decisions without letting emotions blur one’s judgment.

Investing in something as volatile as gold stocks takes much boldness and mental strength.

In the last few months, I’ve had to rely on my experience to carry me further. The four or five false rallies in gold stocks since 2021 wore down my confidence. But I was braced for the brutal sell-off that began at the end of April only because I had the benefit of past successes to help me prevail.

I saw how the past two years sit in the big picture, which I’ll share with you now.

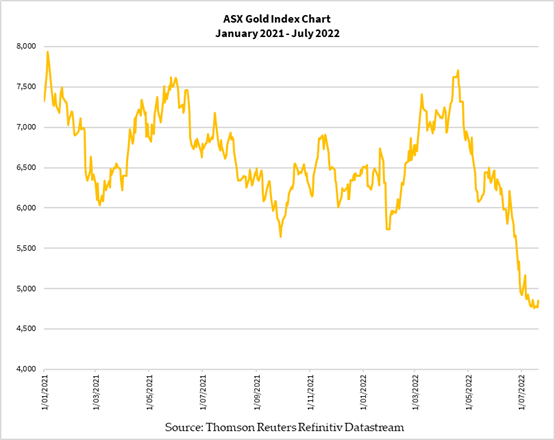

The figure below shows you how the ASX Gold Index [ASX:XGD] has fared since 2021:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

You can see how investing in gold stocks during this time has been a roller coaster. I know that it’s left some swearing off gold stocks forever.

What would have broken one’s resolve would definitely be the drop from mid-April, when we hit 52-week highs of 7,705 points, to yesterday’s close of 4,921 points. That equates to a mind-blowing 36% decline.

All this happened in three months.

Even top-tier producers like Newcrest Mining [ASX:NCM], Evolution Mining [ASX:EVN], Northern Star Resources [ASX:NST], and Regis Resources [ASX:RRL] shed 30–50% in such a short period.

Smaller explorers saw their prices tumble even more, with some trading up to 80% lower than the same time last year.

This recent crash is more severe in magnitude than that in 2020, when the ASX Gold Index fell from 7,700 in late February to its bottom of 5,160 on 16 March 2020.

It would be natural to fear a collapse in gold stocks going forward.

But I would say this is where you need to decide what perspective to take.

What happened is behind you. What matters are the economic and market conditions going forward.

Central banks hike rates into economic disaster

I’ve written my case before as to why I believe the Federal Reserve and central banks are coordinating their rate hikes to bring forth an economic disaster.

Even if they’re raising rates in the hope of reviving their failing fiat currency system, I believe they’re scrambling to get in each other’s way.

In fact, the European Central Bank might appear to have done just that last night as it raised its rates by 0.5%, its first since early 2011.

This may cause the US dollar to weaken, spurring inflation in the US economy and possibly undoing some of the impact from the Federal Reserve’s rate hikes. The US bond yields have recently moved in a way to suggest that inflation may be behind us.

But who knows?

On top of that, could Joe Biden’s attempts to persuade other countries to produce more oil backfire, causing the price of crude oil to rise again and thus bring back higher inflation?

All this tells me that gold and gold stocks stand to benefit as these bureaucrats try to perform an impossible feat.

Gold stocks — so bad that it’s good

If you step back and look at the bigger picture, gold and gold stocks can deliver exceptional returns if you stay around to catch the right moments.

Take a look at how the ASX Gold Index has performed since 2005 in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

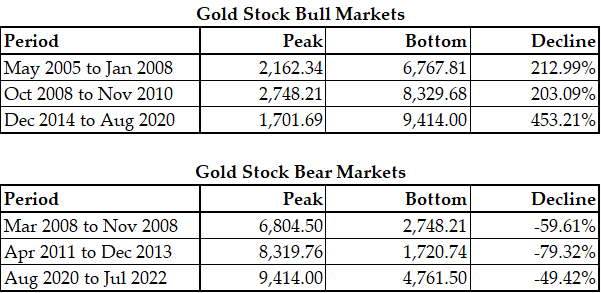

I’ve also calculated the returns gold stocks delivered in previous bull and bear markets, which I present in the tables below:

|

|

| Source: Internal Analysis |

The numbers speak for themselves. Gold stocks are highly cyclical and can vary wildly. Bull markets give forth brutal bear markets, and vice versa.

It’s not a place for the faint hearted or those seeking a quick and easy profit.

That’s why I want to raise a glass to my Gold Stock Pro and Jim Rickards’ Strategic Intelligence Australia members. They’ve gone through an exceptional period, and I can sense that they’re hardened to endure until they taste victory, which I hope isn’t far away.

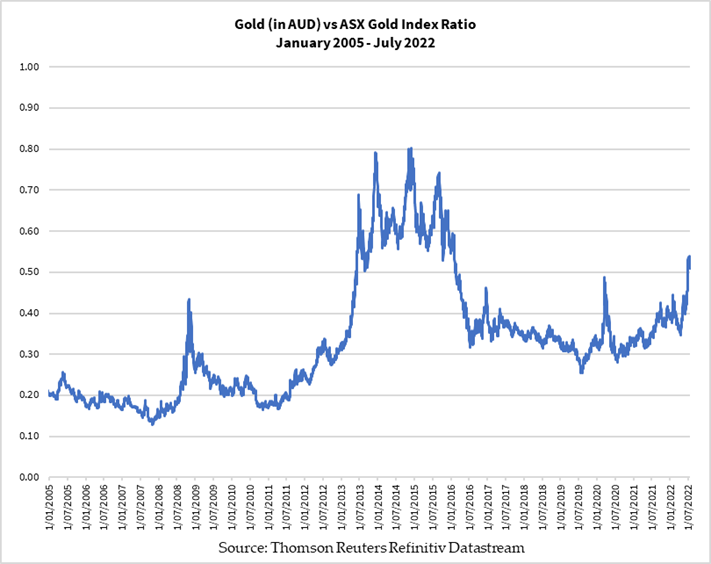

The last figure I want to share will hopefully fire them up to hold their ground. It’s the relative gold price and the ASX Gold Index since 2005:

|

|

| Source: Market Watch |

What this tells me is that gold is trading at its highest level relative to gold stocks since 2015, when gold stocks were coming out of the most brutal bear market in recent history.

Gold stocks are cheaper than after the subprime crisis in 2008.

Cheaper than in 2016 after the US election…

Even cheaper than the depths of the 2020 flash crash!

Perhaps this is the time to get into gold and gold stocks. The rewards are now looking even more attractive.

You will join the ranks of what I believe are one of the finest and most resilient investors.

Click here to find out more.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia