James Cooper is off this week.

So we thought we’d share a snippet of a recent report he sent to members of he’s resource advisory service, Diggers & Drillers.

Enjoy!

*****

In this month’s edition of Diggers and Drillers, we’ll be looking to take a slice of the booming AI market.

Mining and tech might not seem like a likely partnership. But this is an emerging segment of the market full of unique opportunities.

Just take our mining service stock, RPMGlobal Holdings [ASX:RUL].

The company has developed a suite of software packages tailored specifically for mining operators.

It’s business model makes sense. The resource sector is bleeding cash in this high-cost environment and RUL’s AI backed technology improves efficiency across operations, saving the miners cash.

So far, the strategy has worked out well.

RUL is up around 43% since we recommended it last November. You’ll recall we took some profits in February.

Yet, the company stands to benefit over the long term too.

Given tech is set to play a much larger role in mining’s future, I’ve continued searching for more opportunities in this niche field.

But this time, we’ll be focusing on the supply side…

Raw material for the Semiconductor Industry

As you know, interest in semiconductors has exploded in recent months. That’s thanks to a boom in artificial intelligence.

If you’re unfamiliar with the link, semiconductors have been likened to the ‘picks and shovels’ of the AI boom.

In other words, the vital tools needed to expand AI’s reach throughout the global economy.

No doubt, this is a sector offering massive growth opportunities.

For better or worse, corporations are rapidly adopting AI into their workplace. This is an unstoppable trend.

The AI revolution promises major disruption, especially within the white-collar sectors like law, accounting, and finance.

That could devastate the many professionals who could lose their jobs in this new AI era.

Still, it is set to become a boon for major corporations benefitting from higher productivity.

From the graduate to the experienced practitioner, no one’s immune from the threat of AI.

But as they say… ‘If you can’t beat them, join them!’

The resource sector may not seem like an obvious choice to do that.

But recall the blowup in gallium and germanium supplies last year. Two minerals critical for semiconductor manufacturing.

China holds a firm grip on global supply and used its dominance to hit back on Western pressure.

Given the country supplies almost 80% of the global market, the announcement of China’s germanium and gallium restrictions last year created a major stir in the market.

A small handful of Australian explorers surged on the back of these geopolitical rumblings.

And all it took was a sniff of germanium or gallium in some old drill core.

Yet, beyond a couple of tiny explorers, few ASX-listed players exist in this China-dominated market.

That’s why we’re not focusing on germanium or gallium this month.

I’ve uncovered another critical material used in the manufacturing of semiconductors.

It’s known as High Purity Alumina, or HPA for short.

And this company is set to become one of the world’s largest suppliers.

So, strap yourself in. This month’s opportunity is looking to deliver something very unique.

But to truly understand the opportunity, we must first get a picture of why HPA will be critically important in the years to come.

High Purity Alumina: A Metal for the Future

Demand for HPA is diverse and driven by two MAJOR growth drivers: renewables and artificial intelligence.

This month’s recommendation will be looking to tap into both these mega themes.

This is truly a metal for the future.

Yet so few understand or know about the important role of high purity alumina.

According to Grand View Research, the global HPA market was valued at around US$3.2 billion in 2022. But that’s expected to see a compound annual growth rate (CAGR) of around 22% from 2023 to 2030.

But what exactly is high purity alumina?

HPA is an ultra-refined form of aluminium oxide with a purity exceeding 99.99%!

You see, unrefined aluminium tends to hold small amounts of trace elements like silica and iron. This gives it vastly different properties to HPA.

But once these ‘impurities’ are removed, the magic of HPA begins to emerge.

High transparency, chemical inertness, high thermal conductivity, and resistance to thermal shock…these are some of the properties that make HPA ideal for semiconductor manufacturing.

The material is used to build the tiny wafers and insulating layers that surround the chips.

Yet, this is not the only market for this unique commodity.

It is transparent like glass but has far superior strength. This means it’s used for optical lenses, medical equipment, and specialised windows.

In fact, purified alumina is so strong it’s used as ‘transparent armour’ for the military.

Meanwhile, it’s perfect for making scratch-resistant camera lenses and smartphone screens.

But the applications are broader, still.

HPA plays a critical role in lithium-ion batteries.

Here, it acts as something known as a ‘separator’.

A thin, porous membrane that divides the positive and negative electrodes (anodes and cathodes) in a battery cell.

While separating the electrodes it also allows free flow of ions during charging and discharging battery cycles.

This is critical for preventing short circuits in EV batteries thereby eliminating the problem of spontaneous explosions that have plagued electric vehicles.

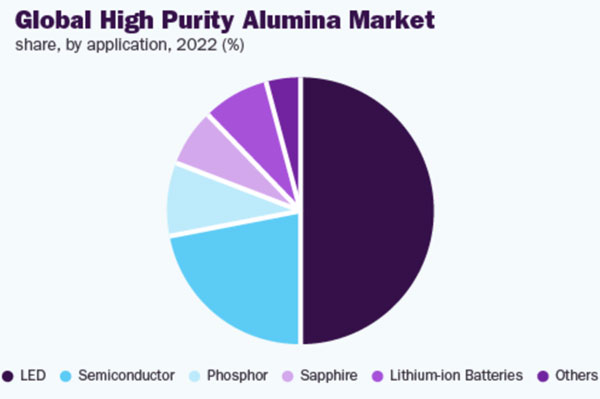

Yet, the biggest demand driver for high purity alumina comes from the LED sector. According to a report by Grand View Research, it accounts for 49% of overall demand.

You can see the full breakdown, below:

| |

| Source: Grand View Research |

Two things to note here, ‘phosphor’ relates to the light emitting sector while ‘sapphire’ refers to the specialised glass derived from HPA.

We’ll get into the ‘sapphire’ component in a moment as this forms an important part of our company’s future downstream ambitions.

But a key thing to point out here is that the landscape is shifting in the resource sector.

There are enormous opportunities among niche commodity markets, especially those tied to minerals with unique properties and wide technological applications.

That’s a big change from the last commodity boom of the early 2000s.

Here the focus was on bulk tonnage iron ore and base metal operations feeding a hungry Chinese infrastructure boom.

But I believe investors will need to be much more targeted with their investment choices in the years ahead.

The coming resource boom may not be a tide that floats all boats, like it did during the last cycle.

Specific commodities will feature prominently, just like lithium has over the last few years.

And it is those companies that can value add and find a niche in the market that could benefit the most.

That’s what I have found for you this month.

A stock already producing a small volume of ultra-high purity alumina for specialised clients yet destined to become one of the world’s largest HPA suppliers.

And this is an ASX-listed home grown, downstream producer that’s ideally positioned to serve major tech firms and EV markets throughout Asia and beyond.

So, let’s jump in and uncover this month’s emerging success story!

*****

To access the full report plus all of James’ research and stock recommendations, you can do so here!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments