Gold enthusiasts take heart!

The frustration of watching gold struggle to break past the August 2020 record highs may end soon.

Your determination to stick to your guns with gold stocks amidst dashed hopes and frustration may pay off shortly!

For those who aren’t in yet, do you want to just watch these companies take off quickly and therefore miss out on massive gains when the stars align?

And what happened late last week might have just confirmed that the time has come for gold to shine…

I’m seeing it come together with the economy, the geopolitical landscape, and individual gold mining companies.

If you’re excited about this opportunity, I have something just for you…

But let me first tell you why I think it’s all coming together in gold’s favour.

Markets foresee central banks end to rate rises

The US Consumer Price Index data for July (released last Friday night) came out at 8.5%, lower than the June reading of 9.1%.

It’s far above the 2–3% mandate that the US Federal Reserve set for itself.

But let’s lay off on the Fed a little bit…at least inflation is moving in the right direction, finally.

Though, let me say tongue-in-cheek that at this rate, it might take another year before inflation comes back down to the mandated levels.

Of course, I’m being facetious. The inflation mandate takes into account the long-term inflation, not year-on-year figures.

Conflicting signals, same outcome

Nonetheless, the market has caught wind of that already, causing literally everything to rally in the US markets last Friday.

The Dow Jones traded up more than 400 points (1.27%), the S&P 500 up more than 70 points (1.73%), NASDAQ up more than 250 points (2.09%), and gold up almost US$15 an ounce (0.7%).

Even the US Dollar Index rose slightly.

Interestingly, oil traded lower to US$91.46 a barrel, down just over 2.5%.

It’s the type of market move that would look like a bull market is making its return.

If only that were so.

Cast your mind back to the last Federal Reserve Open Market Committee meeting just over two weeks ago. The Committee stated that it would slow down on raising rates because the markets and the broader economy felt the pressure of monetary tightening.

Talk about a heavier burden, alright.

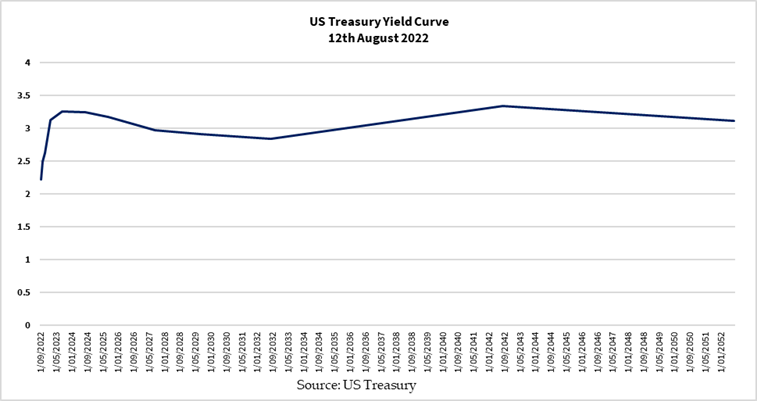

The US Treasury yield curve is now heavily inverted, with the one- and two-year yields trading higher than the 3–10-year and even the 30-year yields (refer to the figure below):

|

|

| Source: US Treasury |

This is not a good sign at all. An inverted yield curve usually precedes a recession.

And the fact that it’s quite deeply inverted suggests that we should also brace for a perfect storm. After all, the combination of lower business and consumer confidence, a crippled global supply chain, record debt levels worldwide, and elevated crude oil prices are like lying underneath a boulder.

While I don’t trust the central bankers who have hardly run a business in their life, let alone pull the levers for the global economy, let’s give them credit where it’s due on their awareness that their policies have made things worse.

It’s possible that the market crash could come after the Federal Reserve’s next meeting in mid-September. The Committee might even pause on raising rates, thereby at least giving the Committee plausible deniability to say that it could’ve been worse had it not been for their policy positioning.

In other words, aside from the upcoming market troubles ahead, beware of gaslighting from the same people who created that.

So while the markets are rallying now, this may be the chance for the smart money to quietly head for the exits as they offload to the chumps who think it’s time to jump back in the water.

Don’t fall for it.

Something brews in this space…

Gold stocks have rallied nicely from late June to mid-July after a sharp sell-off, with several big names bouncing some 20% from their lows.

If you look at the smaller names, a couple of companies have rallied more than 30%, even 100% or more (take Ora Banda Mining [ASX:OBM], for example).

Many took a pummelling in the last 20 months or so and the paper losses are steep.

The good news is that many explorers have taken the last few weeks to raise some cash to help them bunker down in case things get worse, increasing their chances of surviving what’s to come. Operating conditions could improve as restrictions and mandates lift, allowing companies to fire up their engines.

So when the tide turns on the markets, watch for gold to reassert itself as a safe-haven trade, just like what we saw in late February.

This could make gold stocks the blockbuster trade.

Should crude oil prices continue to head down further, that could really give gold stocks the rocket pack it needs.

Who knows, perhaps this can come about from a weakening economy causing less demand or the political stunt by the Biden Administration in depleting the strategic oil reserves to help increase its chances in the upcoming mid-term elections.

And I could be wrong about this call. In this case, oil surges due to falling production, and a lack of investment for exploration and development leads to a panic over future supply. That could stoke inflation further, placing greater pressure on the markets.

Call it an unassailable position for gold and gold stocks.

Why not join me here on ‘The Gold Investor Series’, where I bring in the biggest names in the gold investment community — Peter Schiff, Jim Rickards, Bill Bonner, and Don Durrett — as they share potential ways to capitalise on this opportunity.

Hurry, the show’s starting today!

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia