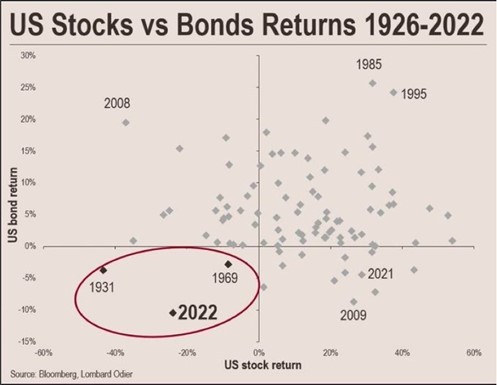

Check out this confronting chart:

|

|

| Source: Bloomberg |

You can see in the 2008 GFC bond value gains helped cushion equity market falls.

Not this time…

It’s a double whammy as both stocks and bonds take a pounding.

But it’s the bond valuation collapse that is most important to note.

As senior analyst Dylan LeClair noted, this is often the prelude to something big:

‘The last time the U.S. markets faced a drawdown of this magnitude, the U.S. Government defaulted upon its gold peg within the next 24 months.

‘1933 — Executive order 6102.

‘1971 — Nixon Shock.’

These events led to the eventual transition from gold-backed money to our current fiat system (dominated by the US dollar).

These current moves could set in motion a new transition.

Let me explain…

We’re witnessing a slow motion collapse

The fiat system dominated by central banks and underpinned by the US dollar is irretrievably broken.

That’s the story behind the volatility in markets right now.

But it shouldn’t be a surprise to anyone who’s been paying attention.

My colleague (Greg Canavan) and I wrote a special report called ‘Why the Old Money System Will Collapse on Itself’ way back in May 2021.

We wrote:

‘Nearly every country in the world is locked into the dollar-based monetary system.

‘According to the International Monetary Fund, nearly 40% of the world’s debt is issued in US dollars. As a result, global banks need a lot of dollars to conduct business.

‘But that’s just what you do see. The “surface level” borrowing and need for US dollars. Under the surface there is much more. I mentioned the Eurodollar market earlier. Thanks to decades of financial deregulation, this market has become massive.

‘All kinds of off-balance sheet activities like derivatives and interest rate swaps (conducted by global banks) are transacted in US dollars.

‘This creates a huge market (and demand for) US dollars.

‘But this US dollar-based system has now become so large and all-encompassing that it no longer functions without some kind of central bank or government (fiscal policy) support…

‘Our conclusion is that the US dollar based monetary system no longer works effectively.’

It was obvious back then, and it’s even more obvious now.

Reliance on the US dollar has always been a systemic risk.

Not just to adversaries like Russia or China either.

Friendly countries like the UK, Japan, and Germany are also on the wrong end of US monetary policy right now.

To what end?

As this tweet states, this could be more than a temporary blip from the US’s point of view.

It could be a complete strategic about-face:

|

|

| Source: Twitter |

This certainly seems like the plan to me.

The question is, how will other countries react?

Nowhere is risk-free these days

Currency markets will be where this war is fought.

China, Russia, and India have already started trying to shift away from the US dollar as the currency of trade.

But the bigger ramifications lie in the use of US government bonds as ‘pristine collateral’.

As JPMorgan wrote last week, who will fund US government debts going forward?

As reported:

‘In fact, they say, all of the three main buyers for US government debt — commercial banks, foreign governments and of course the Federal Reserve itself — appear to have stepped away from the market.’

In financial terms, US treasury bonds are held by countries, global banks, and other big financial institutions to support their capital base.

Regulations actively encourage it.

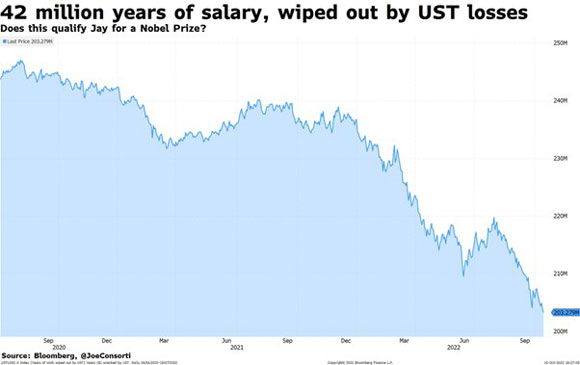

But as this chart shows, it’s not providing much stability these days.

A whopping US$2.3 trillion in returns have been lost since 2020. Or, as the author puts it, ‘42 million years of average US salary.’

|

|

| Source: Bloomberg |

He sarcastically added:

‘Does this qualify Jay Powell for the Nobel Prize?’

Anyway, historically, as LeClair pointed out, the underlying system of money changes within two years of such moves in US bonds.

It’s a big call, but I think the same will occur this time.

And that means opportunity if you can guess where it’s heading.

For example, gold surged after the de-pegging in 1971 as investors sought out hard money alternatives to the now free-floating US dollar.

Check it out:

|

|

| Source: Bloomberg |

That’s a 22-times run.

And certainly, gold could be where the non-US powers look to as they try to distance themselves from US Treasuries.

But for my money, Bitcoin [BTC] remains the best asymmetric play on this front.

It’s a provably scarce digital asset, controlled by no one and completely independent from interference.

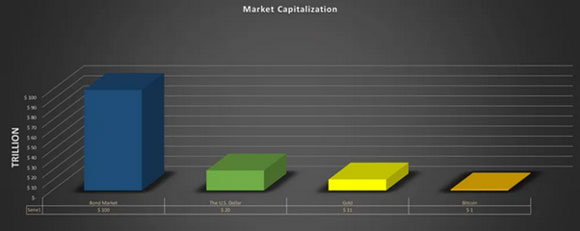

And as this chart shows, the sheer potential on offer if the world transitions, even in part to bitcoin, is immense:

|

|

| Source: Solberg Invest |

If bitcoin swallowed the entire US$100 trillion bond market, you’d be looking at around US$60 million per bitcoin!

Of course, that’s not going to happen.

But you can clearly see the scope for bitcoin to advance quite substantially from today’s price of just under US$20,000.

For example, a tiny 1% allocation shift from bonds to bitcoin would equal a valuation of US$600,000 per bitcoin.

But more than that…

Our only chance

As the famous Austrian-British economist and philosopher Professor Friedrich Hayek said in 1974:

‘I don’t believe we should ever have good money again, before we take the thing out of the hands of government.

‘If we can’t take them violently out of the hands of government, all we can do is by some sly or roundabout way, introduce something they can’t stop.’

I’d wager Hayek would support bitcoin.

But I also think a lot of non-US countries will be seriously considering it, too, now.

And in my opinion, we’ll see the largest transfer of wealth from fiat bondholders to bitcoin holders over the next decade.

If I’m right, a small portfolio allocation (1–5%) to bitcoin could be the only way to maintain your purchasing power over the decade to come.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also the Editor of Crypto Capital. This service looks beyond the hype and the hate regarding the fast-evolving world of cryptocurrencies. An area, Ryan believes, is set to become the most disruptive force on how the world works since the internet. For information on how to subscribe, click here.