It’s great to be back home after a busy few weeks of travelling.

As tiring as that can be, I’ve had the chance to chat with dozens of companies, industry insiders and Fat Tail readers!

One of the key discussion points has been Trump… How will his hard-hitting policies affect commodity demand?

The industry has been on edge.

Clearly, the market is too, given the steep sell-off in resource stocks since Trump’s re-election victory two weeks ago.

Why?

Well, the market is betting that Trump will deliver on his promises when he takes office in January.

His ‘America First’ policies have sent the US dollar surging, which is bad news for commodities.

Meanwhile, the threat of tariffs looms large over China, weakening the outlook for commodities even further.

But there are some key reasons you should view this latest sell-off as an opportunity.

Let me explain…

Earlier this week, I told my paid readership group at Diggers and Drillers that US equities are sitting in a honeymoon period thanks to Trump’s re-election.

However, the setup in today’s market displays some uncanny similarities to Trump’s first term in office.

And as I’ll show you, that was actually a pretty good period for commodities, especially base metals.

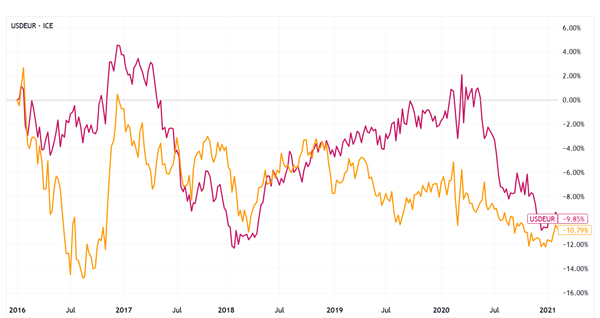

You see, just like today, the US Dollar rallied on the back of Trump’s victory in 2016.

Again, that was based on expectations of what this real estate mogul could deliver for the US economy.

But you might be surprised to learn that the US dollar fell once Trump actually took office.

Check it out below:

| |

| Source: TradingView |

Over his four-year term, from 2017 to 2021, the US Dollar dropped 9.85% against the Euro, shown in red above.

Meanwhile, against the Japanese Yen (yellow), it fell by 10.79%.

Could US Dollar weakness happen again under Trump’s second term?

Who knows, but it’s a clear example that Trump’s leadership doesn’t necessarily equate to a strong USD.

Why this matters for resource stocks

As I pointed out earlier, the strength of the US dollar has been one of the major forces driving weakness in metal markets over the last two weeks.

Commodities and the US dollar are typically negatively correlated… When one appreciates, the other tends to fall.

And perhaps that’s one of the reasons commodities surged during Trump’s first term in office!

To show you what I mean…

At the start of Trump’s presidency in 2017, copper traded for just US$2.50/pound.

But by the end of his term in office, copper prices had risen to US$3.50/pound.

A handsome gain of around 40%.

But get this…

Iron ore traded for just US$76/tonne at the start of 2017.

Four years later, it doubled to over US$155/tonne!

Check it out:

| |

| Source: Trading Economics |

So, you might say, sure, but what about the threat of tariffs on Chinese manufactured goods?

Surely, this looms as a major threat to the Middle Kingdom and commodity demand?

Well, tariffs are nothing new for China.

According to the US and European Tax Foundation’s Tariff Tracker, the Trump administration imposed nearly $80 billion in tariffs from 2018 to 2019.

As US workers rejoiced in this seemingly ‘America First’ policy, little did they know that they were footing the bill!

Trump’s 2018/2019 tariffs resulted in one of the largest tax increases in US history!

That’s right, the real loser here wasn’t China; it was the American consumer.

Why certain commodities could

boom under Trump

Anyway, it’s one example of why you shouldn’t abandon commodity investments based solely on Trump’s tariff threats.

China is already well-versed in navigating US and European trade barriers.

As Trump continues chest-beating on tariffs, it’ll be business as usual for China.

Remember, China has a firm foothold in emerging markets, which means it can quickly expand its manufacturing empire in overseas hubs like Southeast Asia.

Capitalising on cheap labour, China drives down the prices of its manufactured goods and offsets some of the penalties imposed by US sanctions.

But there’s perhaps an even bigger story

playing out here…

America is set to ‘deglobalise’ under Trump.

Meanwhile, China continues to build its international footprint. Strengthening itself as the epicentre for international trade.

Last week, China signed over $10 billion agreements with Australia’s closest neighbour, Indonesia.

The focus was infrastructure, green energy, digital technology, and agriculture.

China is signing deals, building bridges, and securing trade routes across Asia, Africa, and South America. And emerging economies are fully on board.

Meanwhile, the US is clamping up, shutting its borders and imposing penalties against most nations that want to trade with it!

These policies will only strengthen China’s position in the global economy while weakening America’s role.

Ultimately, that will erode the strategic advantage the American economy has held for decades as the traditional leader in international trade.

In my mind, that’s what the market is missing as it pours into US-denominated assets following Trump’s election win.

But that’s perhaps your advantage as an investor.

Picking up steeply discounted resource stocks or finding other avenues to pivot into emerging markets.

As I tell my paid readership group at Diggers and Drillers, the future lies in Asia.

And that’s a major advantage for Aussie investors.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments